RemeGen (SEHK:9995) Losses Widen 23.9% Annually, Profitability Forecasts Test Investor Optimism

Reviewed by Simply Wall St

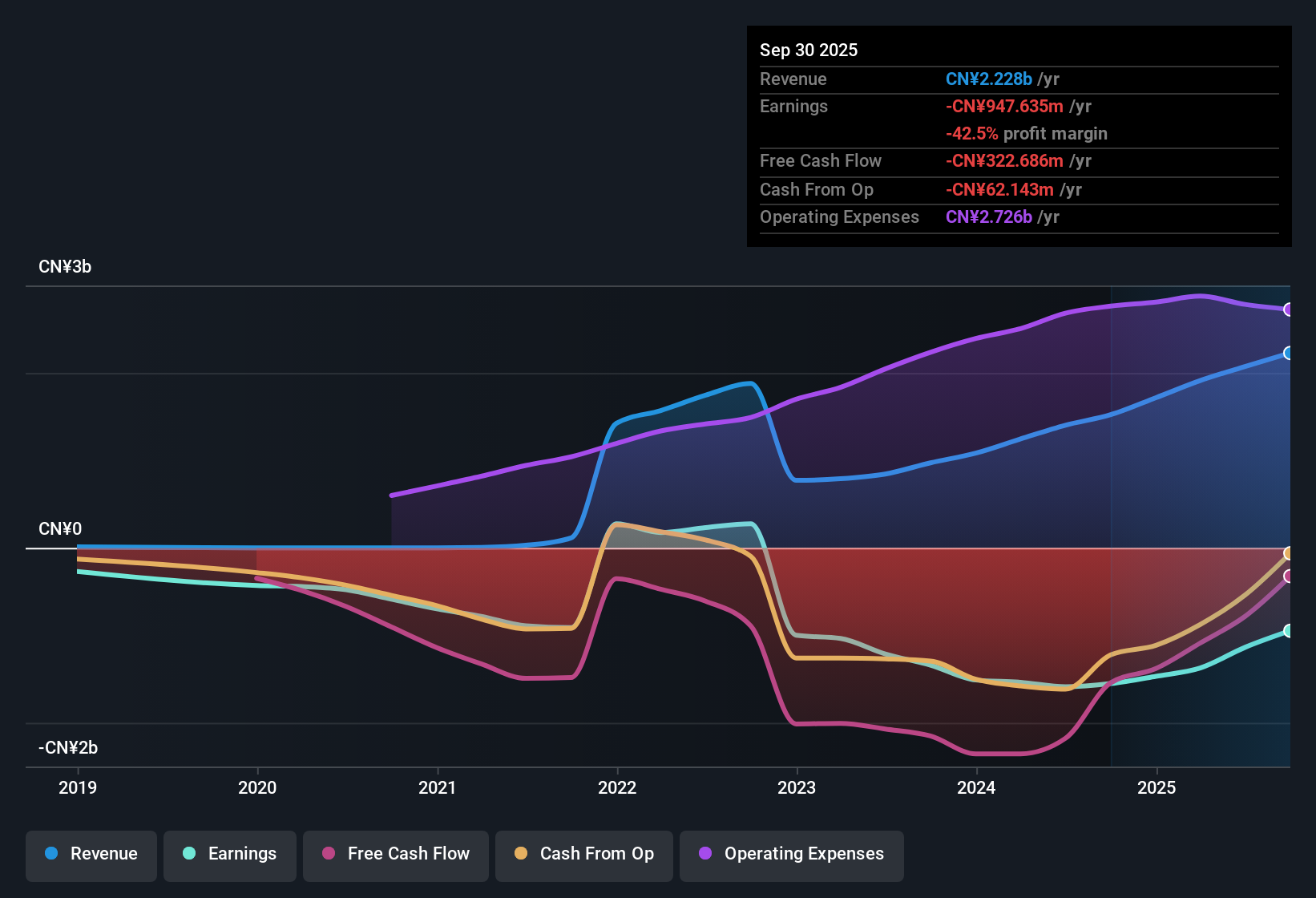

RemeGen (SEHK:9995) continues to operate at a loss, with annual net losses widening by an average of 23.9% over the past five years. While the company remains unprofitable, consensus forecasts point to a turnaround. Projections indicate RemeGen may reach profitability within three years, with earnings expected to surge 68.79% per year and revenue growth anticipated at 26.1% per year. With share price trading at HK$90, the focus is now on whether accelerating growth can justify a lofty price-to-sales multiple of 20.6x, which exceeds both the industry and peer averages.

See our full analysis for RemeGen.Now that we have the headline numbers, let’s see how they compare to the widely discussed narratives. This is where the real story for RemeGen could start to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Averaged 23.9% Annually Over Five Years

- RemeGen’s net losses have widened by an average of 23.9% per year for the last five years, indicating persistent operating challenges and reinforcing that the path to profitability has been slow and costly.

- Strong profit growth projections heavily support the view that rapid earnings expansion could help flip the trajectory:

- Forecasts point to profitability arriving within three years, far outpacing historical loss trends.

- This anticipated turnaround sharpens focus on whether the company’s growth rate can offset years of negative momentum and justify the current valuation premium.

Share Trades at 13% Discount to DCF Fair Value

- With shares at HK$90 versus a DCF fair value of HK$104.07, RemeGen currently trades about 13% below its DCF-based estimate. This provides a valuation buffer not always seen in growth-stage biotech names.

- While robust revenue and earnings outlooks provide a compelling foundation, it is notable that a discounted valuation exists alongside a large five-year net loss average:

- This gap supports optimism that the market’s current price builds in skepticism about forecasted growth rather than fully pricing it in.

- Such a buffer is notable given the wider sector’s tendency to price in future hopes more aggressively, especially when projected annual growth is this high.

Price-to-Sales Multiple Far Exceeds Peers

- RemeGen’s price-to-sales ratio of 20.6x is significantly above both the Hong Kong biotech industry average of 15.1x and its peer group average of 10.2x. This underscores a substantial premium for future potential.

- Both optimistic and cautious investors may question whether projected earnings and revenue expansion truly justify paying such a multiple:

- The persistently high premium suggests investors remain willing to bet that rapid turnaround will play out, but it also raises the bar for what must be delivered to sustain or grow the stock’s current level.

- This narrative tension is at the heart of current debate about whether RemeGen is a smart growth bet or an overvalued play if targets are not met.

See our latest analysis for RemeGen.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on RemeGen's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

RemeGen’s track record of widening losses and reliance on ambitious growth forecasts create uncertainty around its ability to deliver reliable, steady results.

If you prefer businesses with proven consistency, use stable growth stocks screener (2103 results) and find those achieving stable growth quarter after quarter regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9995

RemeGen

A biopharmaceutical company, discovers, develops, produces, and commercializes biological drugs for the treatment of autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States.

Exceptional growth potential with imperfect balance sheet.

Market Insights

Community Narratives