How Surging Revenue and Mazdutide’s Phase 3 Success at Innovent Biologics (SEHK:1801) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

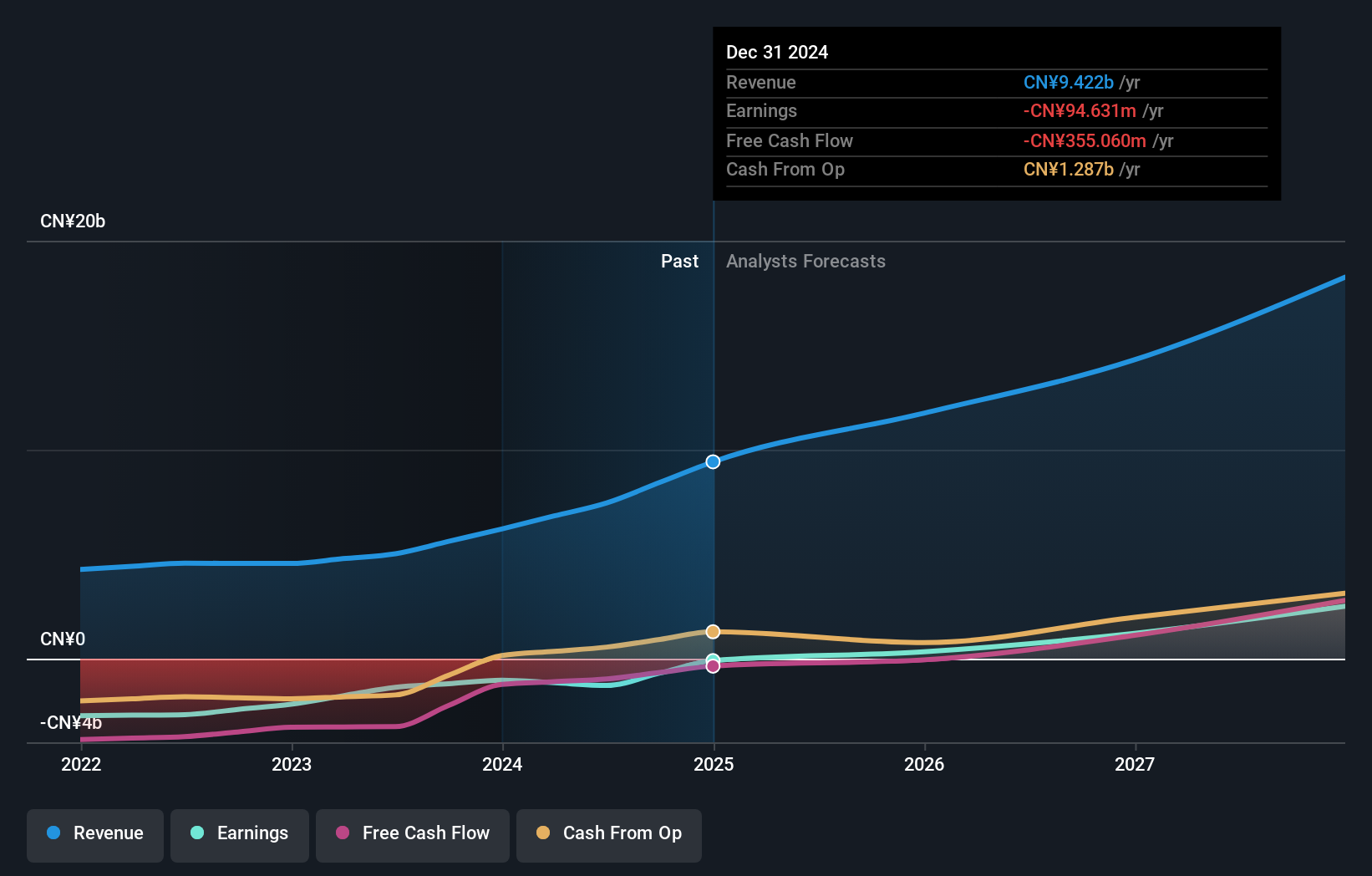

- Innovent Biologics recently reported third quarter 2025 product revenue exceeding RMB 3.3 billion, achieving around 40% year-on-year growth driven by both oncology and newly launched biomedicine therapies, including mazdutide and SINTBILO®.

- The company also announced positive Phase 3 results for mazdutide, showing it surpassed semaglutide in both glycemic and weight reduction outcomes for Chinese patients with type 2 diabetes and obesity, highlighting a potential new-generation treatment option.

- We'll examine how sustained revenue growth and strong clinical data for mazdutide add momentum to Innovent Biologics' investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Innovent Biologics' Investment Narrative?

To understand Innovent Biologics as an investment, you have to weigh its position at the intersection of robust commercial execution and ambitious drug development in China. After a year of improving profitability and strong revenue growth, the company’s headline third-quarter revenue surge and positive mazdutide Phase 3 data have injected real momentum into its short-term outlook. These confirm that Innovent’s expansion beyond oncology, especially in the high-growth metabolic disease segment, may now be a key catalyst, and the faster-than-market revenue growth forecast could become more credible. However, bigger rewards come with complex risks, for Innovent, the steep price-to-earnings ratio and relatively low return on equity stand out, as does the risk of execution as new therapies reach a commercial inflection. The Takeda partnership may reduce some development risks but global execution remains untested. On the flipside, keep an eye on market expectations around profitability as valuation pressure can shift quickly.

Innovent Biologics' shares have been on the rise but are still potentially undervalued by 16%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Innovent Biologics - why the stock might be worth less than half the current price!

Build Your Own Innovent Biologics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovent Biologics research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Innovent Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovent Biologics' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives