Hansoh Pharmaceutical Group (SEHK:3692) Valuation in Focus After Regulatory Progress on Novel RET Inhibitor

Reviewed by Simply Wall St

Hansoh Pharmaceutical Group (SEHK:3692) just announced that China’s National Medical Products Administration has accepted its New Drug Application for HS-10365 capsules, targeting RET fusion-positive non-small cell lung cancer. This regulatory milestone may draw investor attention given its pipeline implications.

See our latest analysis for Hansoh Pharmaceutical Group.

Hansoh Pharmaceutical Group’s latest regulatory news comes amid a year of remarkable momentum, with the share price up a huge 113.7% year-to-date. Investors are taking note, as the 1-year total shareholder return of 102% and an even stronger three-year total return of 175% highlight just how robust sentiment has been. This likely reflects optimism in their innovative pipeline and recent announcements.

Interested in spotting more opportunities among pharma innovators? See what’s moving in the sector with our full list: See the full list for free.

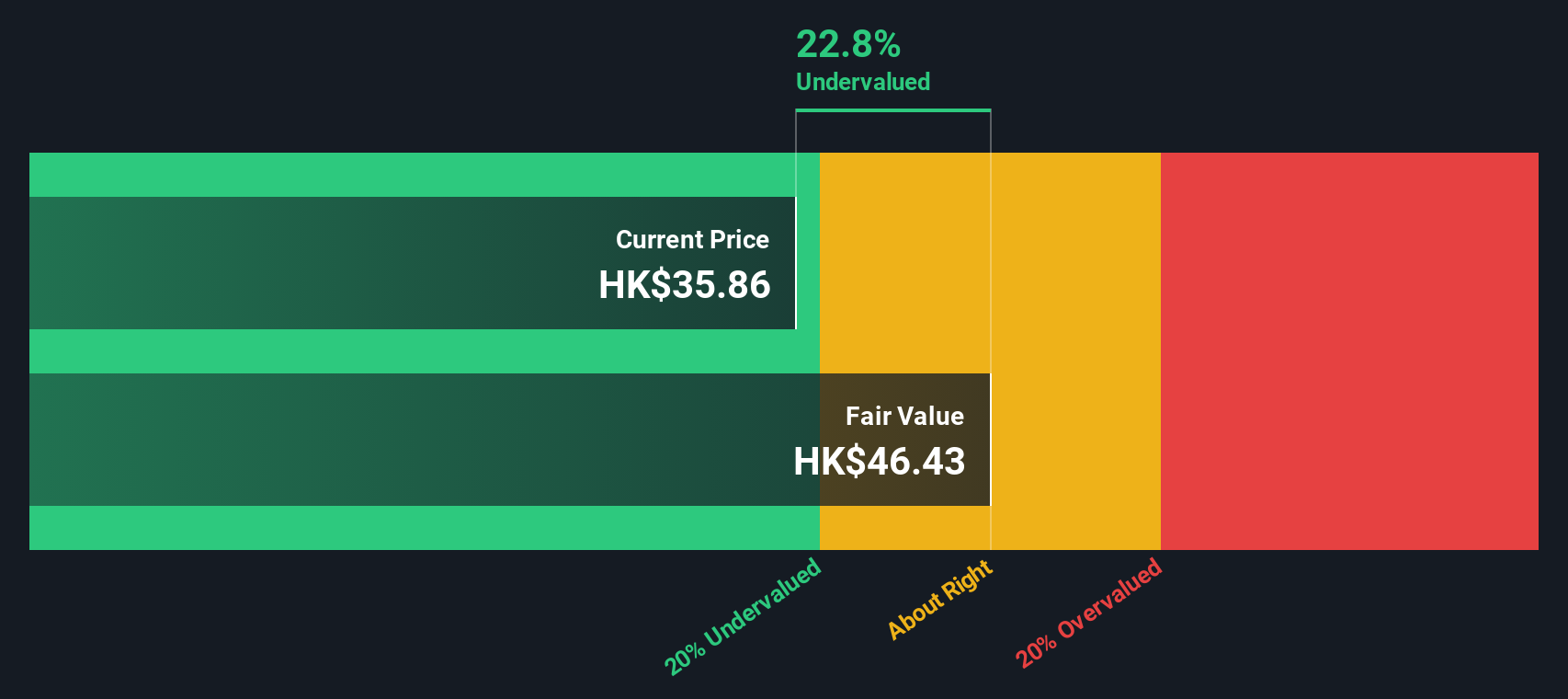

With shares already up over 100% this year and trading nearly 24% below consensus analyst price targets, the key question now is whether Hansoh remains attractively valued or if the market is already factoring in future growth.

Price-to-Earnings of 41.3x: Is it justified?

Hansoh Pharmaceutical Group currently trades at a price-to-earnings (P/E) ratio of 41.3x, which is notably higher than both sector peers and industry averages. With a last close of HK$35.64, the market is assigning the company a valuation premium that stands out in the Hong Kong Pharmaceuticals sector.

The P/E ratio measures how much investors are willing to pay for each dollar of a company's earnings. In pharmaceuticals, a higher P/E can reflect confidence in future pipeline breakthroughs or consistent earnings growth. However, it can also indicate high expectations that may already be priced in.

Despite Hansoh's profits increasing and quality earnings being recognized, its P/E level appears stretched relative to the sector. Compared to the industry average of 13.7x and a fair ratio estimate of 27.3x, Hansoh's current multiple suggests investors see exceptional growth or defensibility. This premium might not be sustainable if future performance does not deliver on expectations.

Explore the SWS fair ratio for Hansoh Pharmaceutical Group

Result: Price-to-Earnings of 41.3x (OVERVALUED)

However, slower-than-expected regulatory approvals or potential setbacks in pipeline development could quickly shift sentiment and put pressure on Hansoh Pharmaceutical Group’s current premium valuation.

Find out about the key risks to this Hansoh Pharmaceutical Group narrative.

Another View: Discounted Cash Flow Paints a Different Picture

Contrary to the high valuation seen with earnings multiples, the SWS DCF model estimates Hansoh Pharmaceutical Group’s shares are actually trading about 23.3% below their fair value. This approach weighs the company’s future cash flows and hints at potential undervaluation by the market. But which view will prove right as growth materializes?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hansoh Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hansoh Pharmaceutical Group Narrative

If you want to dig into the numbers yourself or challenge what’s been presented here, you can quickly craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Hansoh Pharmaceutical Group.

Looking for more investment ideas?

Don’t let your next big opportunity slip by. Get ahead of the curve and explore stocks positioned for growth and innovation using these powerful tools:

- Capture high yields and strengthen your income strategy by checking out these 22 dividend stocks with yields > 3% with proven returns and reliable payout track records.

- Uncover companies leveraging artificial intelligence as you browse these 26 AI penny stocks and pinpoint those propelling this transformative revolution.

- Go after stocks currently undervalued by the market by accessing these 832 undervalued stocks based on cash flows and position yourself for long-term upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hansoh Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3692

Hansoh Pharmaceutical Group

An investment holding company, engages in the research, development, production, and sale of pharmaceutical products in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives