A Look at Akeso (SEHK:9926) Valuation Following Key Phase III HARMONi-6 Study Results

Reviewed by Simply Wall St

Akeso (SEHK:9926) was in the spotlight after recently published Phase III HARMONi-6 study results showed its bispecific antibody, ivonescimab, plus chemotherapy significantly improved progression-free survival in advanced squamous NSCLC compared to current treatments.

See our latest analysis for Akeso.

Akeso’s big clinical win comes after a year of remarkable momentum, with a year-to-date share price return of 93.5% and a 66.3% total shareholder return over the past twelve months. Excitement around recent trial successes and a robust oncology pipeline has clearly caught investors’ attention, even if there has been a short-term pullback since recent highs.

If Akeso’s latest cancer breakthrough has you wondering about what else is happening in the sector, you might want to explore more promising companies using our healthcare screener: See the full list for free.

With those breakthrough results and a pipeline packed with innovation, investors may wonder whether Akeso’s future potential is still undervalued or if the market has already priced in all that growth.

Most Popular Narrative: 34.1% Undervalued

With Akeso’s narrative fair value set far above the latest close, there is growing anticipation that the company’s rapid clinical and commercial advances are not yet fully reflected in the current market price. The consensus view hints at substantial growth catalysts propelling future earnings multiples to new territory.

The collaboration with SUMMIT Therapeutics and the strategic partnership with Pfizer to combine ivonescimab with Pfizer's ADCs suggests expansion into new therapeutic areas and geographic markets, promising to impact earnings positively. The company's strong R&D pipeline, including advanced bispecific antibodies and ADC candidates, provides a foundation for long-term growth, setting the stage for potential increases in net margins as products move from development to commercialization.

Curious how such bold international deals shape the expected price surge? The real secret driving this valuation is a forward-looking profit leap and margin turnaround that stands apart from the sector’s usual pacing. Want to know what projections power this outlook? Peek inside the complete narrative and see the numbers that could change everything.

Result: Fair Value of $172.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including Akeso’s ongoing operating losses and heavy reliance on just a few major products for future commercial success.

Find out about the key risks to this Akeso narrative.

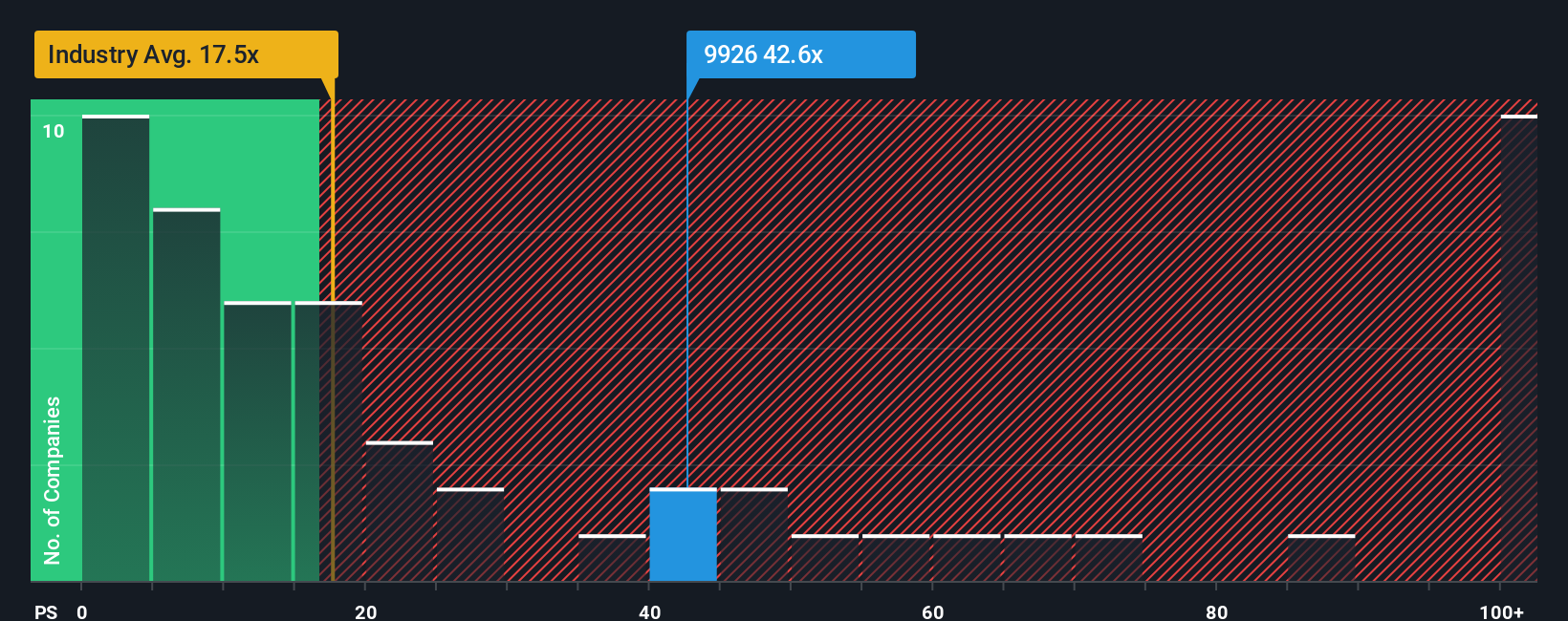

Another View: High Sales Multiple Raises Caution

Looking from a different angle, Akeso's stock trades at a price-to-sales ratio of 38.1x, notably higher than both its peers’ average of 25.9x and the Hong Kong Biotechs industry average of just 15.1x. Even compared to its own fair ratio of 21.4x, the current valuation seems lofty. This suggests that investors are paying a substantial premium for future growth hopes. Could this premium be a warning sign that the risks are higher than they appear, or is the market simply pricing in Akeso's big potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Akeso Narrative

If you see things differently or want to dig into the details yourself, it’s easy to build your personal narrative and insights in just minutes: Do it your way

A great starting point for your Akeso research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Stock Ideas?

Don’t let the next opportunity slip away. Serious investors are capitalizing on new growth themes, and now is your chance to spot tomorrow’s leaders before the crowd.

- Boost your returns by targeting high-yield opportunities among these 22 dividend stocks with yields > 3%, which offer attractive income potential and reliable payout growth.

- Catch the AI wave and put your capital behind innovation with these 26 AI penny stocks, which are poised for breakthroughs in artificial intelligence and automation.

- Stay ahead of the market by tracking these 833 undervalued stocks based on cash flows, where mispriced gems could offer exceptional upside and fresh growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives