CSPC Pharmaceutical Group (SEHK:1093) Valuation After Dual China–US Trial Approvals for Obesity and Kidney Drug Candidates

Reviewed by Simply Wall St

CSPC Pharmaceutical Group (SEHK:1093) just cleared two regulatory hurdles, securing trial approvals in China and the US for first in class obesity and kidney disease candidates, giving investors fresh, data-driven reasons to revisit the stock.

See our latest analysis for CSPC Pharmaceutical Group.

These back to back trial greenlights land at a time when CSPC Pharmaceutical Group’s 1 year total shareholder return of 58.59 percent contrasts sharply with a weak 90 day share price return of negative 31.10 percent. This suggests that long term momentum is still intact even as short term sentiment cools.

If breakthroughs in obesity and kidney treatments are on your radar, it is also worth exploring other opportunities across healthcare stocks to see what the rest of the sector is pricing in.

With earnings still growing, shares trading at a steep discount to analyst targets, and a rich obesity and kidney pipeline advancing, investors now face a key question: Is CSPC mispriced, or is the market already baking in that future growth?

Price to Earnings of 19.7x: Is it justified?

CSPC Pharmaceutical Group closed at HK$7.71, and its current price to earnings ratio of 19.7 times points to a market that is willing to pay up for its earnings, even as some indicators flash caution.

The price to earnings multiple compares the company’s share price to its per share earnings, making it a common yardstick for profitable pharmaceutical companies where near term profitability and pipeline potential both matter.

For CSPC, the 19.7 times price to earnings sits below our estimated fair price to earnings level of 24.1 times. This implies the market is not fully crediting its earnings power. Yet that same 19.7 times is higher than the Hong Kong pharmaceuticals industry average of 13.7 times, suggesting investors are still assigning a premium relative to sector peers. Looking at peers more narrowly, CSPC’s price to earnings is below the average of 23.1 times. This gap highlights how much room there is for the market multiple to move if sentiment shifts toward the fair ratio implied by fundamentals.

Explore the SWS fair ratio for CSPC Pharmaceutical Group

Result: Price-to-Earnings of 19.7x (UNDERVALUED)

However, risks remain, including potential clinical setbacks in obesity or kidney programs and a sharp reversal in investor appetite for higher multiple pharma names.

Find out about the key risks to this CSPC Pharmaceutical Group narrative.

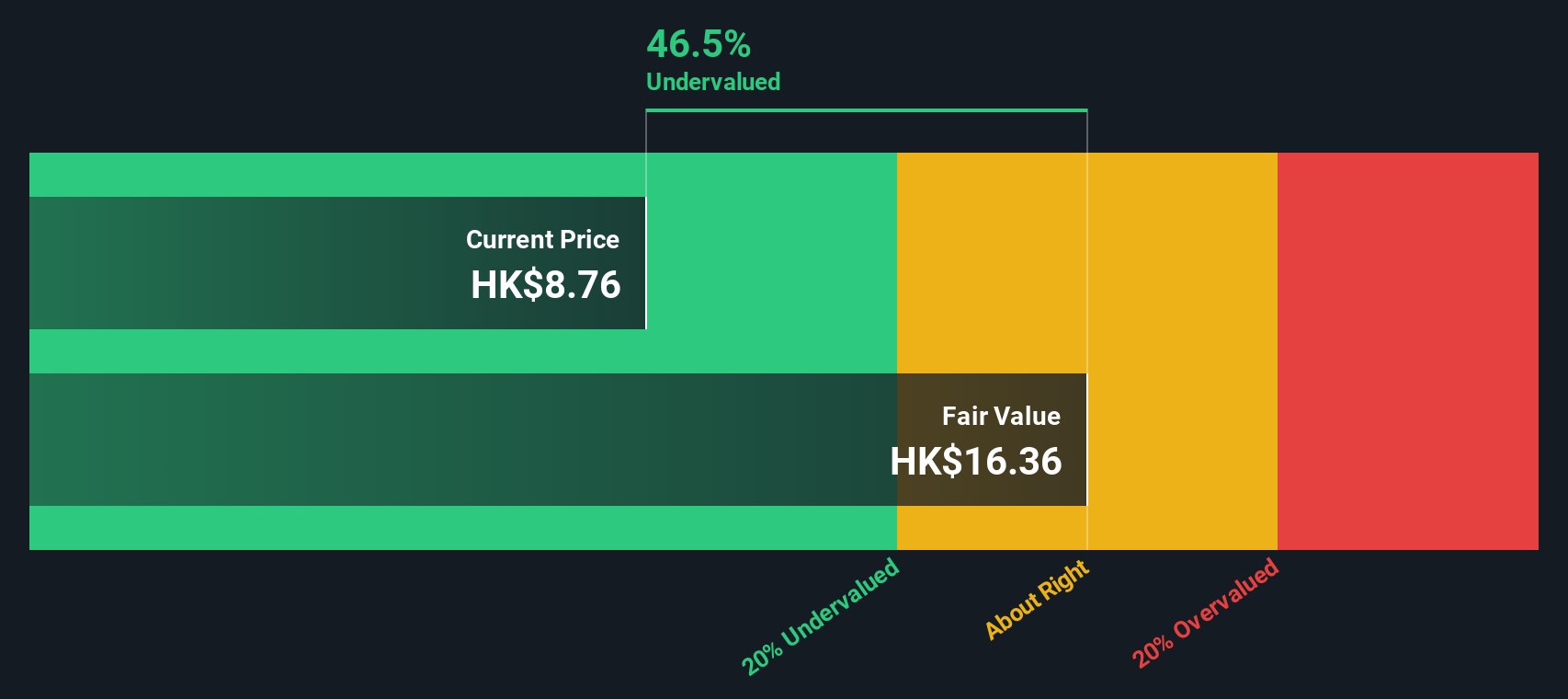

Another View, Using Our DCF Model

On our numbers, the SWS DCF model paints an even starker picture, suggesting fair value near HK$15.78, roughly 51 percent above the current HK$7.71 share price. If both earnings multiples and cash flows hint at upside, the question is whether the market is being too cautious on CSPC’s pipeline risk.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSPC Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSPC Pharmaceutical Group Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized CSPC view in minutes at Do it your way.

A great starting point for your CSPC Pharmaceutical Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock. Use the Simply Wall Street Screener to quickly pinpoint fresh opportunities that fit your exact strategy and risk profile.

- Capitalize on market mispricing by targeting companies trading below their cash flow value with these 907 undervalued stocks based on cash flows that might not stay cheap for long.

- Catch early momentum in breakthrough technologies by scanning these 26 AI penny stocks before the crowd fully appreciates their growth potential.

- Secure growing income streams by reviewing these 15 dividend stocks with yields > 3% that could strengthen your portfolio with consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the manufacture and sale of pharmaceutical products in Mainland China, other Asian regions, Europe, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026