- Hong Kong

- /

- Real Estate

- /

- SEHK:1200

Global Penny Stocks: Midland Holdings And 2 More Exciting Picks

Reviewed by Simply Wall St

Global markets have recently faced a downturn, with U.S. stocks snapping a three-week winning streak due to tech sell-offs and concerns over AI spending, while consumer sentiment has hit its lowest point since 2022. Despite these challenges, certain investment opportunities remain attractive, particularly in the realm of penny stocks—an area that continues to hold potential for those willing to explore smaller or newer companies with solid financial foundations. Though the term 'penny stock' may seem outdated, it still represents an intriguing segment where investors can find hidden value and growth prospects in companies like Midland Holdings and others that combine balance sheet strength with promising potential.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.54 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (NasdaqGS:LX) | $4.24 | $715.12M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.06 | A$473.37M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.13 | SGD457.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.23 | MYR493.91M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ✅ 5 ⚠️ 0 View Analysis > |

Click here to see the full list of 3,571 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Midland Holdings (SEHK:1200)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midland Holdings Limited is an investment holding company offering property agency services across Hong Kong, Macau, and Mainland China with a market cap of HK$1.75 billion.

Operations: The company's revenue is primarily derived from its property agency services, with HK$5.21 billion generated from residential properties and HK$53.95 million from commercial, industrial properties, and shops.

Market Cap: HK$1.75B

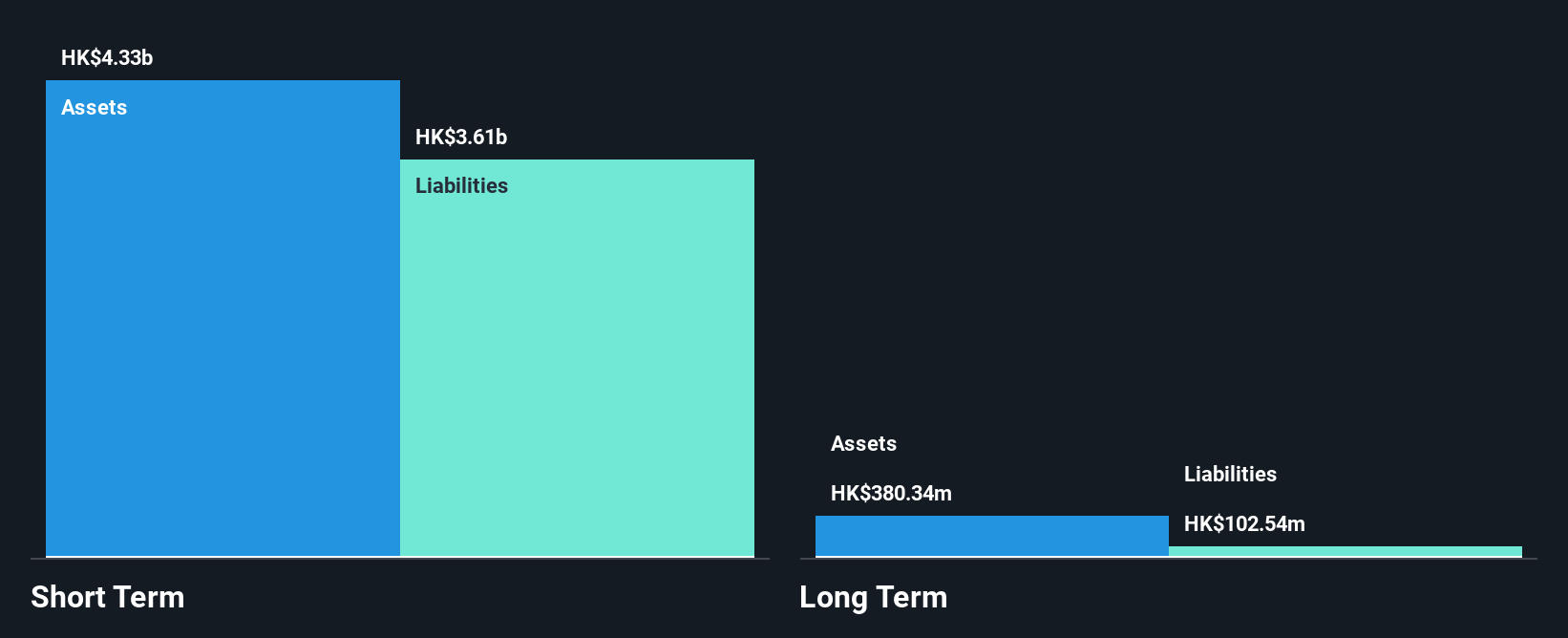

Midland Holdings Limited, with a market cap of HK$1.75 billion, has shown significant earnings growth of 219.7% over the past year, outpacing the real estate industry. The company is debt-free and boasts high-quality earnings and a strong Return on Equity at 26%. Its short-term assets exceed both short-term and long-term liabilities, indicating financial stability. Despite recent insider selling, Midland trades at good value compared to peers. Recent events include its addition to the S&P Global BMI Index and completion of a share buyback program. Earnings for H1 2025 were lower than last year but remain robust overall.

- Dive into the specifics of Midland Holdings here with our thorough balance sheet health report.

- Learn about Midland Holdings' future growth trajectory here.

EverChina Int'l Holdings (SEHK:202)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EverChina Int'l Holdings Company Limited is an investment holding company focused on property investment and hotel operations in China and Bolivia, with a market cap of HK$1.16 billion.

Operations: The company's revenue is primarily derived from its agricultural operation, which generated HK$78.43 million, and its property investment operation, contributing HK$29.75 million.

Market Cap: HK$1.16B

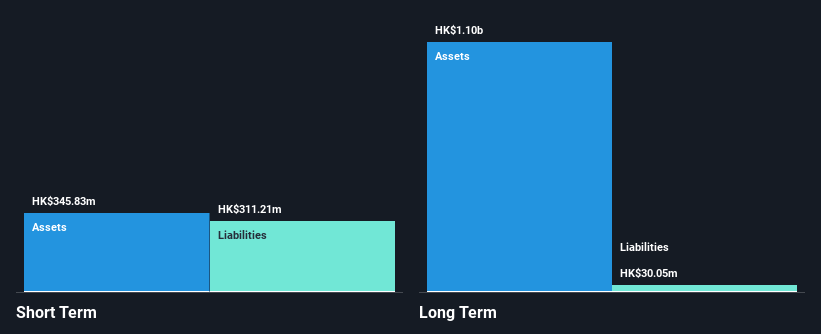

EverChina Int'l Holdings, with a market cap of HK$1.16 billion, focuses on property investment and hotel operations in China and Bolivia. Despite being unprofitable, the company has reduced its losses by 10.1% annually over the past five years. Its agricultural operations generate HK$78.43 million in revenue, while property investments contribute HK$29.75 million. Short-term assets of HK$431.5 million do not cover short-term liabilities of HK$485.5 million; however, long-term liabilities are well-covered by these assets. The management team is relatively new with an average tenure of 1.5 years, indicating potential changes in strategic direction or operational focus.

- Take a closer look at EverChina Int'l Holdings' potential here in our financial health report.

- Gain insights into EverChina Int'l Holdings' past trends and performance with our report on the company's historical track record.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, engages in the manufacturing and sale of petroleum and chemical products in the People’s Republic of China, with a market cap of approximately HK$27.05 billion.

Operations: Revenue segments for Sinopec Shanghai Petrochemical Company Limited are not reported.

Market Cap: HK$27.05B

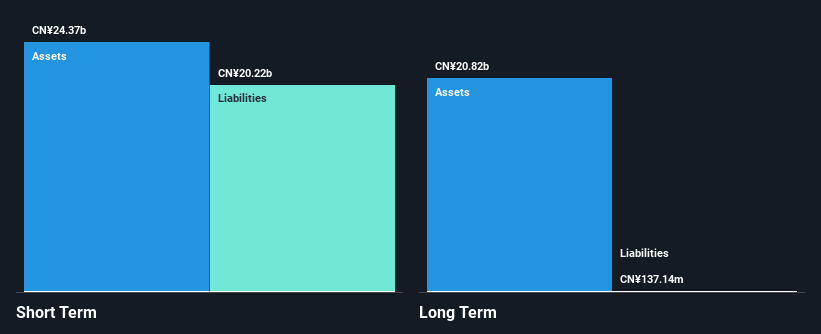

Sinopec Shanghai Petrochemical, with a market cap of HK$27.05 billion, has faced financial challenges recently, reporting a net loss of CN¥431.53 million for the nine months ending September 2025 compared to a profit the previous year. Despite its unprofitable status and negative return on equity, the company benefits from strong liquidity, with short-term assets exceeding both short and long-term liabilities. The management team is experienced with an average tenure of 3.4 years, and efforts to reduce debt have been successful over the past five years. Additionally, no significant shareholder dilution occurred in the past year despite ongoing losses.

- Unlock comprehensive insights into our analysis of Sinopec Shanghai Petrochemical stock in this financial health report.

- Understand Sinopec Shanghai Petrochemical's earnings outlook by examining our growth report.

Make It Happen

- Embark on your investment journey to our 3,571 Global Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1200

Midland Holdings

An investment holding company, provides property agency services in Hong Kong, Macau, and Mainland China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives