Ascletis Pharma (SEHK:1672) Reports Promising Data For ASC30 Obesity Treatment In U.S. Trials

Reviewed by Simply Wall St

Ascletis Pharma (SEHK:1672) recently announced noteworthy advancements related to its investigational drug ASC30, showcasing a promising 75-day half-life in a clinical study, which propelled excitement around potential once-quarterly administration for obesity management. As a result, the company's share price increased by nearly 48% over the last quarter. This rise occurred against a backdrop of broader market gains, with indexes like the Nasdaq and S&P 500 reaching all-time highs, reflecting overall investor optimism. While Ascletis' advancements in its drug pipeline likely added momentum, broader market trends also played a role in enhancing investor sentiment during this period.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past year, Ascletis Pharma's total shareholder return has experienced a very large increase of 1213.89%, outperforming both the Hong Kong Biotechs industry, which returned 188.3%, and the broader Hong Kong market, which returned 50.8%. This substantial growth in shareholder value reflects a combination of project advancements, strategic announcements, and supportive market conditions.

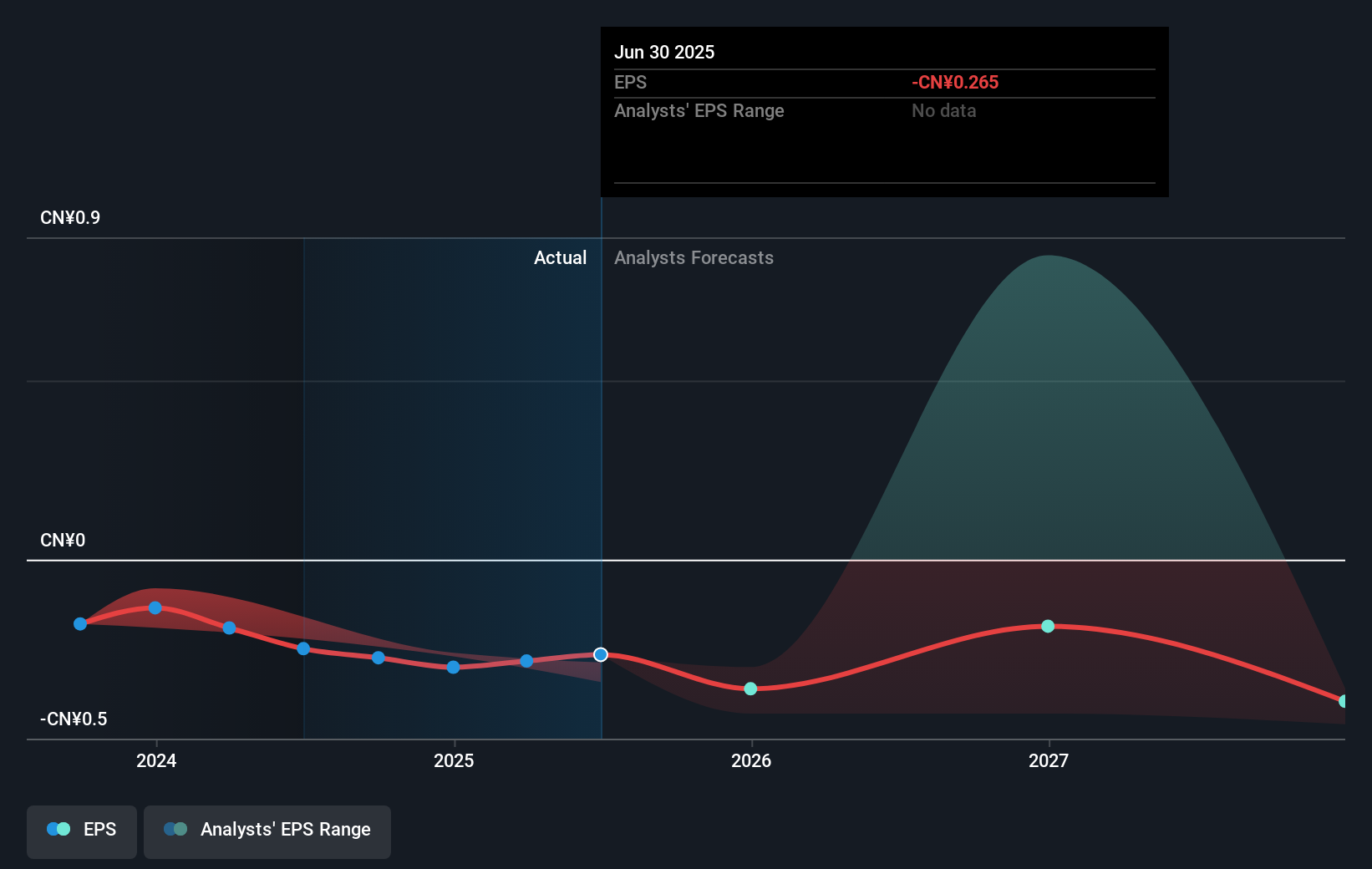

The recent developments around the investigational drug ASC30, particularly the positive Phase Ib study results, have boosted investor confidence and are likely to influence future revenue projections positively. Despite experiencing persistent financial losses, Ascletis Pharma's continuous focus on drug pipeline enhancement could suggest an improvement in earnings forecasts. However, the company remains unprofitable, with its price target standing at HK$23.40 — a significant premium to the current share price of HK$14.19. Given these dynamics, analysts perceive potential for future price adjustment, although current volatility and past insider selling may warrant caution among prospective investors. Ascletis' ability to reach profitability remains uncertain over the next few years, but its projected revenue growth stands well above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1672

Ascletis Pharma

A biotechnology company, engages in the research and development, manufacture, marketing, and sale of pharmaceutical products in Mainland China.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives