- Taiwan

- /

- Construction

- /

- TWSE:2597

3 Global Dividend Stocks To Watch With Up To 4.8% Yield

Reviewed by Simply Wall St

Amidst a backdrop of muted market reactions to new U.S. tariffs and mixed economic signals from major global economies, investors are carefully navigating the current landscape. With the Nasdaq Composite showing resilience among U.S. indices and European markets buoyed by potential trade deals, dividend stocks remain a focal point for those seeking steady income in uncertain times. In this environment, strong dividend stocks can offer stability through reliable yields, making them an attractive option for investors looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.43% | ★★★★★★ |

| NCD (TSE:4783) | 4.23% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.80% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.14% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.00% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.62% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 1507 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

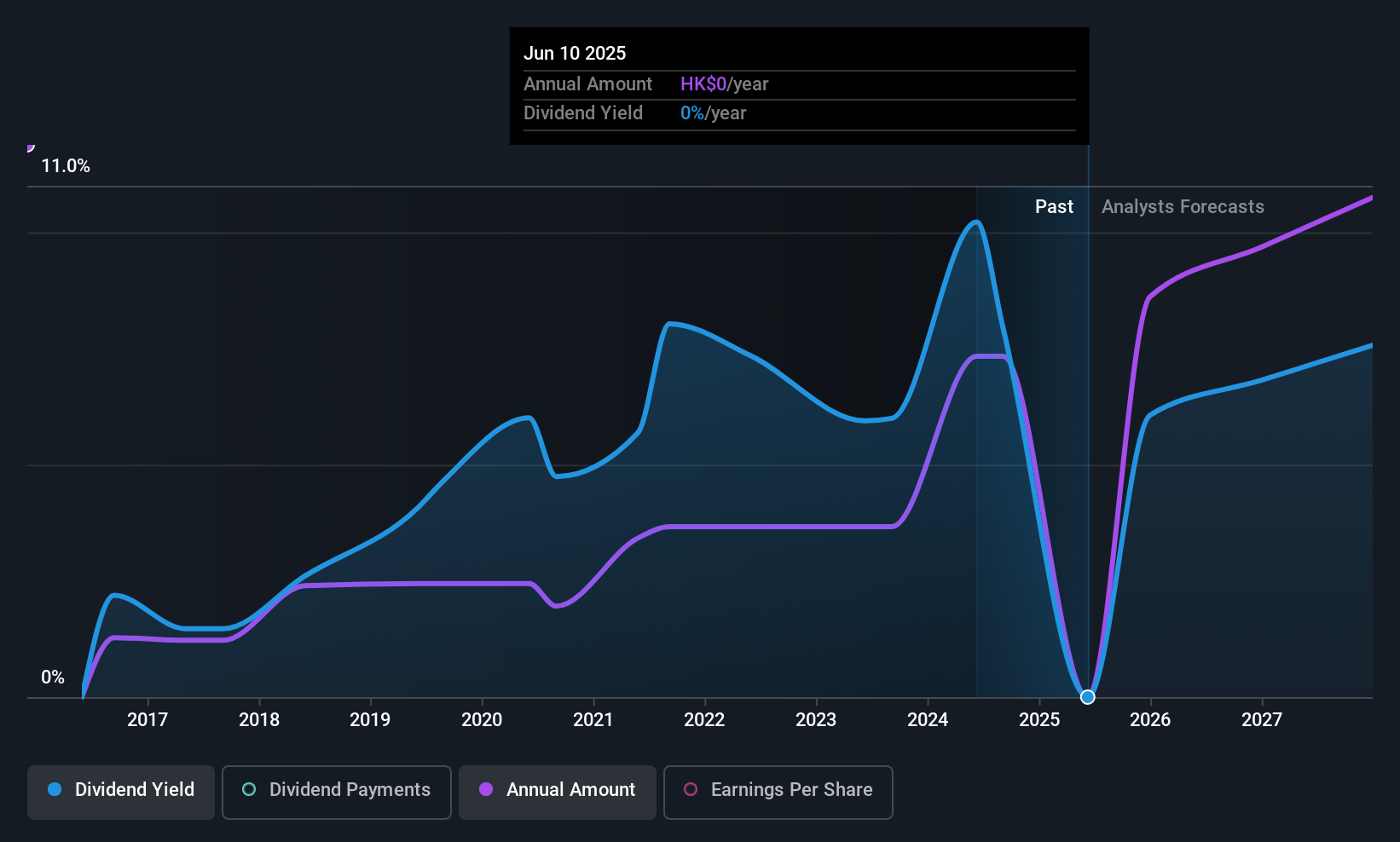

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consun Pharmaceutical Group Limited is engaged in the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China with a market cap of HK$10.17 billion.

Operations: Consun Pharmaceutical Group's revenue is primarily derived from the Consun Pharmaceutical Segment, contributing CN¥2.53 billion, and the Yulin Pharmaceutical Segment, adding CN¥442.84 million.

Dividend Yield: 4.9%

Consun Pharmaceutical Group's dividends are well-covered by earnings and cash flows, with payout ratios of 50.8% and 46.4%, respectively. However, past dividend payments have been volatile over the last decade, despite recent growth in earnings by 16.1%. The company trades at a good value relative to peers but offers a lower dividend yield compared to top-tier Hong Kong payers. Recent share buybacks may enhance shareholder value, while board changes could impact future strategic decisions.

- Dive into the specifics of Consun Pharmaceutical Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Consun Pharmaceutical Group shares in the market.

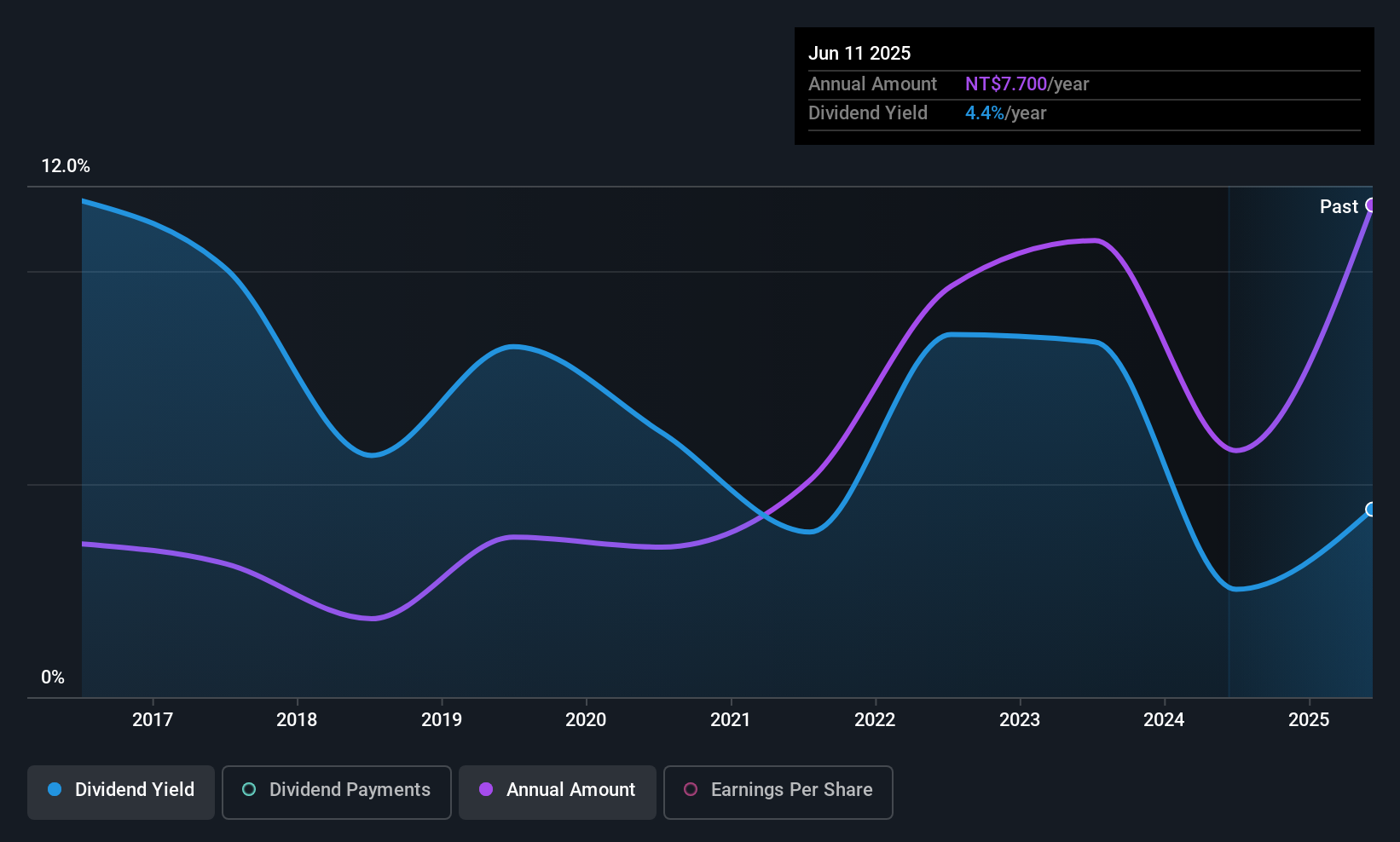

Ruentex Engineering & Construction (TWSE:2597)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ruentex Engineering & Construction Co., Ltd. operates in the construction industry and has a market cap of NT$47.25 billion.

Operations: Ruentex Engineering & Construction Co., Ltd. generates revenue from three main segments: NT$2.16 billion from the Interior Decoration Design Segment, NT$4.70 billion from the Construction Materials Business Segment, and NT$20.65 billion from the Construction Division (excluding Interior Design Department).

Dividend Yield: 4.1%

Ruentex Engineering & Construction's dividends are covered by earnings and cash flows, with payout ratios of 68.1% and 45.6%, respectively, though past payments have been volatile. Despite a recent increase in dividend payments to TWD 7.7 per share, the yield remains lower than Taiwan's top-tier payers. The company trades significantly below its estimated fair value and has shown strong earnings growth, with Q1 net income rising to TWD 549.43 million from TWD 395.87 million last year.

- Navigate through the intricacies of Ruentex Engineering & Construction with our comprehensive dividend report here.

- According our valuation report, there's an indication that Ruentex Engineering & Construction's share price might be on the cheaper side.

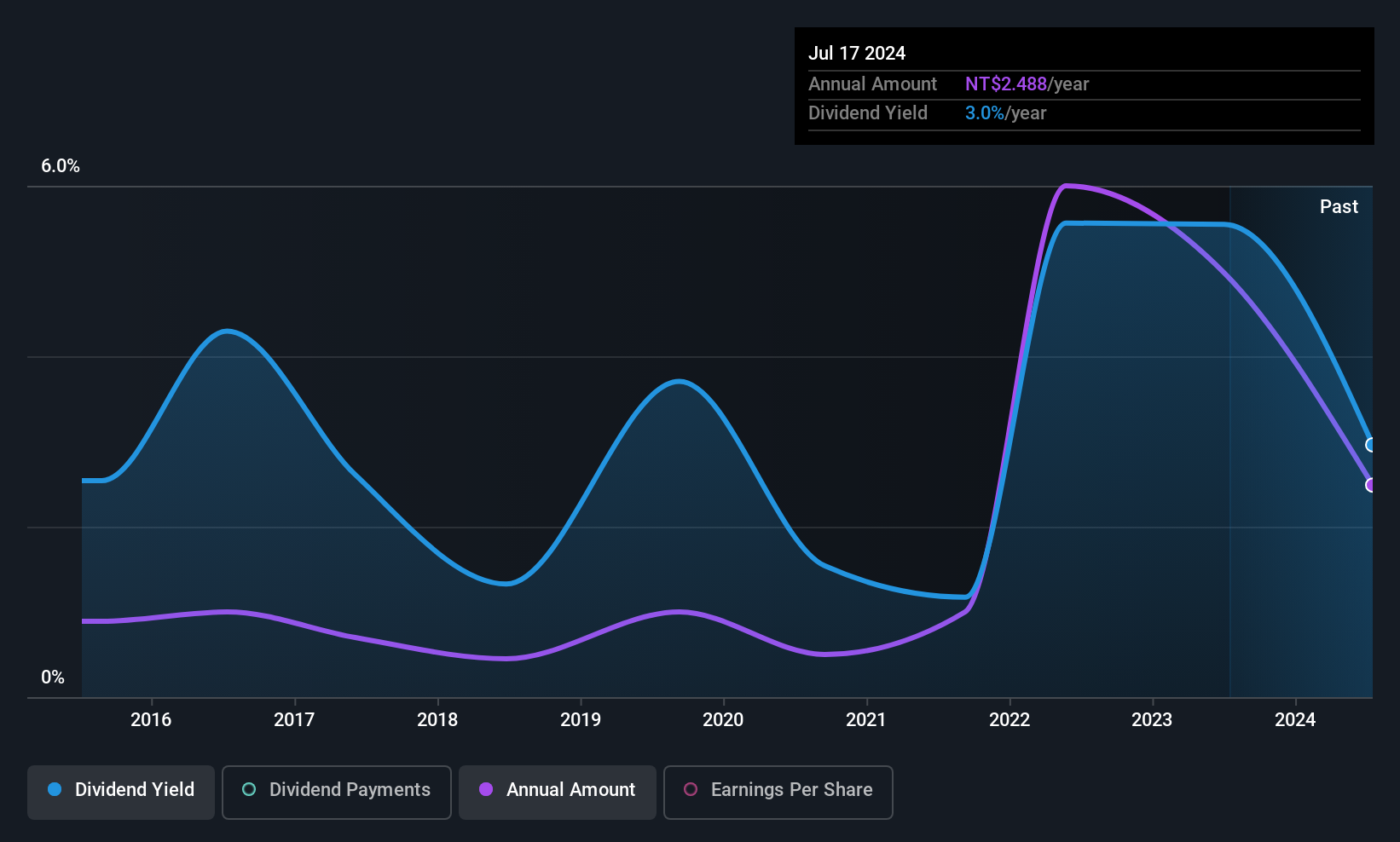

Advanced Power Electronics (TWSE:8261)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advanced Power Electronics Co., Ltd. operates in Taiwan, offering power discrete products and has a market cap of NT$9.65 billion.

Operations: Advanced Power Electronics Co., Ltd. generates revenue of NT$3.04 billion from its Electronic Components & Parts segment.

Dividend Yield: 3.7%

Advanced Power Electronics' dividends are well-covered by earnings and cash flows, with payout ratios of 58.1% and 41.3%, respectively. Despite a history of volatility, dividends have grown over the past decade but remain unreliable. The dividend yield of 3.74% is below Taiwan's top-tier payers, though the company trades at a favorable price-to-earnings ratio of 15.6x compared to the market average. Recent earnings showed significant growth, with Q1 net income reaching TWD 171.55 million from TWD 86.35 million last year.

- Get an in-depth perspective on Advanced Power Electronics' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Advanced Power Electronics is trading beyond its estimated value.

Taking Advantage

- Explore the 1507 names from our Top Global Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2597

Ruentex Engineering & Construction

Ruentex Engineering & Construction Co., Ltd.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives