- Thailand

- /

- Trade Distributors

- /

- SET:XYZ

Asian Penny Stocks: 3 Picks With US$300M Market Cap

Reviewed by Simply Wall St

As global markets navigate through a period of economic uncertainty, driven by renewed trade tensions and fluctuating economic indicators, investors are increasingly looking beyond traditional investments. Penny stocks, often seen as remnants of past market eras, continue to hold potential for those seeking affordability and growth opportunities. These stocks typically represent smaller or newer companies that can offer significant value when backed by strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.12 | THB4.07B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.42 | HK$895.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.04 | HK$3.53B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.42 | HK$2.02B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.535 | SGD216.83M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.84 | THB2.9B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.63 | SGD10.35B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB1.00 | THB1.47B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.82 | THB9.74B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 978 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Shun Tak Holdings (SEHK:242)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shun Tak Holdings Limited is an investment holding company involved in property, transportation, hospitality and leisure, and investment sectors across Hong Kong, Macau, the People's Republic of China, Singapore, and internationally with a market cap of approximately HK$2.20 billion.

Operations: The company's revenue is primarily derived from its Property segment at HK$3.83 billion, followed by Hospitality at HK$660.02 million, and Investment at HK$147.12 million.

Market Cap: HK$2.2B

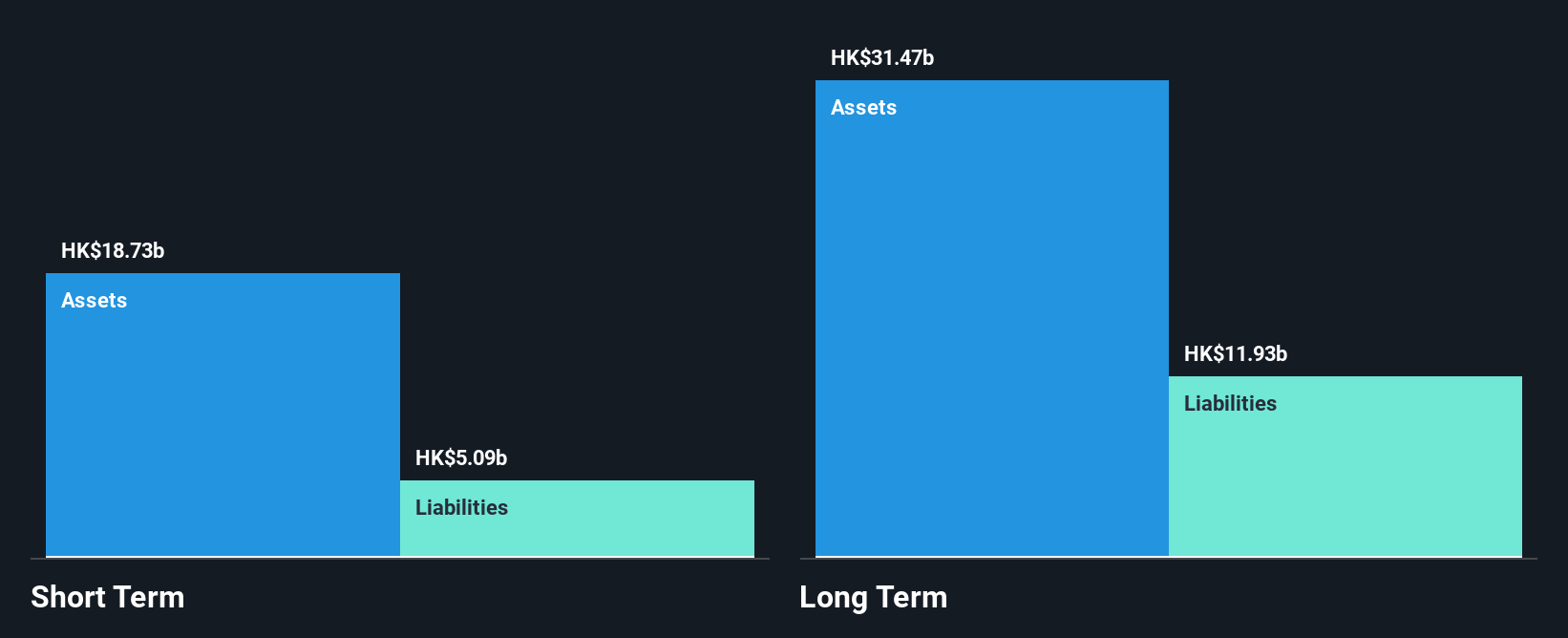

Shun Tak Holdings, with a market cap of approximately HK$2.20 billion, primarily generates revenue from its Property segment at HK$3.83 billion. Despite being unprofitable and having increased losses over the past five years, the company maintains satisfactory net debt to equity at 23.4% and covers short-term liabilities with assets of HK$18.8 billion against liabilities of HK$6.9 billion. Recent board changes include appointing Amelia Yau as an independent non-executive director, enhancing governance with her extensive public accounting experience amid the passing of long-serving director Charles Ho in June 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Shun Tak Holdings.

- Evaluate Shun Tak Holdings' prospects by accessing our earnings growth report.

RSXYZ (SET:XYZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: RSXYZ Public Company Limited, along with its subsidiaries, operates in the supply and distribution of chemical products in Thailand and has a market cap of THB2.02 billion.

Operations: The company generates revenue primarily from its Sim card Electronic Media Distribution segment, which accounts for THB2.30 billion.

Market Cap: THB2.02B

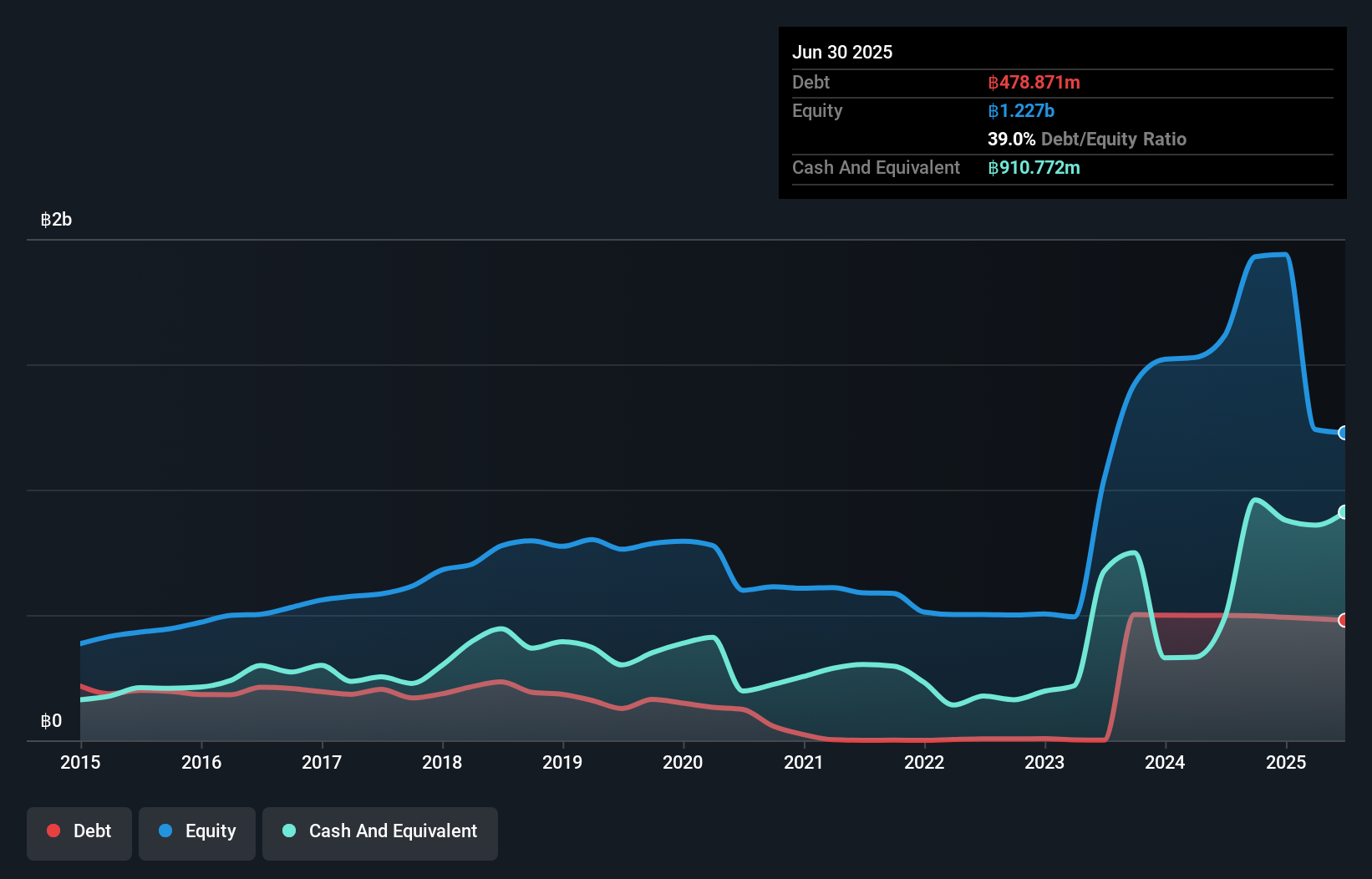

RSXYZ Public Company Limited, with a market cap of THB2.02 billion, primarily derives revenue from its Sim card Electronic Media Distribution segment amounting to THB2.30 billion. Despite being unprofitable and experiencing a net loss of THB66.27 million in Q1 2025, the company has managed to reduce losses over five years by 0.3% annually and maintains strong liquidity with short-term assets exceeding both long-term and short-term liabilities significantly. Recent board changes include appointing new directors and amending the Articles of Association, reflecting ongoing governance adjustments amidst high share price volatility.

- Click to explore a detailed breakdown of our findings in RSXYZ's financial health report.

- Review our historical performance report to gain insights into RSXYZ's track record.

CSE Global (SGX:544)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CSE Global Limited is an investment holding company that provides integrated industrial automation, information technology, and intelligent transport solutions across the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of SGD483.06 million.

Operations: The company's revenue is primarily derived from three segments: Automation (SGD194.36 million), Communications (SGD232.04 million), and Electrification (SGD434.78 million).

Market Cap: SGD483.06M

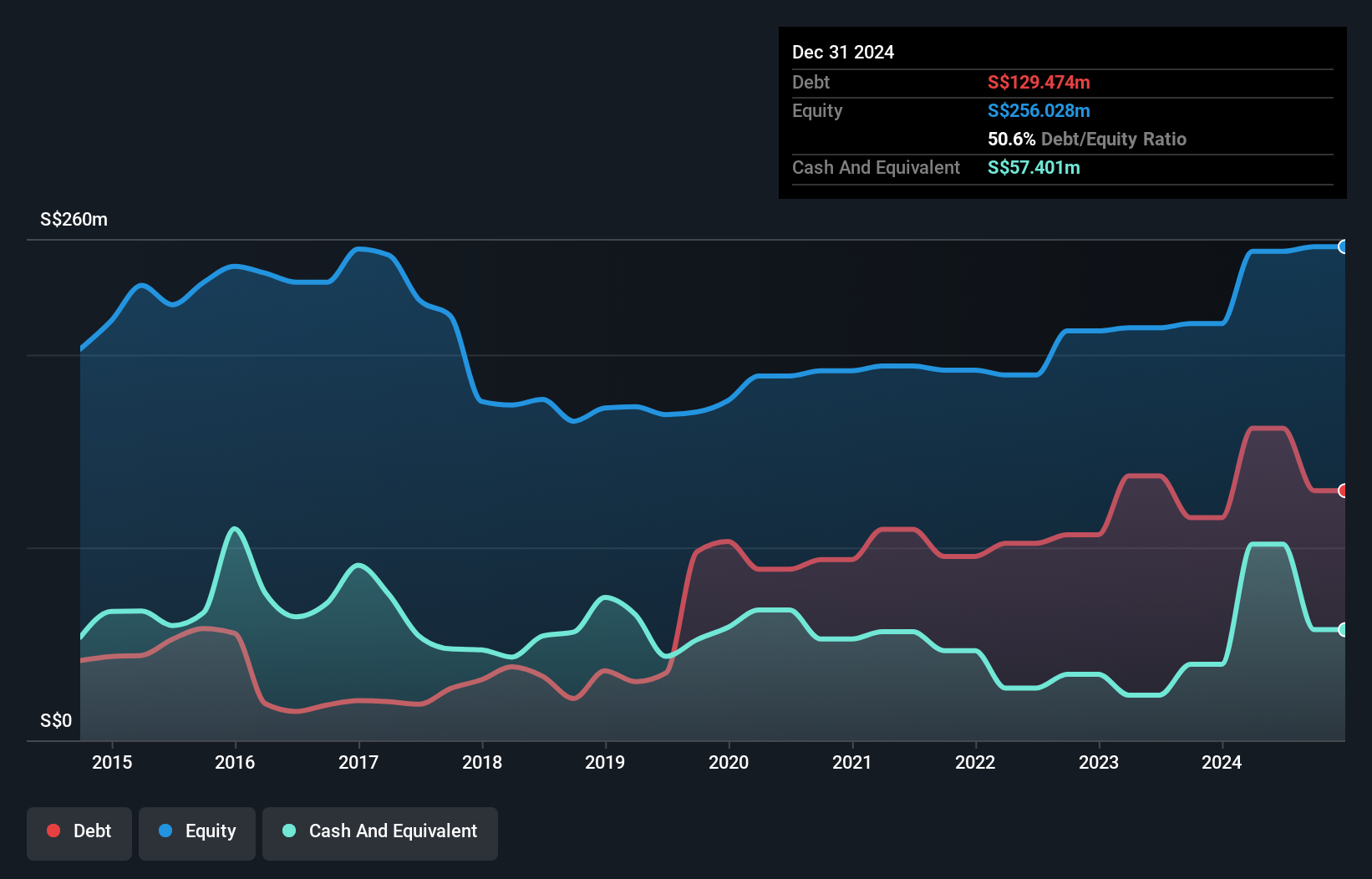

CSE Global Limited, with a market cap of SGD483.06 million, shows financial stability with short-term assets exceeding both long-term and short-term liabilities. The company has improved its debt-to-equity ratio from 58.5% to 50.6% over five years, indicating prudent financial management. Despite experiencing a decline in earnings by 5.4% annually over the past five years, recent growth of 16.9% suggests positive momentum surpassing industry averages. However, the dividend yield of 3.56% is not well covered by free cash flows, raising sustainability concerns. Recent board changes include appointing Ravinder Singh as Non-Executive Non-Independent Director to enhance strategic oversight.

- Take a closer look at CSE Global's potential here in our financial health report.

- Gain insights into CSE Global's future direction by reviewing our growth report.

Make It Happen

- Get an in-depth perspective on all 978 Asian Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:XYZ

RSXYZ

Engages in supply and distribution of chemical products in Thailand.

Adequate balance sheet and fair value.

Market Insights

Community Narratives