- Hong Kong

- /

- Life Sciences

- /

- SEHK:2228

XtalPi Holdings (SEHK:2228) Is Up 6.6% After Eli Lilly Endorses Ailux AI Platform Partnership Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 5, 2025, Ailux announced a platform-based collaboration with Eli Lilly to expedite the discovery and development of bispecific antibodies using Ailux’s AI-powered engineering platform, with the deal including upfront and near-term payments in the double-digit millions and potential milestones up to US$345 million.

- This partnership highlights the value of Ailux’s AI technology in drug discovery and represents a significant validation from an established pharmaceutical company.

- We'll explore how the endorsement from Eli Lilly, combined with meaningful deal terms, shapes XtalPi Holdings' investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is XtalPi Holdings' Investment Narrative?

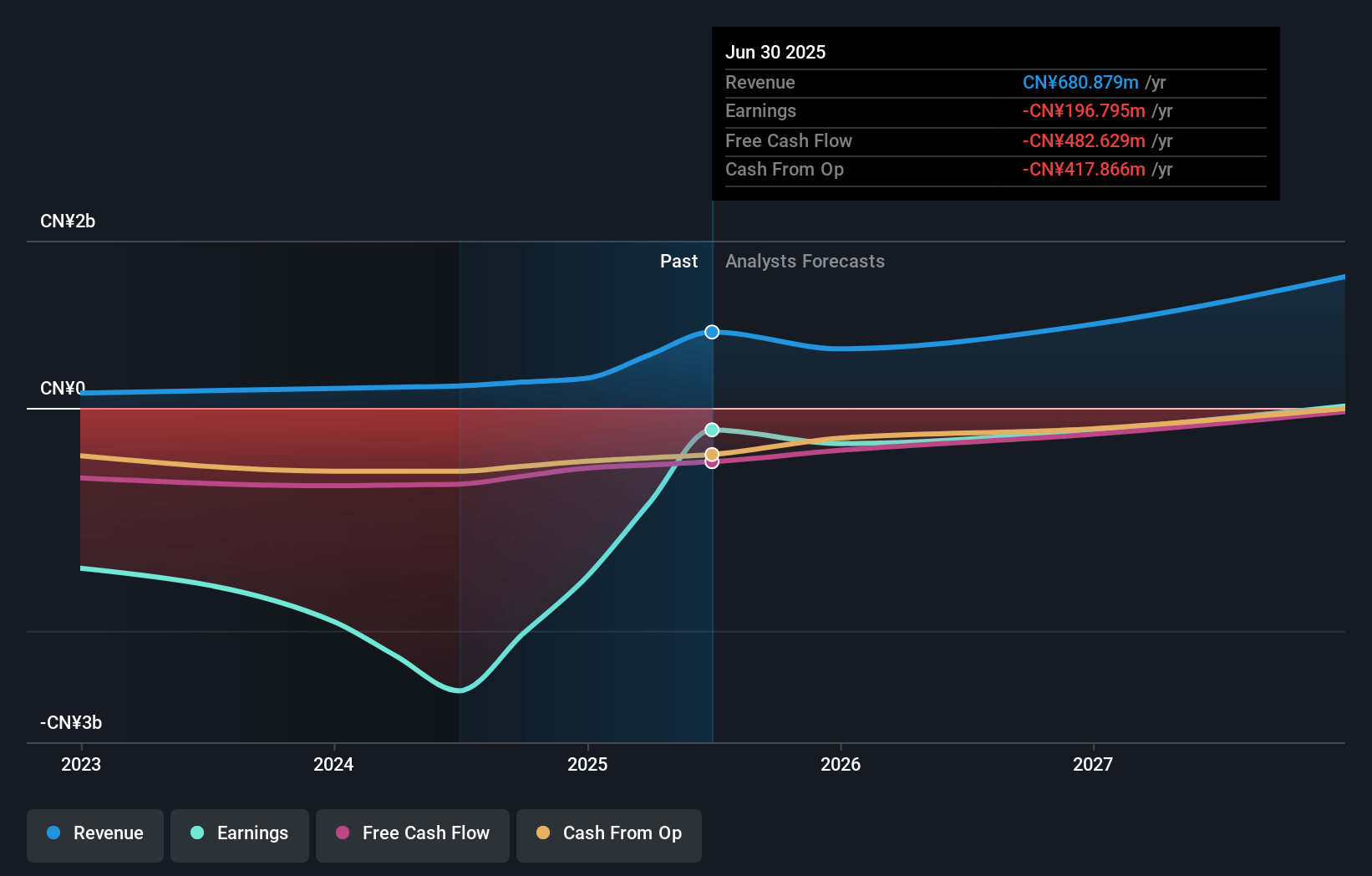

To be a shareholder in XtalPi Holdings, you need to believe in the long-run promise of AI-powered drug discovery and the company’s ability to convert partnerships into consistent revenue streams. The recent alliance between Ailux (a XtalPi subsidiary) and Eli Lilly has brought both high-profile validation and a possible shift in the company’s near-term catalysts. This high-value deal, featuring substantial upfront payments and long-term milestone potential, could address previous concerns around XtalPi’s pathway to short-term cash flows and commercial credibility. Prior to this event, the biggest risks centered on XtalPi’s persistent losses, high valuation compared to peers, and share dilution. With Lilly’s endorsement and contractual financial milestones, some risk factors tied to funding gaps and client adoption may ease, but questions about long-term profitability and valuation remain at the forefront.

But while optimism is up, the company’s expensive price-to-book ratio is a key risk you should be aware of. XtalPi Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on XtalPi Holdings - why the stock might be worth as much as HK$10.12!

Build Your Own XtalPi Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XtalPi Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free XtalPi Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XtalPi Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2228

XtalPi Holdings

An investment holding company, engages in the provision of robotics and drug discovery solutions in Mainland China, the United States, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives