- Hong Kong

- /

- Real Estate

- /

- SEHK:28

Top 3 SEHK Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

As global markets react to the U.S. Federal Reserve's recent rate cut, Hong Kong's Hang Seng Index has shown a notable gain of 5.12%, reflecting positive investor sentiment despite mixed economic data from China. With this backdrop, dividend stocks in Hong Kong present an attractive option for investors seeking stable returns amid market volatility. In the current environment, a good dividend stock typically offers consistent payouts and demonstrates resilience against economic fluctuations—qualities that are particularly valuable as markets adjust to new monetary policies and economic conditions.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.55% | ★★★★★★ |

| Consun Pharmaceutical Group (SEHK:1681) | 9.69% | ★★★★★☆ |

| Lenovo Group (SEHK:992) | 4.03% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.61% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.80% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.63% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.57% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.76% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 7.46% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.10% | ★★★★★☆ |

Click here to see the full list of 79 stocks from our Top SEHK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

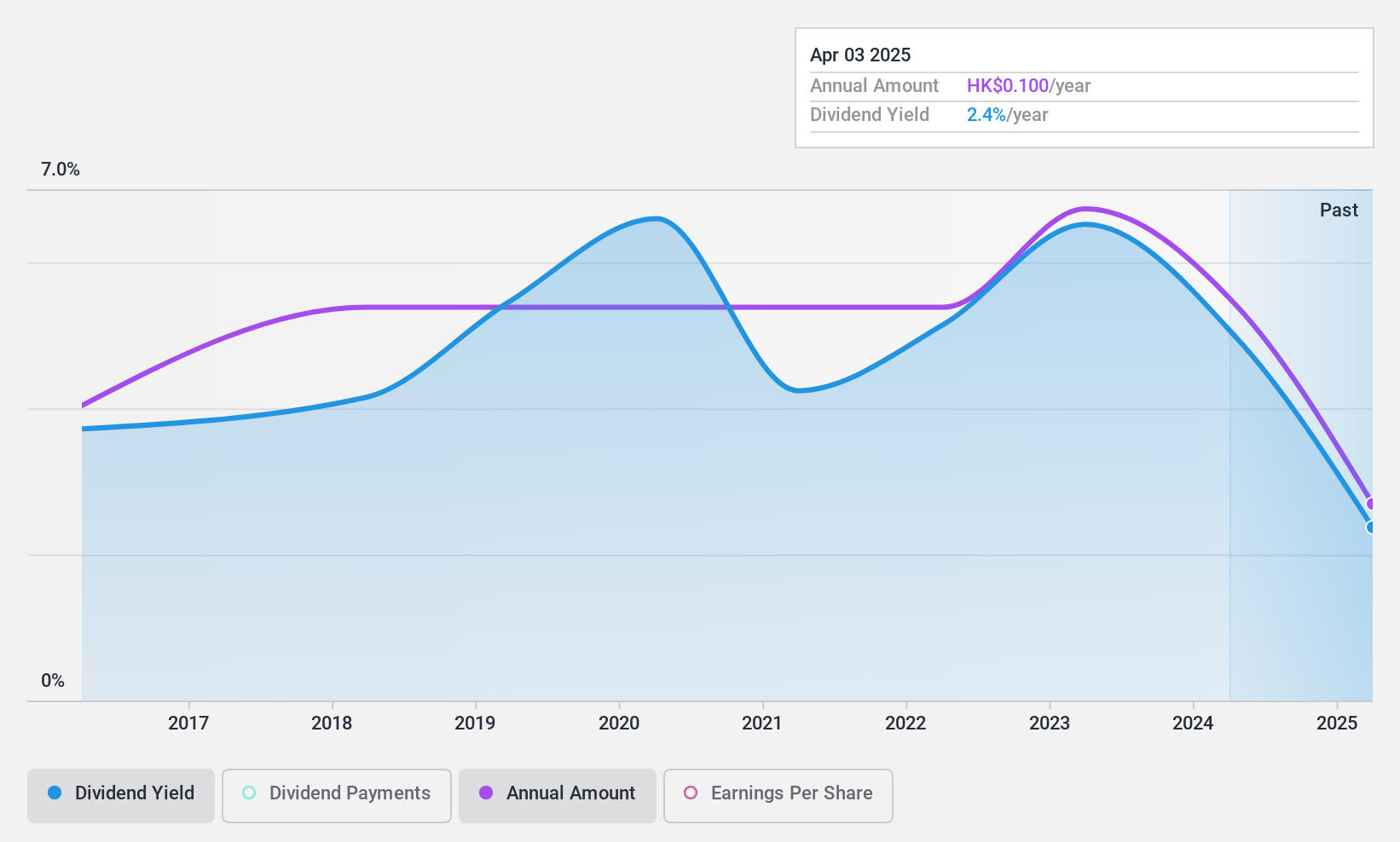

Financial Street Property (SEHK:1502)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Financial Street Property Co., Limited, with a market cap of HK$829.17 million, provides property management and related services in the People’s Republic of China through its subsidiaries.

Operations: Financial Street Property Co., Limited generates CN¥1.62 billion in revenue from property management and related services in the People’s Republic of China through its subsidiaries.

Dividend Yield: 8.6%

Financial Street Property is currently trading at 66.4% below its estimated fair value, making it potentially attractive for value investors. The company’s dividend yield of 8.61% places it in the top 25% of dividend payers in Hong Kong, with dividends covered by earnings (52%) and cash flows (54.6%). However, its dividend history is short and volatile, having paid dividends for only three years with significant fluctuations. Recent earnings showed a decline in net income from CNY 71.11 million to CNY 63.47 million year-over-year as of June 30, 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Financial Street Property.

- Our comprehensive valuation report raises the possibility that Financial Street Property is priced lower than what may be justified by its financials.

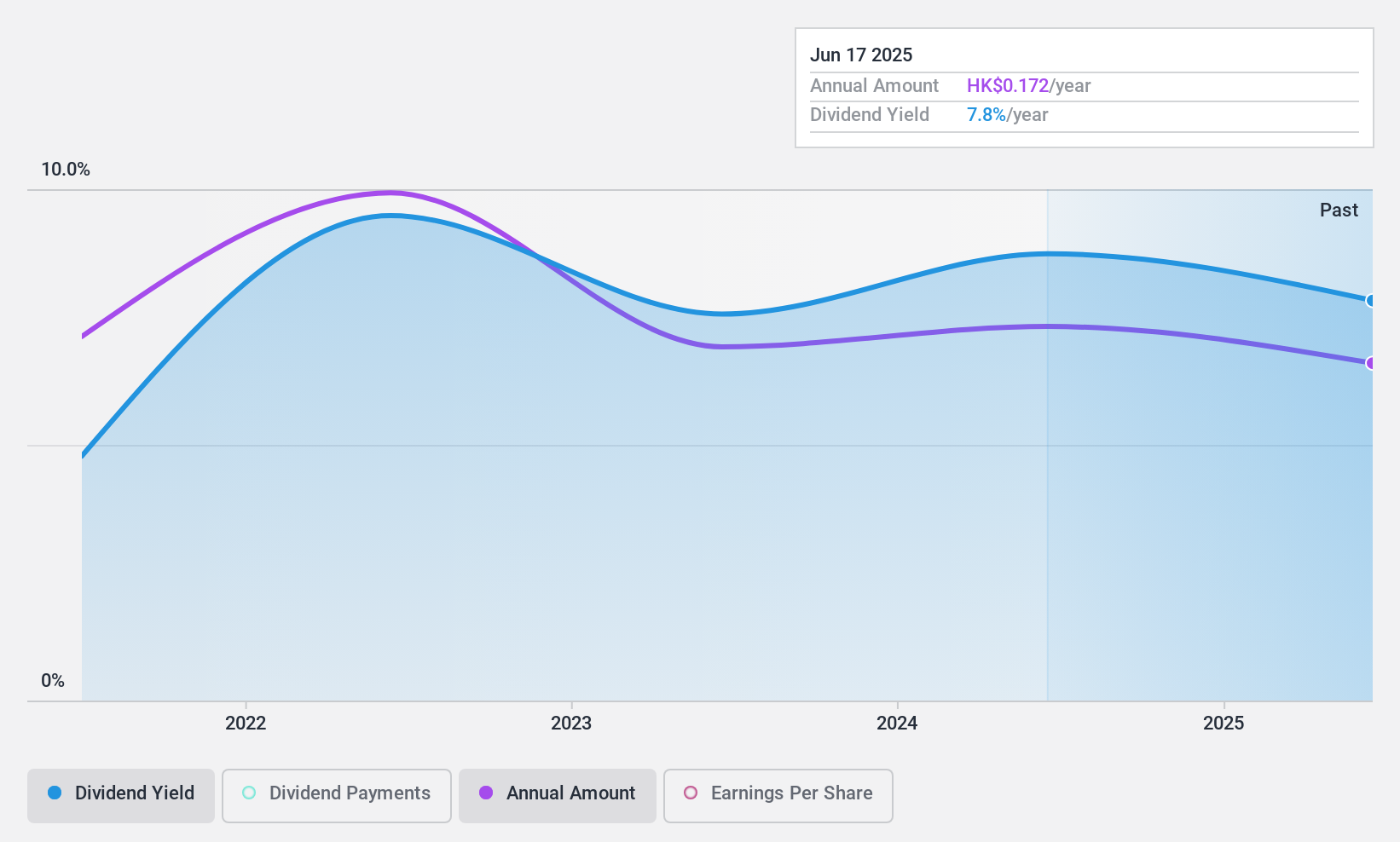

Tian An China Investments (SEHK:28)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties in the People's Republic of China, Hong Kong, the United Kingdom, and Australia, with a market cap of HK$5.75 billion.

Operations: Tian An China Investments Company Limited generates revenue from property investment (HK$581.17 million) and property development (HK$1.10 billion).

Dividend Yield: 5.1%

Tian An China Investments offers a dividend yield of 5.1%, which is lower than the top 25% of dividend payers in Hong Kong. The company's dividends are well covered by earnings (payout ratio: 30.3%) and cash flows (cash payout ratio: 16.9%), with stable payments over the past decade. However, recent earnings showed a significant decline, with net income dropping from HK$577.22 million to HK$78.06 million year-over-year as of June 30, 2024, due to lower property sales and decreased fair value in investment properties.

- Click here to discover the nuances of Tian An China Investments with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Tian An China Investments is priced higher than what may be justified by its financials.

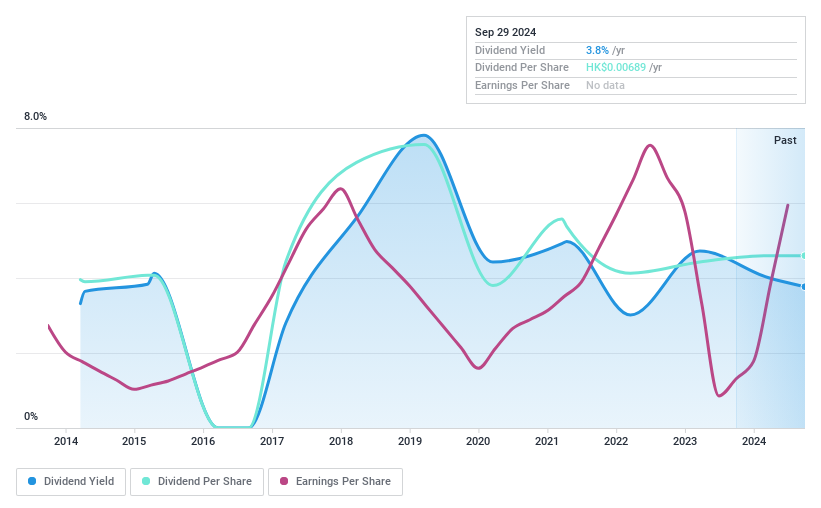

China Starch Holdings (SEHK:3838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Starch Holdings Limited, with a market cap of HK$1.01 billion, manufactures and sells cornstarch, lysine, starch-based sweeteners, modified starch, and other corn-refined products in the People’s Republic of China.

Operations: China Starch Holdings Limited generates revenue primarily from its Upstream Products (CN¥9.80 billion) and Fermented and Downstream Products (CN¥3.86 billion).

Dividend Yield: 4.1%

China Starch Holdings has a low payout ratio of 10.4%, ensuring dividends are well covered by earnings and cash flows (cash payout ratio: 25.9%). However, its dividend payments have been volatile over the past decade. Recent earnings showed a significant turnaround, with net income at CNY 214.66 million for the first half of 2024 compared to a net loss previously. Board changes include Ms. Sze Tak On's appointment as an independent non-executive Director and chairman of various committees effective August 2024.

- Navigate through the intricacies of China Starch Holdings with our comprehensive dividend report here.

- Our valuation report here indicates China Starch Holdings may be undervalued.

Seize The Opportunity

- Gain an insight into the universe of 79 Top SEHK Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tian An China Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:28

Tian An China Investments

An investment holding company, invests in, develops, and manages properties in the People's Republic of China, Hong Kong, the United Kingdom, and Australia.

Excellent balance sheet established dividend payer.