Asian Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by economic challenges and investor caution, the focus on insider ownership becomes increasingly relevant. In this context, companies with significant insider stakes can offer insights into potential growth opportunities, as they often reflect confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.1% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Ganfeng Lithium Group (SZSE:002460) | 27.2% | 45.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy (AFM) systems globally and has a market cap of ₩1.75 trillion.

Operations: The company's revenue is primarily derived from the Scientific & Technical Instruments segment, which generated ₩207.92 billion.

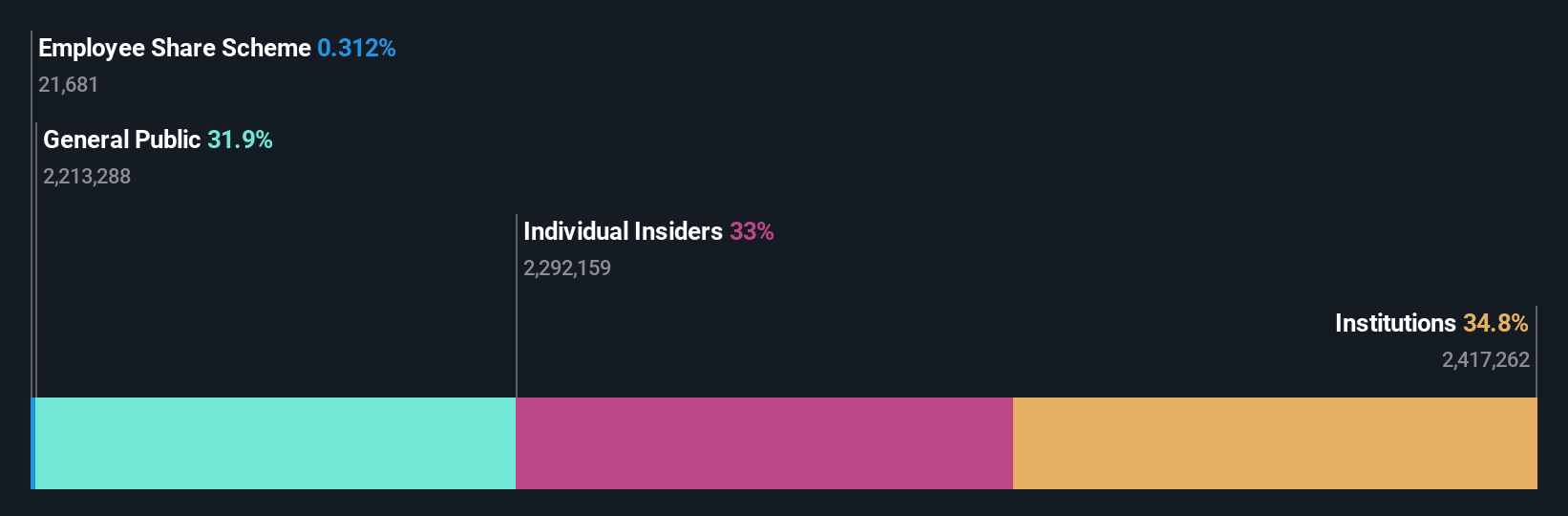

Insider Ownership: 33%

Earnings Growth Forecast: 23.3% p.a.

Park Systems demonstrates a compelling growth narrative with earnings having grown by 50.2% over the past year and revenue forecasted to increase by 18.5% annually, outpacing the Korean market's average. Despite slower projected profit growth compared to the market, its high-quality earnings and anticipated return on equity of 24.3% in three years underscore its potential. Analysts agree on a stock price rise of 27%, though recent insider trading activity is not substantial.

- Click to explore a detailed breakdown of our findings in Park Systems' earnings growth report.

- Our comprehensive valuation report raises the possibility that Park Systems is priced higher than what may be justified by its financials.

Shanghai Chicmax Cosmetic (SEHK:2145)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Chicmax Cosmetic Co., Ltd. is a multi-brand cosmetics company involved in the research, development, manufacture, and sale of cosmetic products both in Mainland China and internationally, with a market capitalization of approximately HK$33.48 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of cosmetic products, totaling CN¥7.40 billion.

Insider Ownership: 39.2%

Earnings Growth Forecast: 23.9% p.a.

Shanghai Chicmax Cosmetic shows strong growth potential, with earnings forecasted to grow by 23.89% annually and revenue expected to rise by 21.8% per year, surpassing the Hong Kong market's average. Recent board changes include Mr. Sun Hao and Ms. Zhou Wei, enhancing strategic direction and governance following amendments in company bylaws. Despite substantial insider selling recently, the company's return on equity is projected to be very high at 41.5%.

- Navigate through the intricacies of Shanghai Chicmax Cosmetic with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Shanghai Chicmax Cosmetic implies its share price may be too high.

Ascentage Pharma Group International (SEHK:6855)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ascentage Pharma Group International is a clinical-stage biotechnology company focused on developing therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China, with a market cap of HK$24.86 billion.

Operations: The company generates revenue primarily through the development and sale of novel small-scale therapies, amounting to CN¥390.60 million.

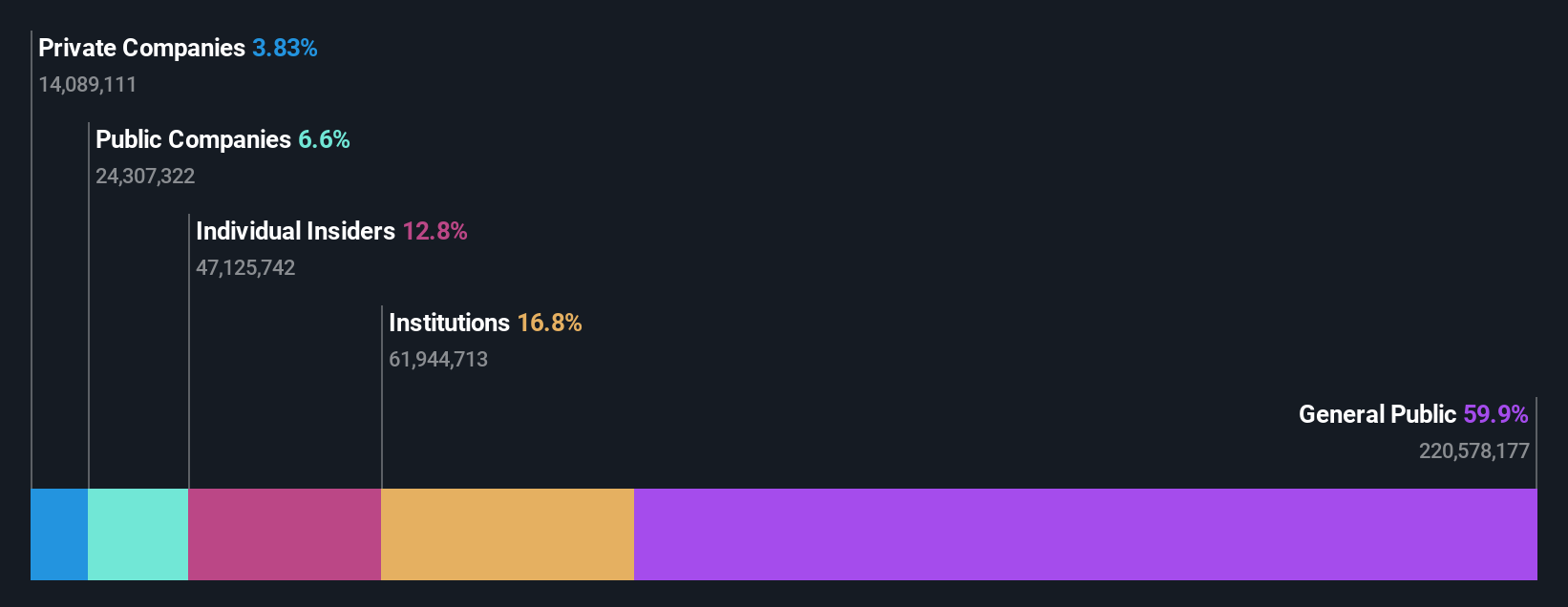

Insider Ownership: 12.8%

Earnings Growth Forecast: 56.2% p.a.

Ascentage Pharma Group International is poised for significant growth, with projected annual revenue increases of 34.3% and earnings growth of 56.21%, outpacing the Hong Kong market average. The company has a robust pipeline, highlighted by recent presentations at the ASH Annual Meeting on investigational drugs like olverembatinib and lisaftoclax. Despite past shareholder dilution, Ascentage's strategic partnerships with industry leaders bolster its innovative drug development efforts across multiple global markets.

- Take a closer look at Ascentage Pharma Group International's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Ascentage Pharma Group International's share price might be too optimistic.

Taking Advantage

- Click this link to deep-dive into the 620 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6855

Ascentage Pharma Group International

A clinical-stage biotechnology company, develops therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives