- Hong Kong

- /

- Entertainment

- /

- SEHK:9999

A Look at NetEase (SEHK:9999) Valuation Following Strong Q3 Sales and Earnings Growth

Reviewed by Simply Wall St

NetEase (SEHK:9999) has released third quarter results showing significant gains in sales and net income compared to last year. Improved earnings per share also highlight stronger operations, attracting attention from market watchers and investors alike.

See our latest analysis for NetEase.

NetEase’s upbeat third quarter results have fueled strong momentum in the stock, with a year-to-date share price return of almost 62%. Recent news, including a fresh dividend, ongoing music platform innovations, and continued buyback announcements, has underscored confidence in both the company’s strategy and prospects. Over the longer term, the total shareholder return stands out, reaching nearly 65% over the past year and more than doubling over three years. This confirms not just short-term optimism but a broader uptrend in value and market sentiment.

If you’re feeling inspired by NetEase’s run, this could be a great moment to explore other tech and digital innovators. See the full list here: See the full list for free.

With NetEase’s latest results exceeding expectations, the pressing question is whether the current share price accurately reflects the business’s growth and future prospects. Investors may also be considering if there is still an attractive entry point.

Most Popular Narrative: 13.1% Undervalued

NetEase’s current share price sits noticeably below the projected fair value in the most widely followed narrative. This suggests strong market optimism for further upside. This valuation assumes that future improvements in profit margins and sustained global expansion are not fully reflected in the current price.

NetEase is accelerating global expansion with self-developed and licensed games that have performed strongly in overseas markets (e.g., Marvel Mystic Mayhem, FragPunk, Once Human, Eggy Party). This is increasing the company's addressable market and diversifying revenue streams beyond China, supporting higher long-term revenue growth and earnings stability.

Want to see what’s fueling this bullish outlook? The narrative leans on bold projections for overseas success and stronger profitability from new game launches. What growth milestones and margin shifts underwrite this price target? Uncover the financial logic behind the optimism by reading the full breakdown now.

Result: Fair Value of $255.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including NetEase's heavy reliance on China as well as the potential for rising costs to squeeze margins if global expansion stumbles.

Find out about the key risks to this NetEase narrative.

Another View: Multiples Say Caution

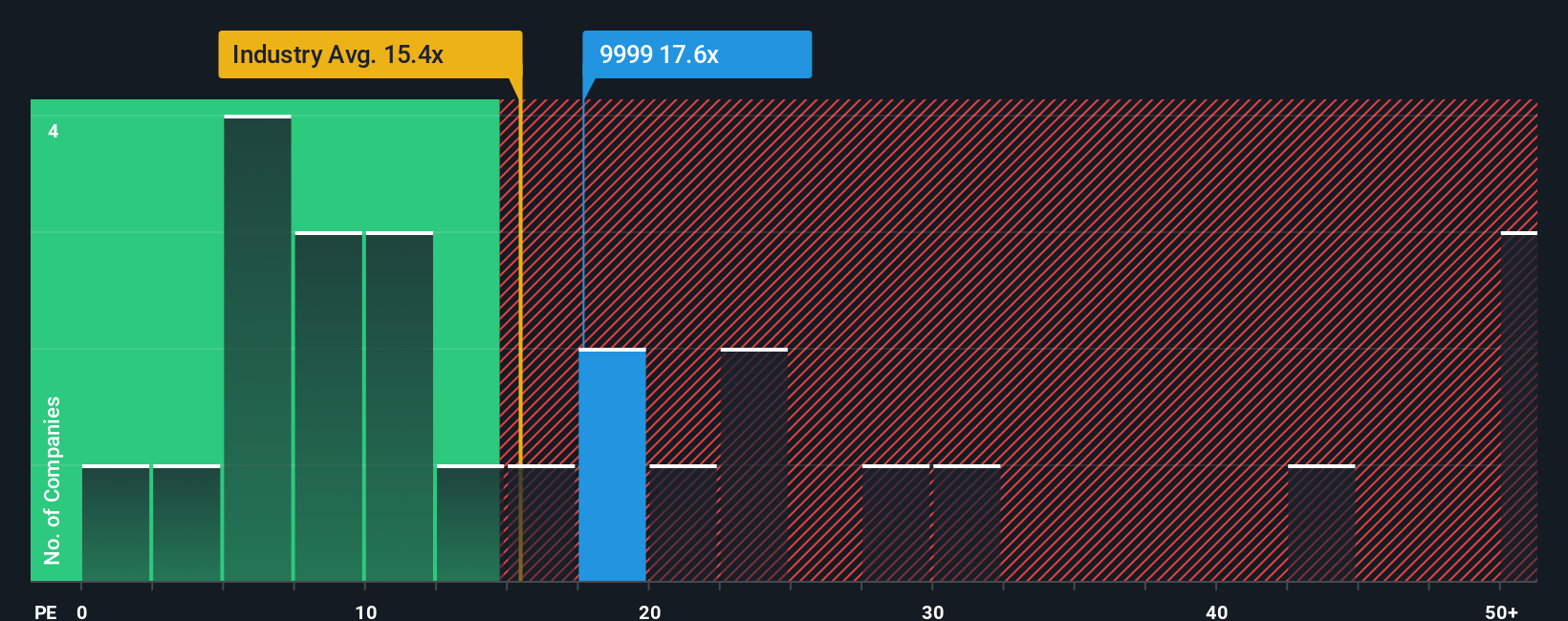

While the fair value estimate suggests NetEase is undervalued, looking at its price-to-earnings ratio tells a different story. The company trades at 17.6 times earnings, which is higher than both the Hong Kong Entertainment industry average of 14.9 times and its peer average of 15.6 times. The fair ratio sits at 22.3 times, hinting there could be room for upward movement if sentiment shifts. Does this premium signal real strength, or is it hiding risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NetEase Narrative

If you want a different take or like to dig into the data yourself, consider shaping your own NetEase story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding NetEase.

Ready for Your Next Smart Move?

Upgrade your watchlist and act while market gaps are still waiting; don’t let these opportunities be the ones you regret missing tomorrow.

- Unlock the power of steady income with these 15 dividend stocks with yields > 3% offering yields above 3% to boost your portfolio returns.

- Ride the future of finance by checking out these 81 cryptocurrency and blockchain stocks blending real-world adoption with breakthrough blockchain innovation.

- Spot market opportunities in undervalued companies before they turn mainstream with these 920 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetEase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9999

NetEase

Engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026