Everest Medicines (SEHK:1952): Valuation Insights Following Exclusive VIS-101 Ophthalmology Deal

Reviewed by Simply Wall St

Everest Medicines (SEHK:1952) has secured exclusive rights to develop and commercialize VIS-101, a promising bifunctional treatment for eye conditions like wet AMD, across Greater China and parts of Asia. This strategic move underscores the company’s ambitions in ophthalmology and signals potential growth ahead.

See our latest analysis for Everest Medicines.

Everest Medicines’ exclusive VIS-101 deal adds momentum to a year already marked by strong long-term performance. The company posted an impressive 58% total shareholder return over the past twelve months. Despite some recent share price pressure, the company’s position in high-growth biotech and steady progress with pipeline assets suggest an appetite for further growth in the months ahead.

If you’re interested in what’s next in healthcare innovation, this is a great time to explore and discover See the full list for free.

With the stock trading below its analyst price target and substantial progress in the pipeline, the question now is whether Everest Medicines is undervalued at current levels or if the market has already priced in its future growth potential.

Most Popular Narrative: 24.1% Undervalued

Everest Medicines’ last close of HK$48.98 sits well below the HK$64.56 fair value suggested by the most popular narrative, highlighting considerable upside potential if the underlying growth story plays out.

Accelerated product launches, market expansion, and manufacturing localization support strong revenue growth, cost efficiency, and operating margin improvement across core therapies. Diversified late-stage pipeline and strategic partnerships position the company for sustained innovation, financial flexibility, and long-term earnings growth.

Curious if this valuation is built on aggressive growth or strategic discipline? The narrative’s secret sauce comes from bold assumptions about future revenues and margins. Want to uncover which financial levers are driving analyst optimism and how these feed into the share price debate? Dive into the full story to decode the high-stakes expectations behind Everest Medicines’ fair value.

Result: Fair Value of $64.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on NEFECON for near-term growth and uncertain pricing dynamics could quickly shift Everest Medicines’ outlook if market conditions change.

Find out about the key risks to this Everest Medicines narrative.

Another View: What Do Sales Ratios Suggest?

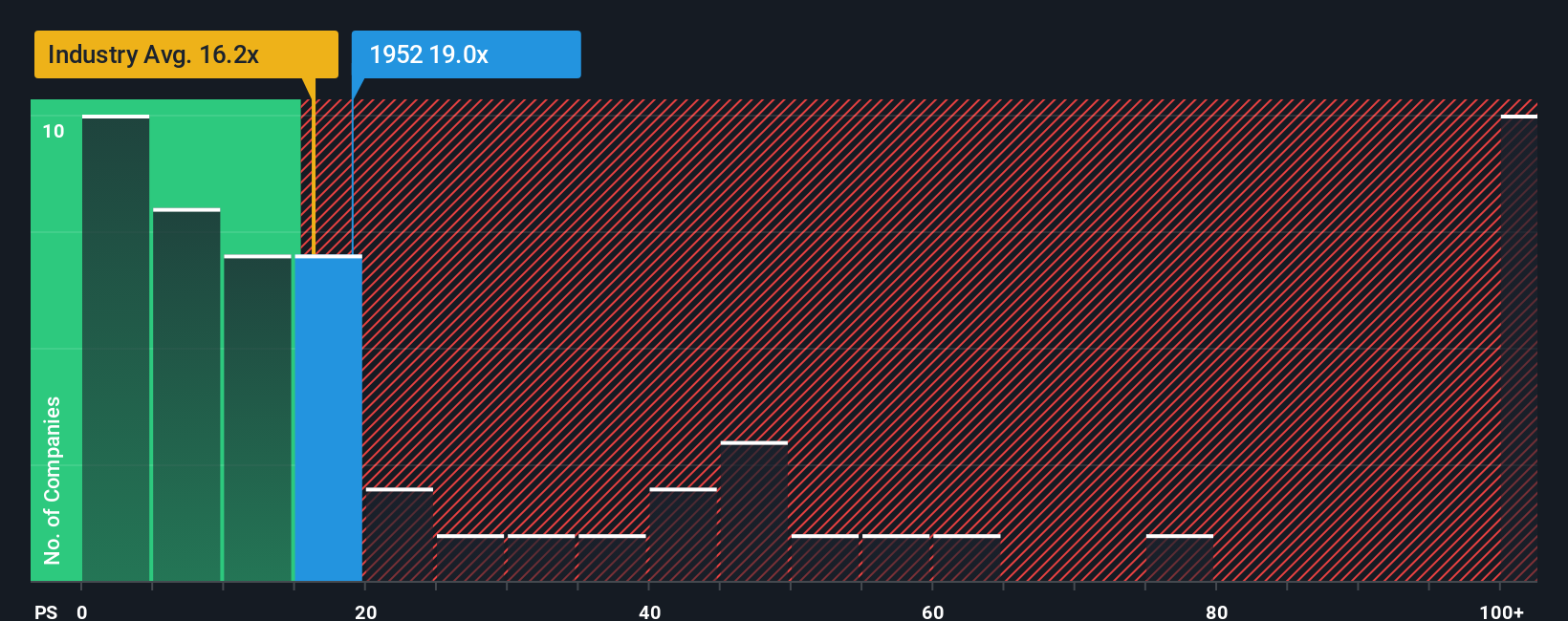

While the fair value points to Everest Medicines being undervalued, our sales ratio analysis tells a more cautious story. The company's price-to-sales ratio sits at 18.6x, notably higher than both the Hong Kong biotech industry average of 15.1x and its fair ratio of 12.2x. This premium means investors are paying more for each dollar of revenue, which could amplify downside risk if growth expectations are not fully met. Which perspective makes more sense for the current market?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Everest Medicines Narrative

If you want to dig deeper, challenge these conclusions, or assemble your own perspective, you can shape a personalized view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Everest Medicines.

Looking for more investment ideas?

Seize your chance to get ahead by using Simply Wall Street’s powerful screener to uncover investments that others might miss. The next big opportunity could be waiting for you.

- Find high-potential tech opportunities and track leading innovators by jumping into these 26 AI penny stocks, shaping the future of artificial intelligence.

- Capture value with stocks trading below their intrinsic worth as you browse these 833 undervalued stocks based on cash flows for overlooked bargains across the market.

- Secure steady returns and reliable income streams by selecting from these 22 dividend stocks with yields > 3%, featuring companies with attractive dividend yields and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1952

Everest Medicines

A biopharmaceutical company, engages in the discovery, license-in, development, and commercialization of therapies and vaccines to address critical unmet medical needs in Greater China and other Asia Pacific markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives