- China

- /

- General Merchandise and Department Stores

- /

- SHSE:601010

3 Asian Penny Stocks With Market Caps Up To US$800M

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty with fluctuating indices and evolving economic conditions, investors are increasingly looking toward alternative opportunities. Penny stocks, though an outdated term, continue to represent smaller or less-established companies that may offer significant value potential. By focusing on those with strong financials and clear growth trajectories, investors can uncover promising opportunities in the Asian market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.16 | SGD470.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.03 | HK$2.77B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.38 | THB8.85B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 945 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Genor Biopharma Holdings (SEHK:6998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genor Biopharma Holdings Limited is a biopharmaceutical company that develops and commercializes oncology and autoimmune drugs in China and internationally, with a market cap of HK$1.73 billion.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to CN¥224.00 million.

Market Cap: HK$1.73B

Genor Biopharma Holdings has shown promising financial improvements, becoming profitable this year with a significant reduction in net loss for the half-year ended June 30, 2025. The company's short-term assets of CN¥1.0 billion comfortably cover both its short and long-term liabilities, while it remains debt-free, enhancing its financial stability. Despite high volatility in share price and low return on equity at 2.5%, Genor's seasoned management and board contribute to strategic oversight. Recent earnings growth is notable but difficult to benchmark against industry trends due to its recent transition to profitability.

- Click to explore a detailed breakdown of our findings in Genor Biopharma Holdings' financial health report.

- Learn about Genor Biopharma Holdings' historical performance here.

Wenfeng Great World Chain Development (SHSE:601010)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wenfeng Great World Chain Development Corporation operates a commercial retail chain in China with a market cap of CN¥5.06 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥5.06B

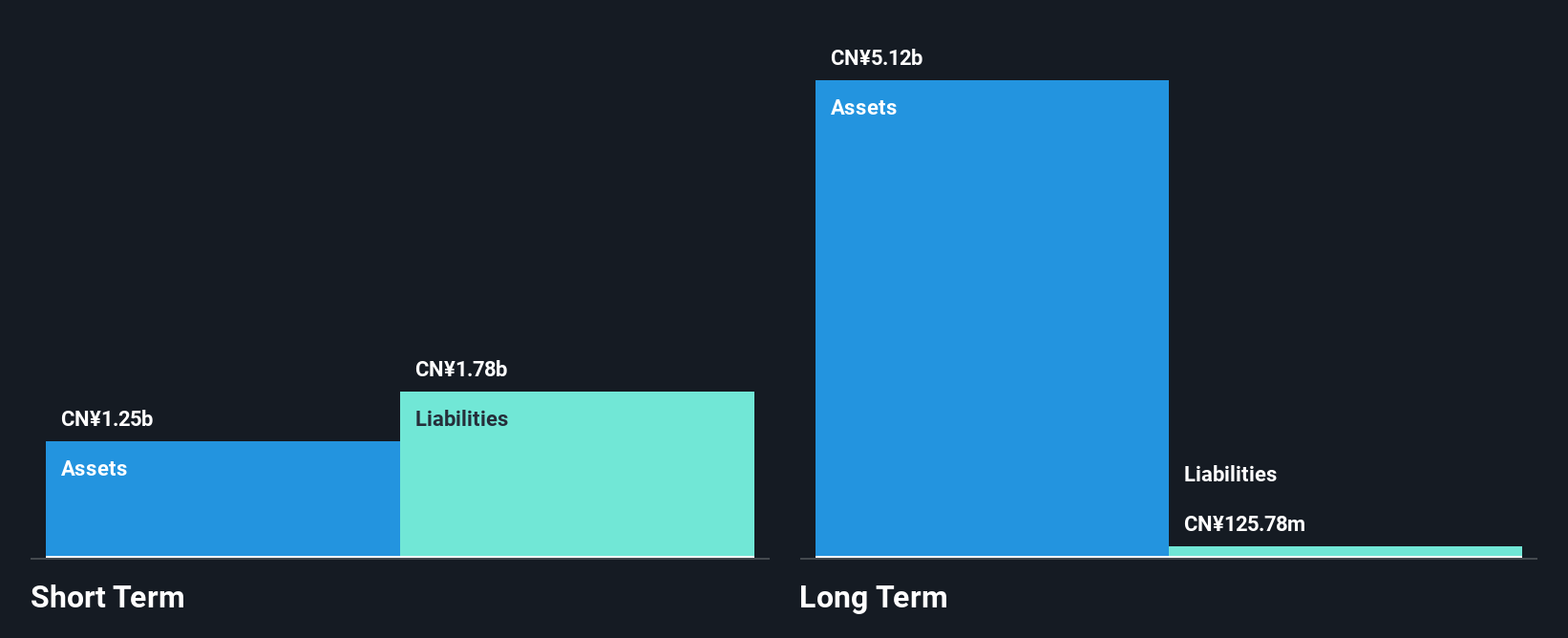

Wenfeng Great World Chain Development Corporation faces challenges with declining earnings, having reported a significant drop in net income for the nine months ended September 30, 2025. Despite this, the company maintains a manageable debt level with cash exceeding total debt and operating cash flow covering its obligations well. However, short-term liabilities surpass short-term assets by CN¥500 million, indicating liquidity concerns. The company's management is relatively experienced but its board lacks tenure stability. Although it offers a dividend of 4.4%, it's not well covered by earnings or free cash flows, raising sustainability questions amidst volatile market conditions.

- Jump into the full analysis health report here for a deeper understanding of Wenfeng Great World Chain Development.

- Explore historical data to track Wenfeng Great World Chain Development's performance over time in our past results report.

Zhanjiang Guolian Aquatic Products (SZSE:300094)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhanjiang Guolian Aquatic Products Co., Ltd. operates in the aquaculture industry, focusing on the farming, processing, and distribution of aquatic products, with a market cap of approximately CN¥4.23 billion.

Operations: There are no specific revenue segments reported for Zhanjiang Guolian Aquatic Products Co., Ltd.

Market Cap: CN¥4.23B

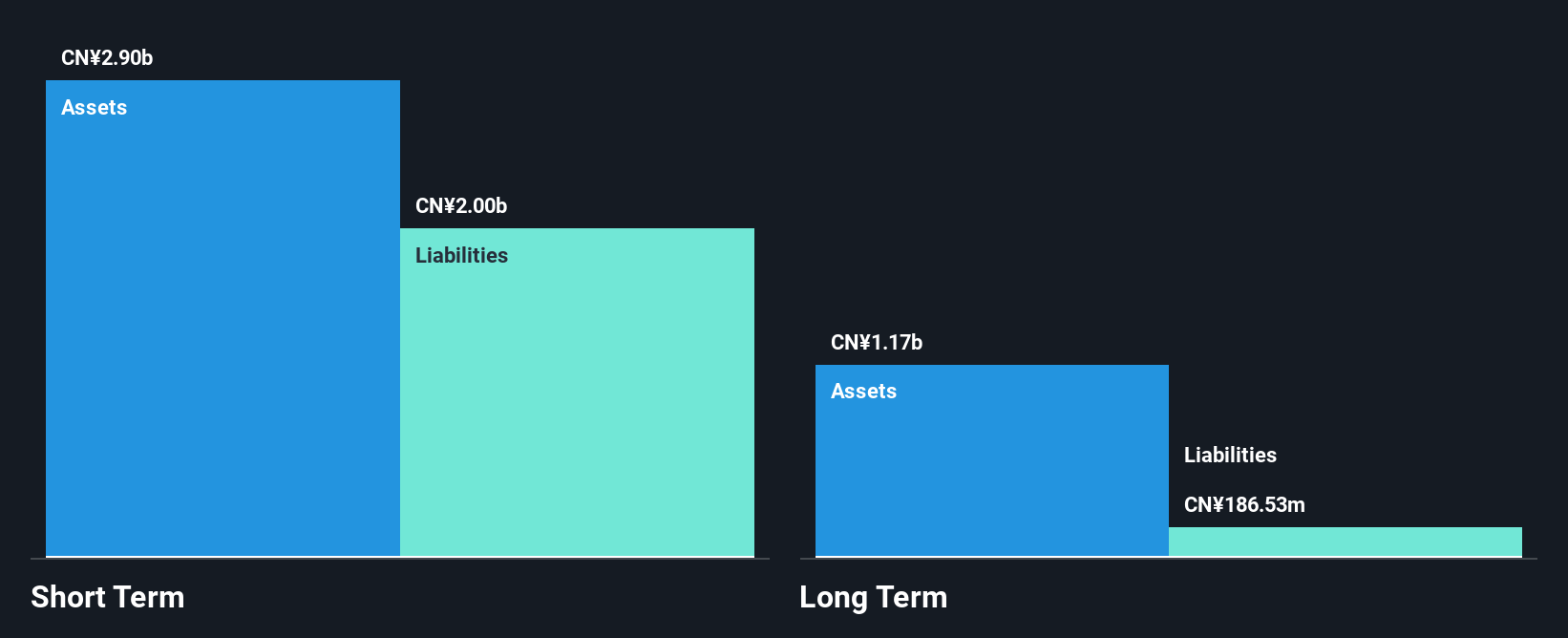

Zhanjiang Guolian Aquatic Products Co., Ltd. has experienced financial difficulties, with a significant increase in net loss to CN¥799.82 million for the nine months ended September 30, 2025, compared to the previous year. Despite stable weekly volatility and sufficient cash runway for over three years based on current free cash flow, its debt to equity ratio has risen considerably over five years, indicating increased leverage risk. The company's short-term assets cover both short- and long-term liabilities; however, it remains unprofitable with declining revenues and earnings growth challenges amidst recent bylaw amendments and strategic shifts in capital allocation.

- Unlock comprehensive insights into our analysis of Zhanjiang Guolian Aquatic Products stock in this financial health report.

- Evaluate Zhanjiang Guolian Aquatic Products' historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 945 Asian Penny Stocks.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wenfeng Great World Chain Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601010

Wenfeng Great World Chain Development

Operates commercial retail chain in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives