Luye Pharma Group (SEHK:2186): Examining Valuation After Recent Stock Volatility

Reviewed by Simply Wall St

Luye Pharma Group (SEHK:2186) has been on the radar for investors lately, thanks to a series of price swings that might leave you wondering what is driving sentiment. While there is no breaking event or dramatic headline making waves this week, the recent moves in the stock price are enough to catch attention, especially for those weighing whether the market is signaling something deeper about the company’s prospects.

In the bigger picture, Luye Pharma Group’s stock has had a mixed ride. Over the past year, it has climbed a steady 24%, yet that momentum has not always been smooth. Recent months saw some dips, including a 3% drop in the past month and a 7% slide in the past three months. Notably, the stock has bounced more than 72% since the start of the year, but the long-term five-year return still lags in negative territory. This highlights a tug-of-war between short-term optimism and longer-term questions. For context, the company’s revenue and net income both show double-digit annual growth, so the fundamentals may not be as gloomy as past returns suggest.

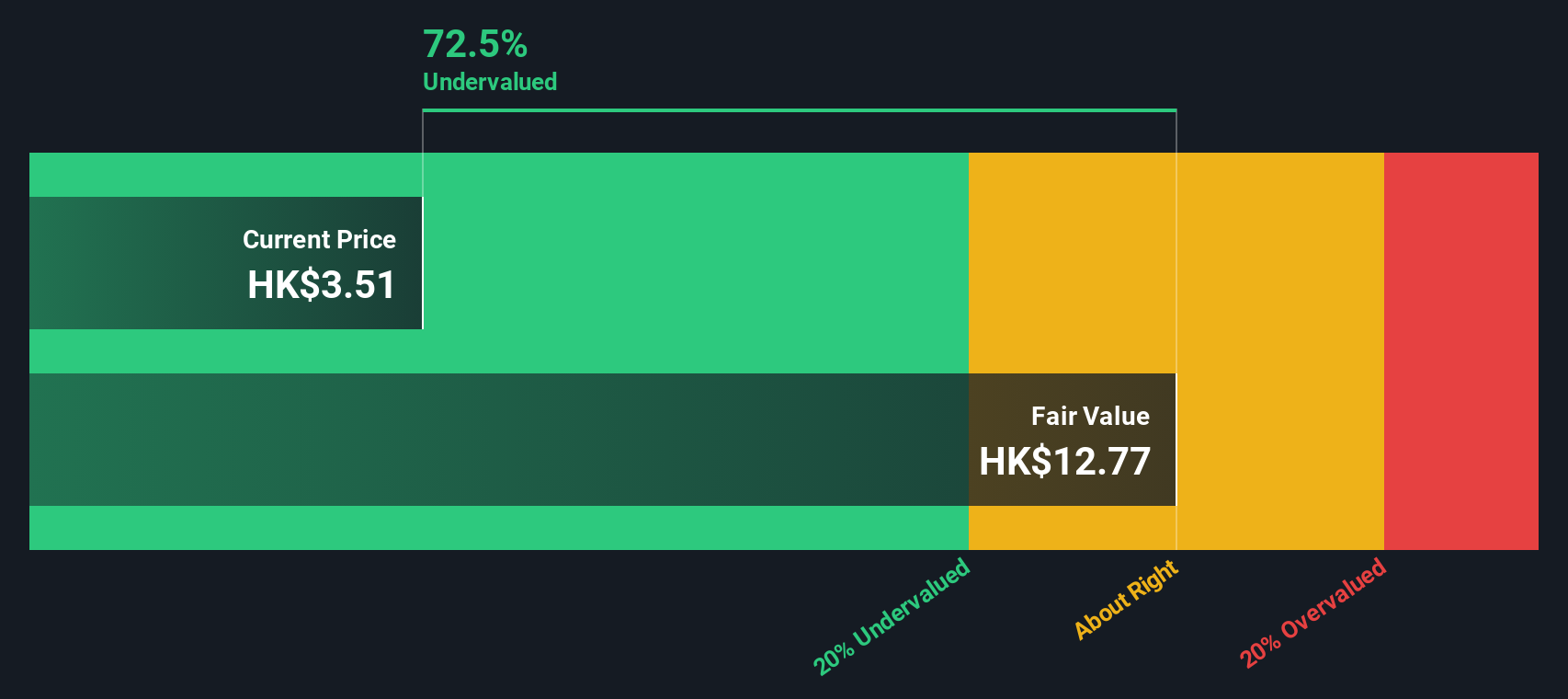

With this recent volatility and the numbers pointing in different directions, investors now face a classic valuation puzzle. Is Luye Pharma Group undervalued after its bumpy ride, or is the market already pricing in every bit of growth ahead?

Price-to-Earnings of 33.6x: Is it justified?

Luye Pharma Group currently trades at a price-to-earnings ratio that is significantly higher than both the peer average and the broader pharmaceuticals industry in Hong Kong.

The price-to-earnings (P/E) ratio compares a company’s share price to its per-share earnings. This metric is widely used to gauge how the market values the company’s future growth prospects and profitability relative to rivals within the same sector. In industries like pharmaceuticals, where earnings can fluctuate due to research cycles and regulatory outcomes, the P/E ratio is particularly revealing.

With a P/E of 33.6x compared to the industry’s 13.5x, investors are paying a substantial premium for each dollar of Luye Pharma Group’s earnings. This high valuation may reflect expectations for rapid future growth or unique market positioning, but it also raises questions about whether the strong growth forecasts fully justify such a lofty multiple.

Result: Fair Value of $3.58 (OVERVALUED)

See our latest analysis for Luye Pharma Group.However, slowing revenue growth or unexpected changes in regulatory policies could quickly challenge the current optimism surrounding Luye Pharma Group’s outlook.

Find out about the key risks to this Luye Pharma Group narrative.Another View: What Does the DCF Model Say?

Looking to a second approach, the SWS DCF model offers no clear answer for Luye Pharma Group at this time because of insufficient data. This leaves the puzzle unsolved. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Luye Pharma Group Narrative

If you see things differently or want to dig into the numbers on your own, you can craft your own perspective in just a few minutes and do it your way Do it your way.

A great starting point for your Luye Pharma Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Shape your portfolio for the future by tapping into smart investing tools available right now. Opportunities are waiting. Don't miss your chance to act on them:

- Grow your returns by targeting stable income streams as you uncover dividend stocks with yields > 3% designed for reliable, high-yield payouts.

- Step ahead of market trends and capitalize on the hottest breakthroughs with AI penny stocks powering tomorrow's innovations in artificial intelligence.

- Spot undervalued companies hiding real potential while using our advanced analysis of undervalued stocks based on cash flows based on strong cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2186

Luye Pharma Group

Develops, produces, markets, and sells pharmaceutical products in the People’s Republic of China, the United States, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives