Assessing CSPC Pharmaceutical Group (SEHK:1093) Valuation After Latest Regulatory Milestones and R&D Pipeline Advances

Reviewed by Simply Wall St

CSPC Pharmaceutical Group (SEHK:1093) has just made headlines with two R&D milestones. Its JSKN003 therapy gained Breakthrough Therapy Designation for advanced colorectal cancer, and SYH2061 secured clearance for clinical trials in China.

See our latest analysis for CSPC Pharmaceutical Group.

After a stellar run earlier this year, CSPC Pharmaceutical Group’s share price recently cooled off, dropping 18.4% over the past month and 22.7% in the last 90 days. Still, its year-to-date share price return sits at an impressive 65.2%, and the 1-year total shareholder return stands at 49.3%. Both figures point to sustained long-term momentum. Positive regulatory milestones such as the latest Breakthrough Therapy Designation and new trial clearances are keeping sentiment strong, suggesting the market sees renewed growth potential despite recent pullbacks.

If CSPC’s innovative pipeline has you interested in what else is out there, discover new opportunities through our comprehensive See the full list for free..

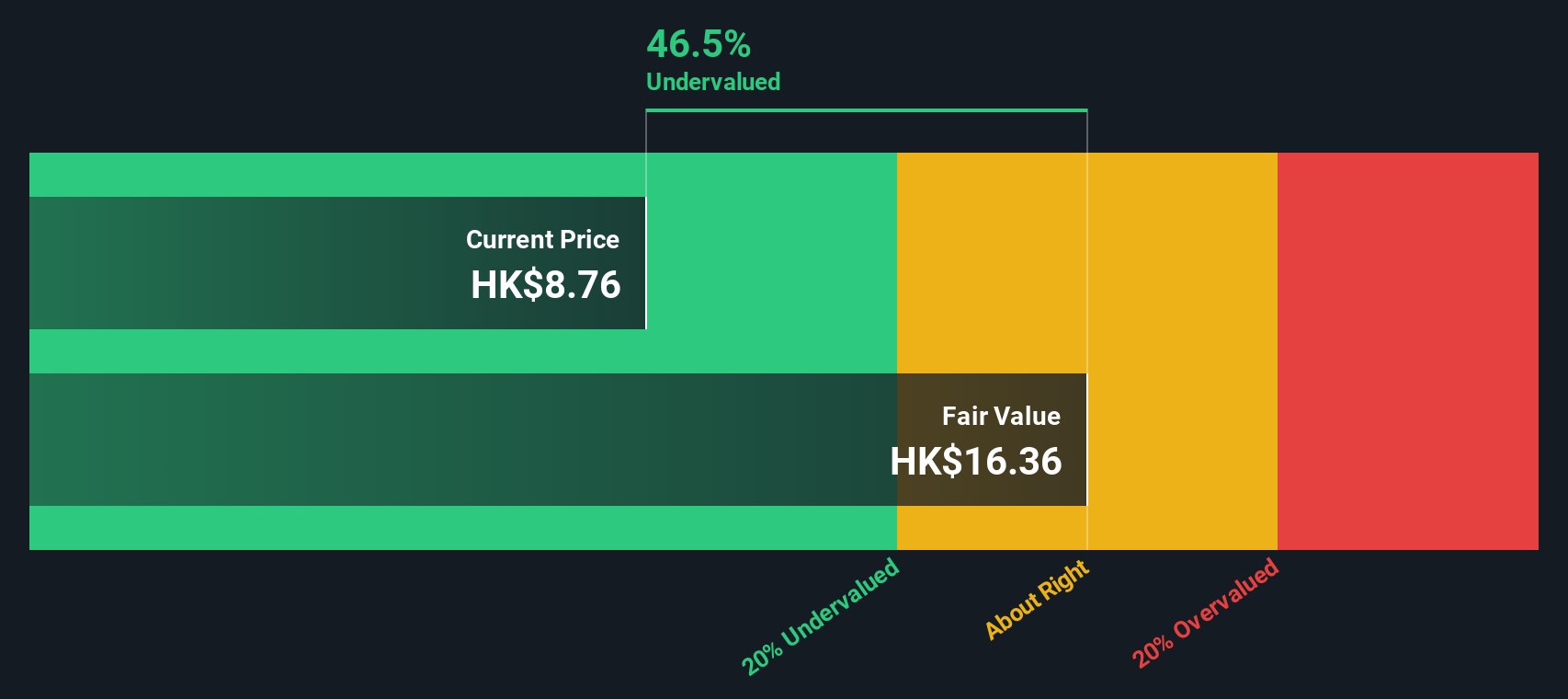

With CSPC’s shares taking a breather after rapid gains and analysts projecting considerable upside from current levels, the key question is whether there is still value to capture or if the market has already accounted for future growth.

Price-to-Earnings of 20.8x: Is it justified?

CSPC Pharmaceutical Group currently trades at a price-to-earnings (P/E) ratio of 20.8x, placing its valuation above the sector average in Hong Kong. At a last close price of HK$7.65 and with positive analyst sentiment, investors have to weigh whether the premium is warranted.

The P/E ratio represents how much investors are willing to pay today for each dollar of the company's future earnings. In pharmaceuticals, higher P/E ratios can signal market optimism regarding future drug launches, research breakthroughs, or sustainable growth in earnings. However, such ratios also imply higher expectations that must be met or exceeded to justify the price.

Compared to its peers, CSPC’s P/E is notably higher than the Hong Kong Pharmaceuticals industry average of 13.7x, suggesting the market is pricing in stronger growth or better prospects than most competitors. Despite this, it is still below the peer set's average of 30.6x and beneath the estimated Fair Price-To-Earnings Ratio of 26.7x, a level the market could conceivably approach if optimism holds.

Explore the SWS fair ratio for CSPC Pharmaceutical Group

Result: Price-to-Earnings of 20.8x (UNDERVALUED)

However, slower revenue growth or unexpected regulatory setbacks could challenge CSPC’s strong outlook and prompt investors to reassess the company’s premium valuation.

Find out about the key risks to this CSPC Pharmaceutical Group narrative.

Another View: Discounted Cash Flow Paints a Bolder Picture

Looking at valuation from another angle, our DCF model suggests CSPC Pharmaceutical Group could be trading at a significant discount, as the current share price sits 53.4% below the estimated fair value of HK$16.43. This method highlights the possibility of substantial upside. The key question remains: can these projections hold up in the real world?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSPC Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSPC Pharmaceutical Group Narrative

If you are curious to see the numbers for yourself or want to form your own perspective, you can dive in and build your narrative in just a few minutes. Do it your way

A great starting point for your CSPC Pharmaceutical Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. The market constantly reveals new trends and tomorrow’s winners. Let Simply Wall Street help you spot your next move.

- Catch early momentum by searching for these 3580 penny stocks with strong financials that combine high growth potential with solid financials before they hit the mainstream radar.

- Boost your income strategy by targeting these 22 dividend stocks with yields > 3% offering attractive yields that can add steady returns to your portfolio.

- Ride the wave of innovation by evaluating these 28 quantum computing stocks leading the way in quantum computing breakthroughs and shaping the tech sector’s next leap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the manufacture and sale of pharmaceutical products in Mainland China, other Asian regions, Europe, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives