- Hong Kong

- /

- Real Estate

- /

- SEHK:258

Discovering Undiscovered Gems in Hong Kong September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, small-cap indices have shown resilience despite remaining below their all-time highs. This backdrop provides a unique opportunity to explore lesser-known stocks in Hong Kong that could benefit from the evolving economic landscape. In this context, identifying promising stocks involves looking for companies with strong fundamentals, growth potential, and the ability to navigate current market conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Morimatsu International Holdings (SEHK:2155)

Simply Wall St Value Rating: ★★★★★★

Overview: Morimatsu International Holdings Company Limited designs, manufactures, installs, operates, and maintains process equipment and systems for chemical, polymerization, and bio-reactions in China and internationally with a market cap of HK$5.67 billion.

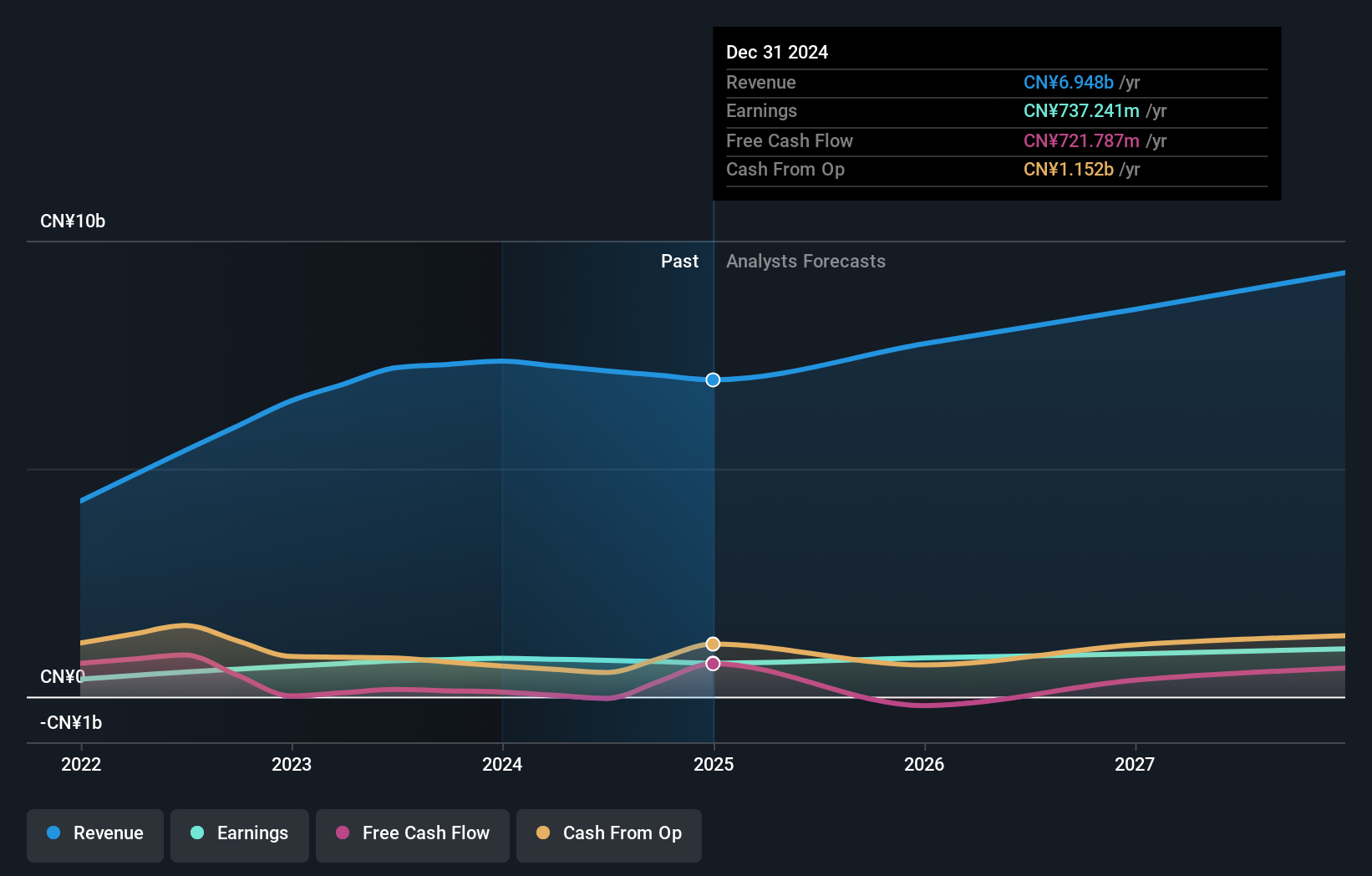

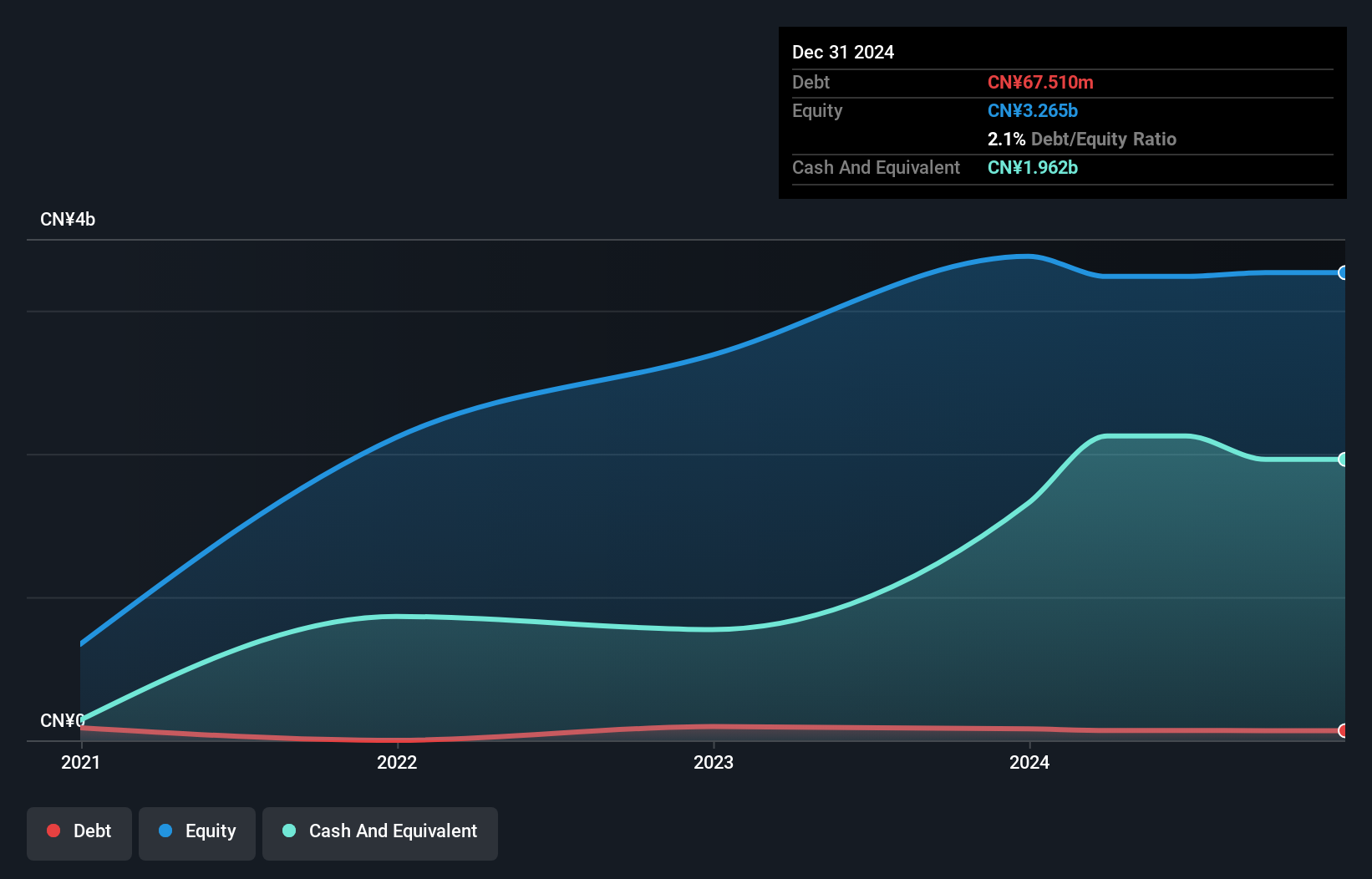

Operations: Morimatsu International Holdings generates revenue primarily from the production and sales of various pressure equipment, amounting to CN¥7.15 billion. The company's net profit margin is %.

Morimatsu International Holdings has seen its debt to equity ratio drop from 54.2% to 5.7% over the past five years, indicating strong financial health. Despite earnings growth of 35.1% annually over the same period, recent figures show a net income of CNY375.89 million for H1 2024, down from CNY422.35 million last year. Trading at a significant discount to fair value (66%), Morimatsu also initiated share repurchases in August 2024, enhancing shareholder value through potential EPS improvement.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$6.98 billion.

Operations: Guoquan Food (Shanghai) generates revenue primarily from retail sales through grocery stores, amounting to CN¥5.998 billion. The company's market cap stands at HK$6.98 billion.

Guoquan Food (Shanghai) Co., Ltd. reported half-year sales of CNY 2,665 million, down from CNY 2,760.91 million last year. Net income also saw a dip to CNY 85.98 million from CNY 107.7 million previously. Basic earnings per share fell to CNY 0.0313 compared to last year's CNY 0.0403. The company trades at a significant discount, about 67% below estimated fair value and maintains more cash than total debt, ensuring financial stability despite recent earnings challenges.

- Unlock comprehensive insights into our analysis of Guoquan Food (Shanghai) stock in this health report.

Assess Guoquan Food (Shanghai)'s past performance with our detailed historical performance reports.

Tomson Group (SEHK:258)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomson Group Limited is an investment holding company involved in property development and investment, hospitality and leisure, securities trading, and media and entertainment operations across Hong Kong, Macau, and Mainland China with a market cap of HK$4.94 billion.

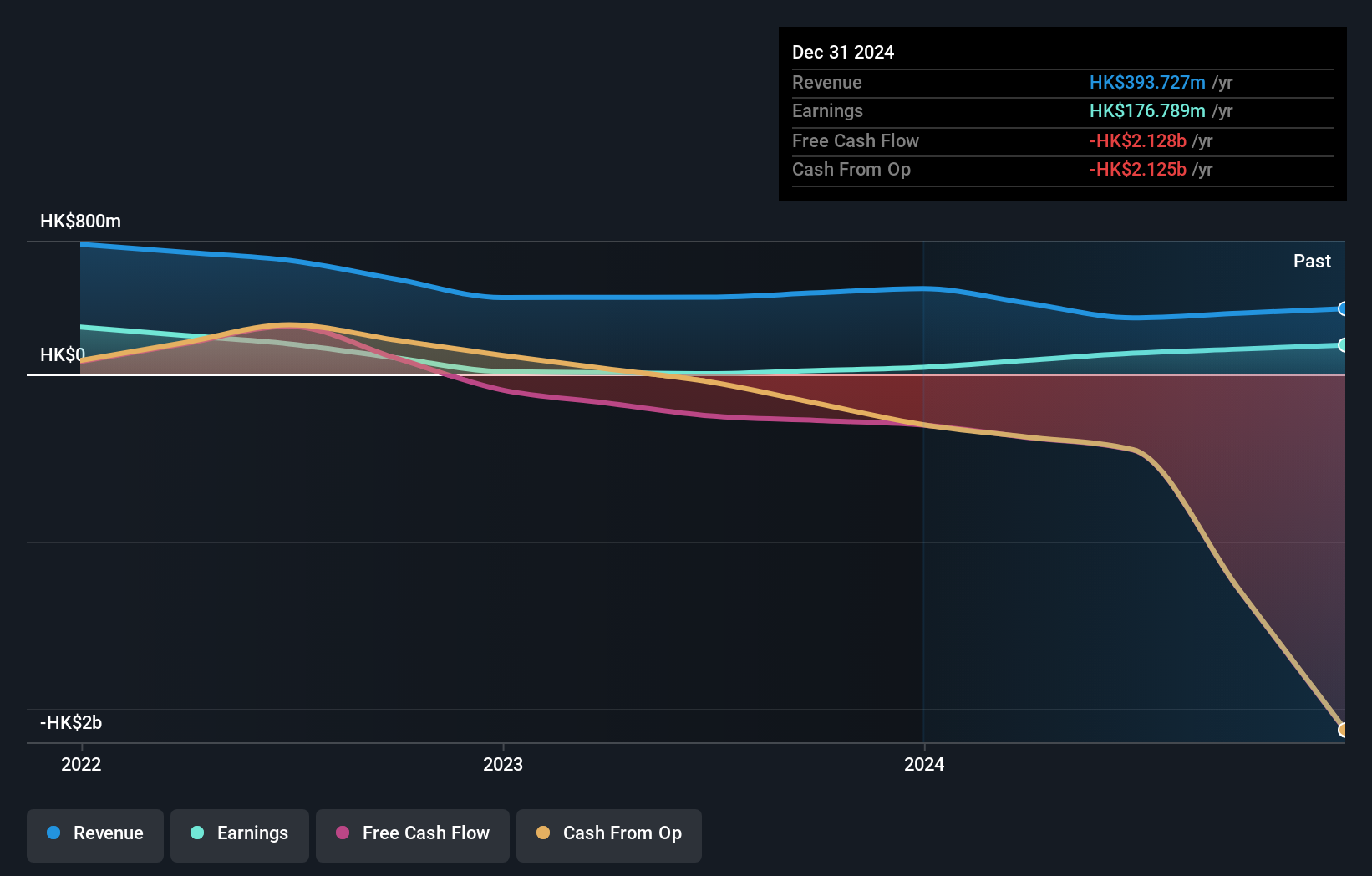

Operations: The group's revenue streams include property investment (HK$217.63 million), leisure (HK$49.69 million), and securities trading (HK$20.19 million).

Tomson Group has shown remarkable earnings growth of 2337.4% over the past year, significantly outperforming the Real Estate industry’s -11%. Despite a large one-off loss of HK$71.8M impacting recent financials, the company reported net income of HK$103.67M for H1 2024, up from HK$19.39M a year ago. Earnings per share also increased to HK$0.0503 from HK$0.0098 last year, reflecting improved profitability and operational efficiency despite revenue challenges.

- Click to explore a detailed breakdown of our findings in Tomson Group's health report.

Understand Tomson Group's track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 170 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomson Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:258

Tomson Group

An investment holding company, engages in the property development and investment, hospitality and leisure, securities trading, and media and entertainment investment and operation businesses in Hong Kong, Macau, and Mainland China.

Excellent balance sheet slight.