As global markets show signs of optimism, with the Hang Seng Index up 1.99% and technology stocks leading gains, Hong Kong's tech sector is drawing significant investor attention. In this dynamic environment, identifying high-growth tech stocks requires a keen eye on companies that are not only innovating but also demonstrating strong fundamentals and market adaptability.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Biocytogen Pharmaceuticals (Beijing) Co., Ltd. is a biotechnology company focused on the research and development of antibody-based drugs, operating in China, the United States, and internationally, with a market cap of HK$2.52 billion.

Operations: Biocytogen Pharmaceuticals generates revenue primarily from animal model sales (CN¥293.68 million), pre-clinical pharmacology and efficacy evaluation (CN¥193.40 million), antibody development (CN¥175.87 million), and gene editing services (CN¥74.33 million).

Biocytogen Pharmaceuticals (Beijing) has demonstrated impressive growth, with revenue increasing by 34.3% over the past year and forecasted to grow at 21.3% annually, outpacing the Hong Kong market's 7.4%. The company's substantial R&D investments have resulted in a robust pipeline, including a recent agreement with IDEAYA Biosciences for a potential $406.5 million in milestone payments and royalties from their B7H3/PTK7 BsADC program. Additionally, Biocytogen's antibody licensing business and innovative animal models continue to drive revenue, contributing significantly to its promising financial outlook despite current unprofitability.

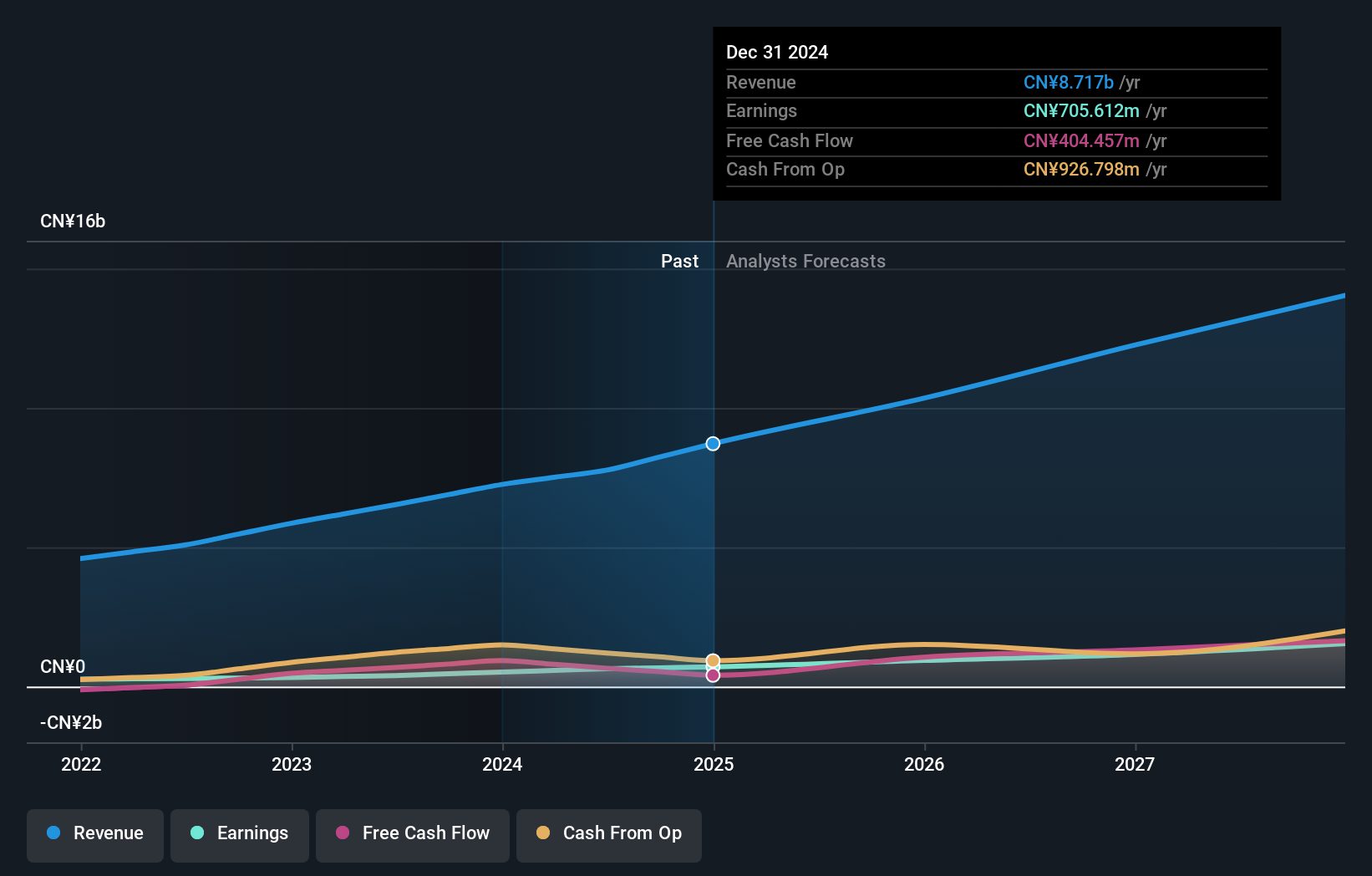

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for the energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$6.51 billion.

Operations: Wasion Holdings Limited generates revenue primarily through three segments: Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion). The company is involved in the research, development, production, and sale of energy metering and energy efficiency management solutions for various regions including China, Africa, the United States, Europe, and Asia.

Wasion Holdings has shown remarkable growth, with earnings surging by 61% over the past year, significantly outperforming the Electronic industry's 7.2% decline. The company's revenue is expected to grow at an impressive 22.7% annually, outpacing the Hong Kong market's 7.4%. Notably, Wasion's R&D expenses have contributed to its innovative edge; in the last fiscal year alone, they allocated approximately RMB 247 million towards research and development efforts. Recent contracts from Hungary (EUR 31.62 million), Singapore (USD 9.42 million), and Malaysia (USD 5.74 million) underscore their expanding international footprint and client trust in their smart meter solutions.

- Dive into the specifics of Wasion Holdings here with our thorough health report.

Understand Wasion Holdings' track record by examining our Past report.

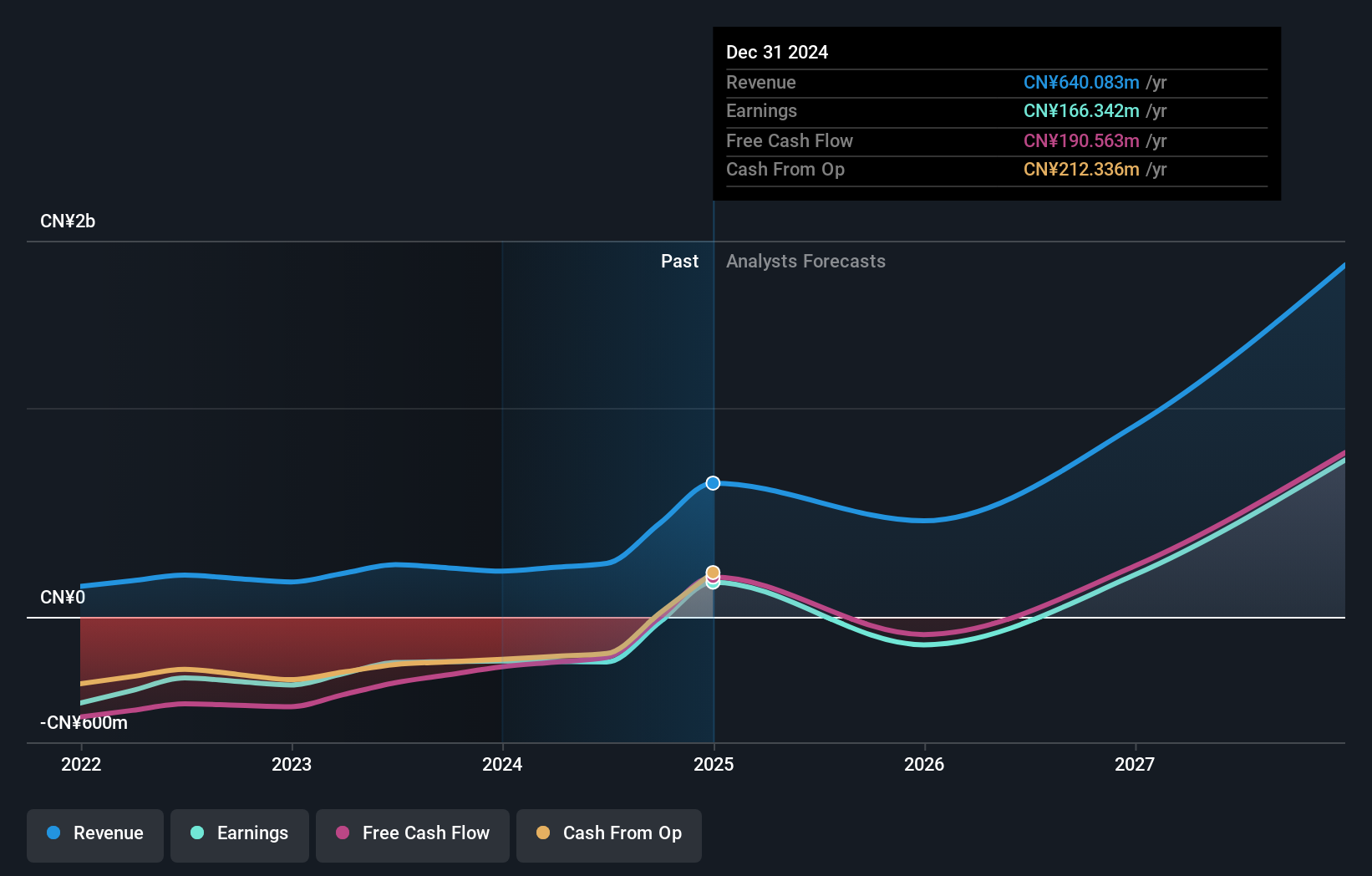

Alphamab Oncology (SEHK:9966)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphamab Oncology, a clinical stage biopharmaceutical company, focuses on the research and development, manufacture, and commercialization of oncology biologics with a market cap of approximately HK$2.36 billion.

Operations: Alphamab Oncology generates revenue primarily from the sale of pharmaceuticals, totaling CN¥255.87 million. The company specializes in developing and commercializing biologics for cancer treatment.

Alphamab Oncology reported a 27.2% increase in sales for the half year ending June 30, 2024, reaching CNY 173.56 million. Despite a net loss of CNY 44.9 million, the company’s R&D expenses underscore its commitment to innovation; their JSKN003 anti-HER2 bispecific ADC has shown promising results in clinical studies across Australia and China. With revenue projected to grow at an impressive annual rate of 39.4%, Alphamab's focus on advanced oncology treatments positions it well within the high-growth tech landscape in Hong Kong.

- Navigate through the intricacies of Alphamab Oncology with our comprehensive health report here.

Assess Alphamab Oncology's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 47 SEHK High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biocytogen Pharmaceuticals (Beijing) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2315

Biocytogen Pharmaceuticals (Beijing)

A biotechnology company, engages in the research and development of antibody-based drugs in the People’s Republic of China, the United States, and internationally.

High growth potential with adequate balance sheet.