Revisiting Ascentage Pharma Group International (SEHK:6855)’s Valuation After Its Strong One-Year Share Price Gain

Reviewed by Simply Wall St

Ascentage Pharma Group International (SEHK:6855) has quietly outperformed over the past year, and with shares up roughly 56% in that time, investors are starting to revisit the story behind this clinical stage biotech.

See our latest analysis for Ascentage Pharma Group International.

The stock has been choppy in recent months, with a 1 day share price return of 4.44 percent and a 90 day share price return of minus 19.91 percent. However, a 1 year total shareholder return of 55.76 percent signals that longer term momentum remains firmly positive.

If Ascentage Pharma’s run has you rethinking the sector, this could be a good moment to explore other healthcare stocks that might be setting up for their next move.

With revenues growing but losses still mounting, and the shares trading at a steep discount to analyst targets, the key question is whether Ascentage Pharma remains undervalued or whether the market is already pricing in a brighter future.

Most Popular Narrative Narrative: 31.5% Undervalued

With Ascentage Pharma last closing at HK$63.55 against a narrative fair value near HK$92.81, the current setup implies substantial upside if the projections are met.

Analysts are assuming Ascentage Pharma Group International's revenue will grow by 19.7% annually over the next 3 years. Analysts assume that profit margins will increase from -41.3% today to 3.0% in 3 years' time.

Curious how a loss-making biotech earns a premium-style valuation, with rapid revenue expansion and margin reversal reflected in the assumptions? Want to see the exact profitability journey behind that fair value?

Result: Fair Value of $92.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Olverembatinib and one off Takeda payments means any regulatory setback or slower trial progress could quickly unwind the upside case.

Find out about the key risks to this Ascentage Pharma Group International narrative.

Another Way to Look at Value

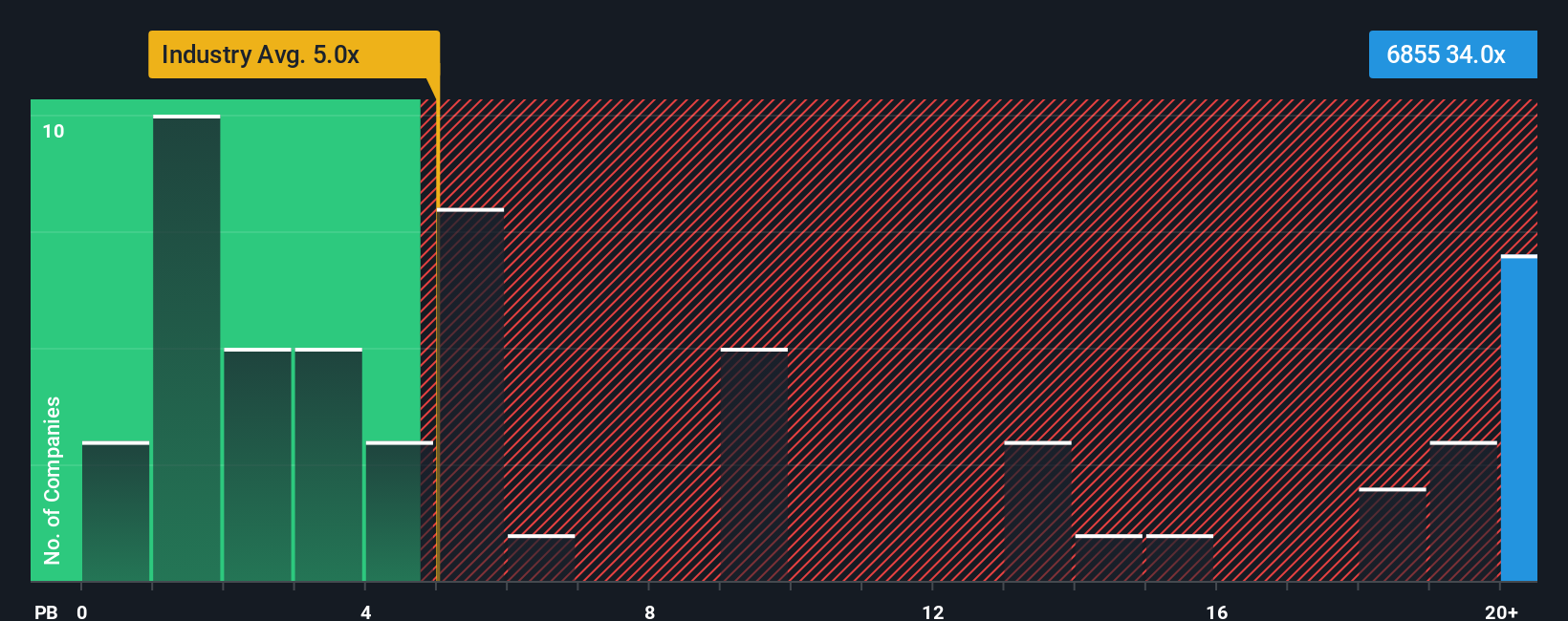

While the narrative fair value paints Ascentage Pharma as 31.5 percent undervalued, a simple balance sheet lens tells a tougher story. At 31.9 times book value versus just 4.9 to 5.8 times for the Hong Kong biotech industry and peers, the shares look richly priced rather than cheap.

That sort of premium multiple can work if growth and execution stay flawless, but it also raises the risk of a sharp reset if sentiment or trial news turns. How much of this optimism are you really comfortable underwriting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ascentage Pharma Group International Narrative

If you want to stress test these assumptions yourself or follow a different angle on Ascentage Pharma, you can build a fresh view in minutes, Do it your way.

A great starting point for your Ascentage Pharma Group International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential winner by scanning fresh opportunities on Simply Wall Street’s powerful screener, tailored to different investing styles.

- Target resilient growth by focusing on stable growth stocks screener (None results) that combine consistent expansion with solid fundamentals.

- Boost your income potential by zeroing in on these 15 dividend stocks with yields > 3% that aim to keep cash flowing into your account.

- Capitalize on valuation gaps by hunting through these 907 undervalued stocks based on cash flows where market pessimism may have gone too far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6855

Ascentage Pharma Group International

A clinical-stage biotechnology company, develops therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026