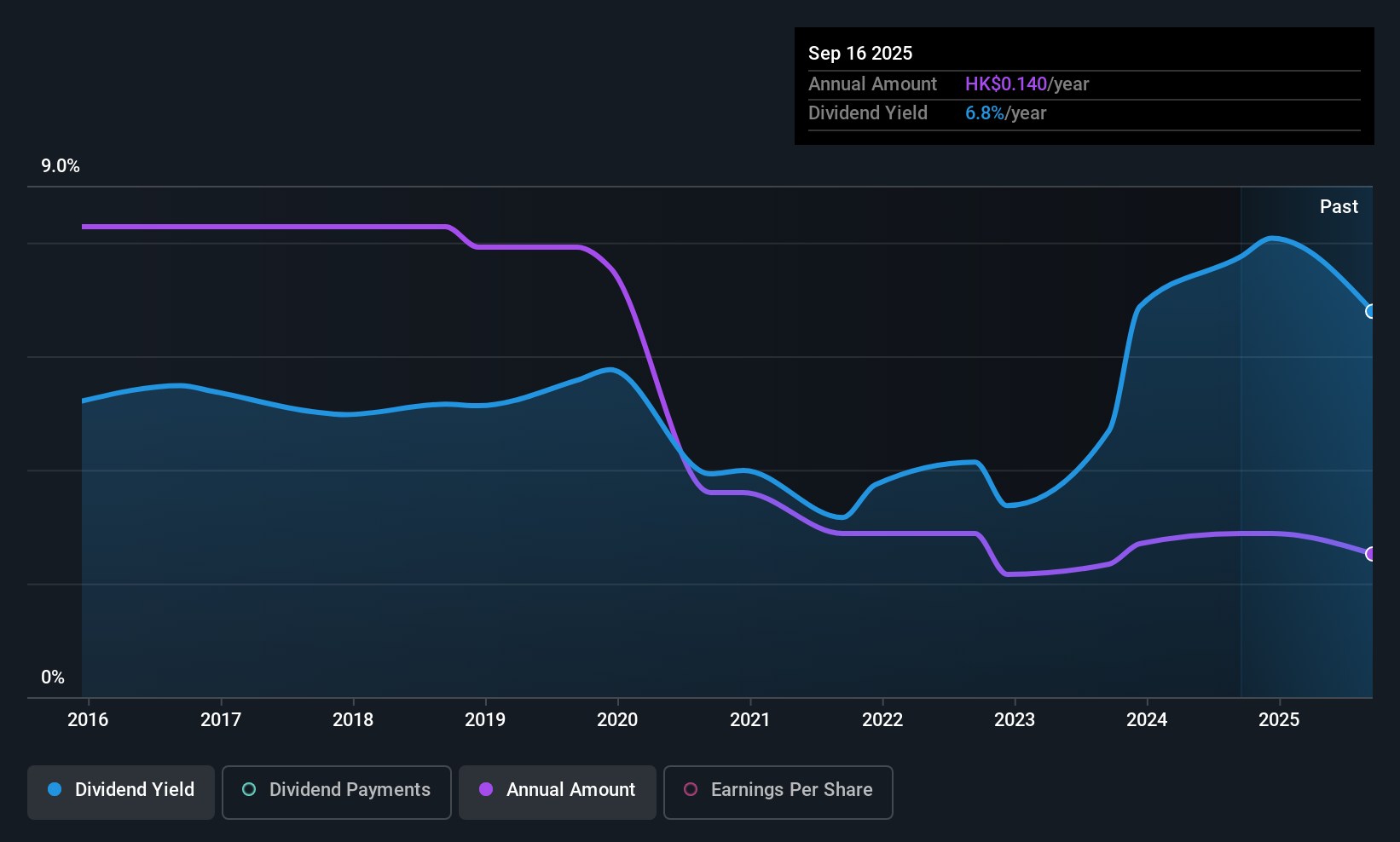

Tian Teck Land Limited's (HKG:266) dividend is being reduced by 17% to HK$0.05 per share on 19th of January, in comparison to last year's comparable payment of HK$0.06. However, the dividend yield of 6.8% still remains in a typical range for the industry.

Tian Teck Land's Distributions May Be Difficult To Sustain

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Even though Tian Teck Land isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Over the next year, EPS could expand by 31.2% if recent trends continue. It's nice to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

View our latest analysis for Tian Teck Land

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the annual payment back then was HK$0.46, compared to the most recent full-year payment of HK$0.14. Dividend payments have fallen sharply, down 70% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Company Could Face Some Challenges Growing The Dividend

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Tian Teck Land has seen EPS rising for the last five years, at 31% per annum. While the company hasn't yet recorded a profit, the growth rates are healthy. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Tian Teck Land that you should be aware of before investing. Is Tian Teck Land not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Tian Teck Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:266

Tian Teck Land

An investment holding company, engages in the property investment activities in the People’s Republic of China and Hong Kong.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026