How China Literature’s HK$1.2 Billion Buyback Will Impact China Literature (SEHK:772) Investors

Reviewed by Sasha Jovanovic

- Earlier this week, China Literature announced it will repurchase on-market shares of up to HK$1.20 billion, stating that it views its stock as undervalued and has sufficient resources to fund the program without disrupting operations.

- This move suggests management is prioritising capital return alongside growth investment, potentially enhancing earnings per share as the share count gradually contracts.

- Next, we will examine how this sizeable buy-back plan could influence China Literature’s existing investment narrative around IP, AI and profitability.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

China Literature Investment Narrative Recap

To own China Literature, you need to believe its vast IP library, AI tools and Tencent ecosystem can offset user declines and volatile IP revenues. The HK$1.20 billion buy-back underlines confidence but does not materially change the key near-term catalyst, which remains execution on IP commercialization, or the biggest risk, which is continued MAU erosion and pressure on topline growth.

The latest buy-back plan sits alongside earlier repurchase activity under the 2024 mandate, where China Literature has already spent over HK$400 million retiring shares. Together, these programs reinforce the capital return thread in the story, but investors still need to weigh that against the lumpiness of IP operations revenue and the earnings swings it can create.

Yet behind the headline buy-back, there is a risk investors should be aware of around ongoing user attrition and...

Read the full narrative on China Literature (it's free!)

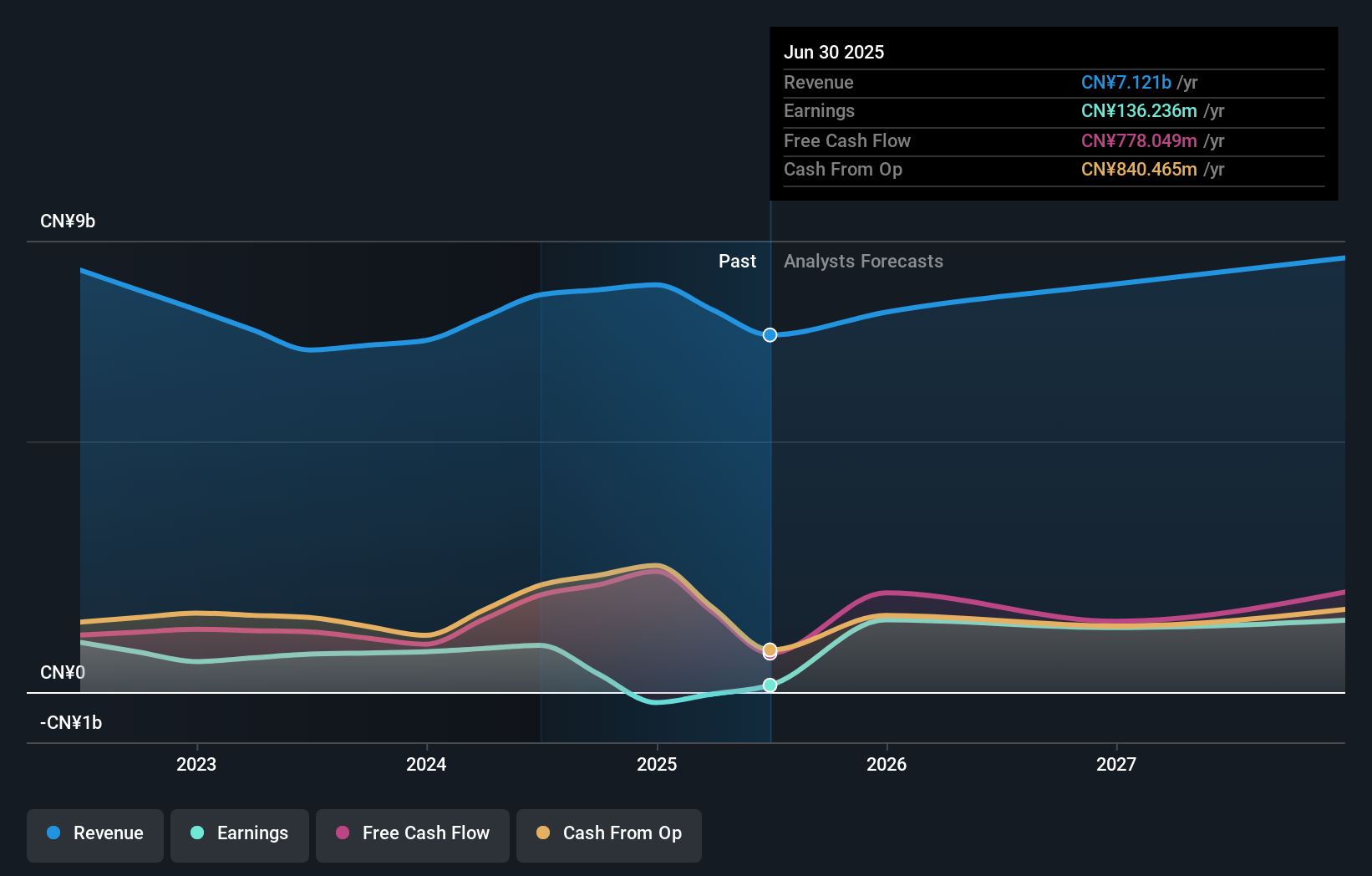

China Literature's narrative projects CN¥9.0 billion revenue and CN¥1.7 billion earnings by 2028. This requires 8.3% yearly revenue growth and roughly CN¥1.6 billion earnings increase from CN¥136.2 million today.

Uncover how China Literature's forecasts yield a HK$40.06 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly HK$40.06 to HK$68.96, showing how widely views on China Literature can differ. You should set these against the current concern that falling MAUs and revenue pressure could challenge the long term IP monetization story and explore several alternative viewpoints before forming a view.

Explore 3 other fair value estimates on China Literature - why the stock might be worth just HK$40.06!

Build Your Own China Literature Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Literature research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Literature research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Literature's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:772

China Literature

An investment holding company, operates an online literature platform in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026