Has Junshi’s 200% Rally Priced in the Latest Immunotherapy Breakthrough?

Reviewed by Simply Wall St

If you’re watching Shanghai Junshi Biosciences stock and wondering what to do next, you’re not alone. After all, this biotech name has delivered a jaw-dropping 201.3% return year-to-date. Over the past year, it’s held onto those gains with a 216.5% surge, even if the rollercoaster over five years shows a different side with a decline of 35.2%. So is this momentum here to stay, or are risks building beneath the surface?

Much of the optimism swirling around Shanghai Junshi Biosciences traces back to fresh market developments that have brought immunotherapy and biotech back into the spotlight. Investors appear to be reassessing the company’s potential, shifting their perception of risk and reward. Even with a slight loss of 2.2% over the last week, its 30-day move is a healthy 5.4%, showing that sentiment has held firm despite occasional bouts of volatility. There’s clearly something different happening here compared to just a year or two ago.

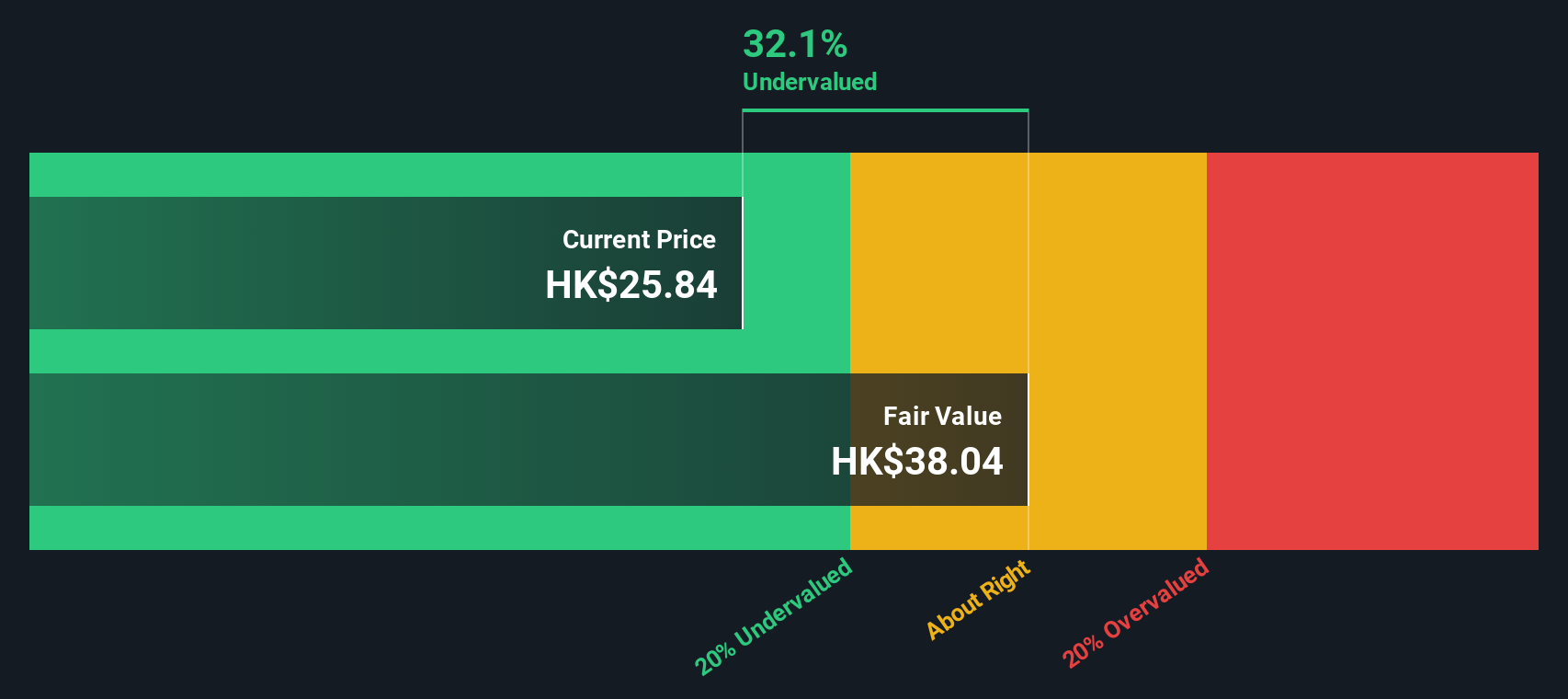

Now, when it comes to valuation, which is really the key question on many investors’ minds, Junshi’s numbers stand out. Out of six common valuation checks, the company is undervalued in five, giving it a value score of 5. This signals a rare alignment between price and underlying fundamentals, at least by conventional methods.

But just how meaningful are those valuation checks? Next, let's break down each approach to see where Shanghai Junshi Biosciences stands. Stay tuned, as there may be an even smarter way to gauge the stock’s true value at the end.

Shanghai Junshi Biosciences delivered 216.5% returns over the last year. See how this stacks up to the rest of the Biotechs industry.Approach 1: Shanghai Junshi Biosciences Discounted Cash Flow (DCF) Analysis

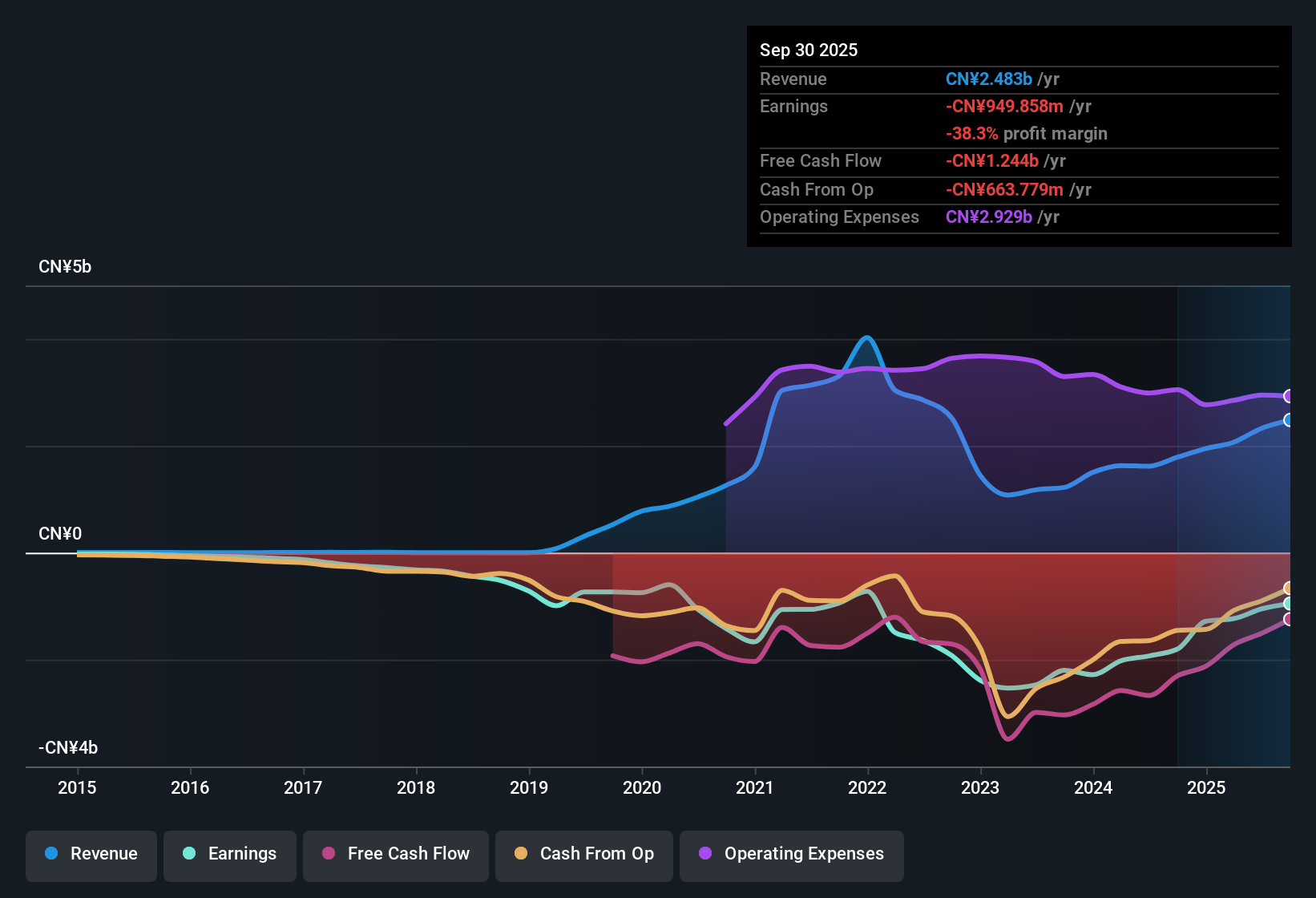

A Discounted Cash Flow (DCF) valuation estimates what a business is worth today by projecting its future cash flows and discounting them back to the present value. For Shanghai Junshi Biosciences, this model looks at expected free cash flow generation over time and calculates what those future streams are worth in today's terms, using CN¥ as the reporting currency.

Currently, the company’s latest twelve-month free cash flow sits at a negative CN¥1,838 million. Analyst forecasts expect Junshi's cash flows to turn positive over the coming years, with a projected free cash flow of CN¥1,234 million by the end of 2029. Simply Wall St extrapolates additional growth beyond analyst estimates, and sees free cash flow rise steadily through to 2035.

Based on this approach, the DCF model calculates an intrinsic value of HK$46.04 per share. The DCF implies that the stock is trading at a 26.7% discount to this intrinsic value, which leads to the following conclusion.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Shanghai Junshi Biosciences.

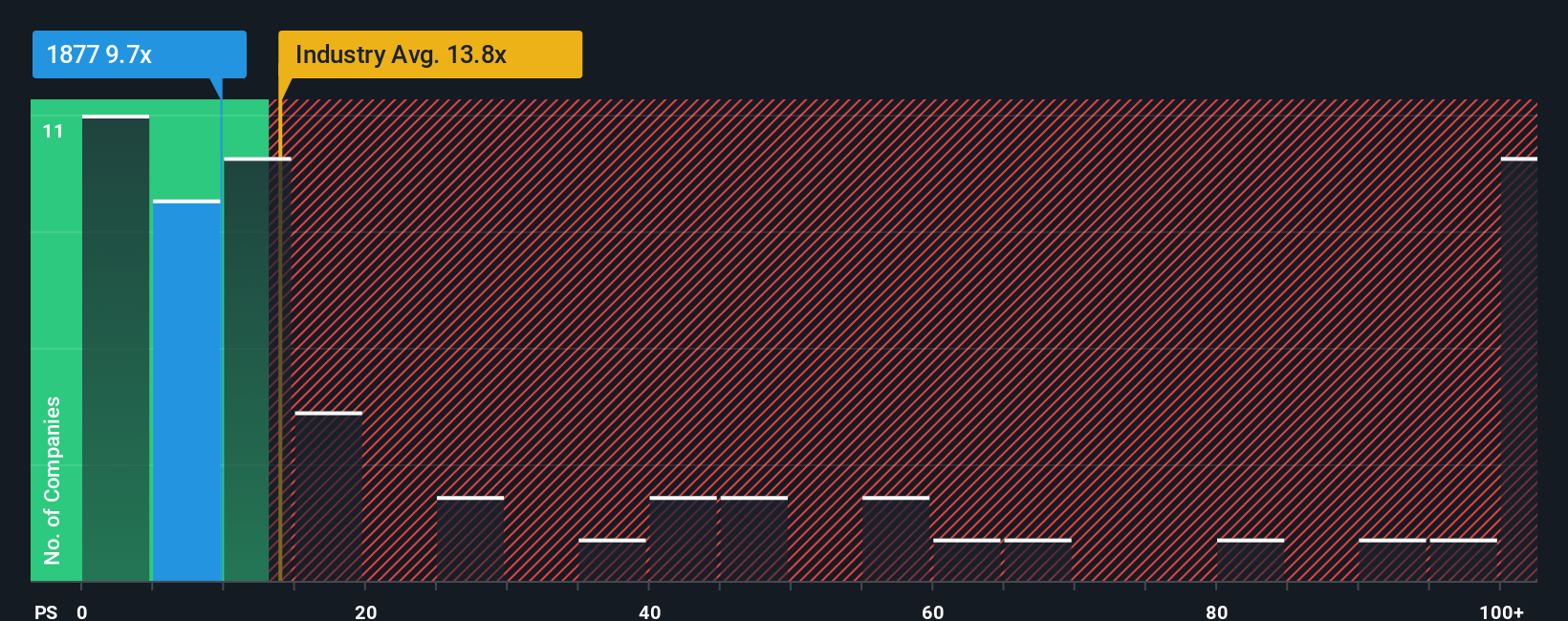

Approach 2: Shanghai Junshi Biosciences Price vs Sales

For many biotech companies, especially those not yet profitable, the Price-to-Sales (P/S) ratio is the go-to yardstick for valuation. It works well here because it focuses on revenue, which is often more stable and less prone to short-term swings than net income, particularly in this sector where earnings can be negative due to ongoing research and development investments.

The "right" P/S ratio for a company depends on more than just its sales. Higher growth expectations, lower risk, and healthy profit margins can all justify a higher multiple, while slower growth or greater uncertainty might pull it down. The biotech industry itself tends to trade at premium multiples, factoring in hopes for future breakthroughs and scaling returns.

Looking at Shanghai Junshi Biosciences, its current P/S ratio stands at 13.60x. For context, the industry average hovers around 19.93x, and similar peers have an average of 18.72x. However, Simply Wall St's proprietary "Fair Ratio," which is a tailored multiple that considers Junshi’s growth prospects, risk profile, profit margins, and where it sits within the biotech space, suggests a fair value ratio of 14.46x for the stock.

The Fair Ratio offers a more precise benchmark than industry or peer averages because it blends both company-specific strengths and broader market realities, so you get a clearer picture of whether the valuation is justified.

Comparing these numbers tells us that Shanghai Junshi Biosciences’ current P/S ratio of 13.60x is nearly identical to its Fair Ratio of 14.46x. This suggests the market price is broadly in line with the company's fundamentals.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Shanghai Junshi Biosciences Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you put your perspective on a company’s future into a financial story, connecting your assumptions about fair value and growth to the company’s bigger picture.

Narratives link the company’s story to a financial forecast and, ultimately, to a fair value. This helps you move from “What’s the stock worth?” to “What do I believe about this stock’s future?” On Simply Wall St’s Community page, millions of investors use Narratives to quickly compare their Fair Value against the current price, making it easier to know when to buy or sell.

Narratives update automatically as news or earnings are released, so your view of Shanghai Junshi Biosciences stays current without any manual effort. For example, one investor might see strong clinical trial results and set a high fair value, while another may take a much more conservative stance. This demonstrates how Narratives reflect a wide range of views.

Do you think there's more to the story for Shanghai Junshi Biosciences? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of malignant tumors, neurological, autoimmune, chronic metabolic, nervous system, and infectious diseases in the People's Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives