Will New Depression and Metabolic Trial Approvals Change CSPC Pharmaceutical Group's (SEHK:1093) Narrative?

Reviewed by Sasha Jovanovic

- In late 2025, CSPC Pharmaceutical Group announced multiple regulatory approvals in the U.S. and China to begin clinical trials for innovative therapies targeting major depressive disorder, obesity and overweight with comorbidities, and complement-mediated diseases such as IgA nephropathy.

- By advancing a 5-HT2A agonist without hallucination risk, a dual-biased GLP-1/GIP agonist, and an ultra-long-acting C5 siRNA, CSPC is pivoting its pipeline toward high-demand areas where existing treatment options have important clinical limitations.

- We will now look at how this push into innovative depression and metabolic therapies shapes CSPC Pharmaceutical Group’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is CSPC Pharmaceutical Group's Investment Narrative?

For CSPC Pharmaceutical Group, the investment case now hinges on whether its pivot from a slowing legacy business to higher-value innovation can gain real commercial traction. Earnings and revenue have been under pressure, dividends were trimmed, and recent share price weakness after a strong year-to-date run shows the market is already questioning the near-term growth path. Against that backdrop, the cluster of late‑2025 trial approvals in depression, obesity, and complement-mediated diseases is material for the story: it strengthens CSPC’s innovation credentials and could refresh medium-term catalysts beyond the existing generics and oncology portfolio. In the short term, though, these programs add R&D burden and binary clinical risk without changing the reality of softer margins and slower forecast growth than the Hong Kong market, so execution becomes even more central to the thesis.

However, one key execution risk around these new trials is easy to overlook, and investors should not.Despite retreating, CSPC Pharmaceutical Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.

Exploring Other Perspectives

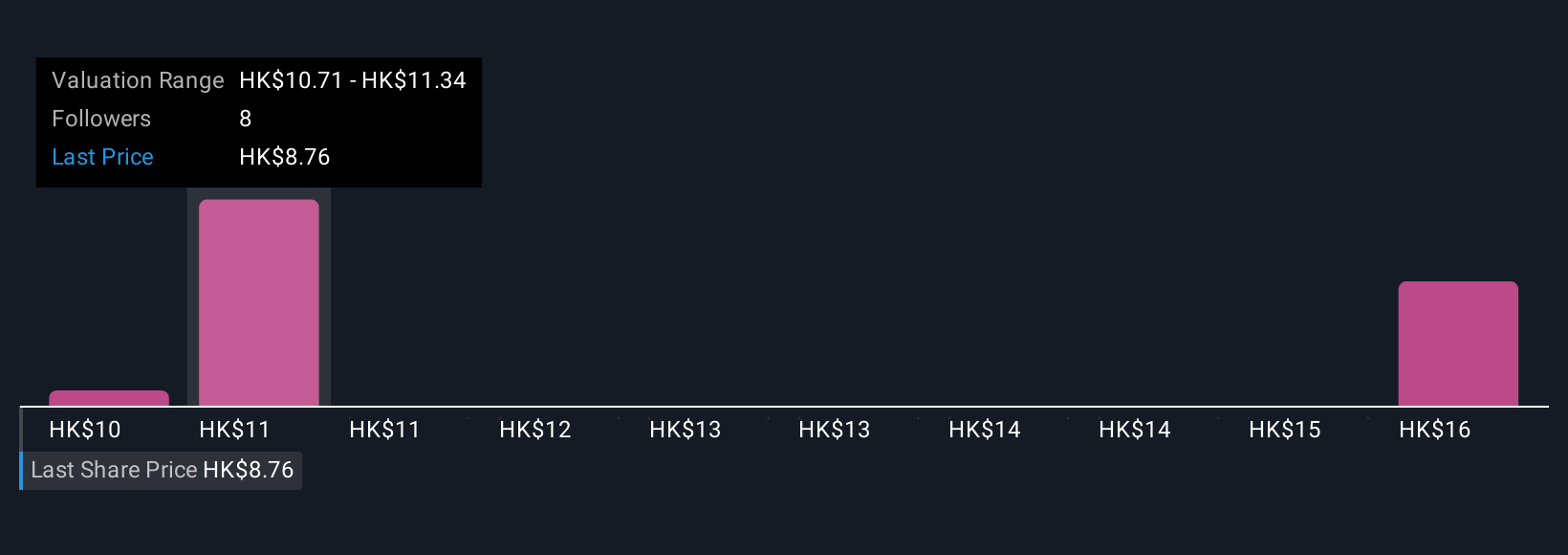

Four members of the Simply Wall St Community currently see CSPC’s fair value between HK$10.08 and HK$15.77, a wide spread that underlines how differently people read the same story. Set those opinions against the recent earnings softness and the heavier clinical pipeline risk discussed above, and it becomes clear why many prefer to compare multiple views before deciding how CSPC might fit into their own expectations for the business.

Explore 4 other fair value estimates on CSPC Pharmaceutical Group - why the stock might be worth over 2x more than the current price!

Build Your Own CSPC Pharmaceutical Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSPC Pharmaceutical Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSPC Pharmaceutical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSPC Pharmaceutical Group's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the manufacture and sale of pharmaceutical products in Mainland China, other Asian regions, Europe, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026