- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

A Look at Kingsoft (SEHK:3888) Valuation Following Recent Earnings Decline

Reviewed by Simply Wall St

Kingsoft (SEHK:3888) released its earnings for the nine months ended September 2025, revealing declines in both revenue and net income compared to the same period last year. This has drawn investor focus to the company’s latest performance trends.

See our latest analysis for Kingsoft.

Kingsoft’s latest results have sent ripples through its share price, with a 14% decline over the past month and a 9% drop year-to-date, as investors digest declining revenue and earnings. Despite these headwinds, the three-year total shareholder return of 9.4% shows the long-term story is more resilient than recent numbers suggest. However, momentum has clearly faded for now.

If recent performance has you rethinking your approach, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a steep discount to analyst targets and an intrinsic discount of over 60%, the real question for investors is whether Kingsoft is a bargain, or if the market is fairly reflecting its future prospects.

Most Popular Narrative: 29.9% Undervalued

At HK$29.12, Kingsoft is trading well below the narrative's fair value estimate of HK$41.54. The gap points to a strong disagreement between recent market pricing and what analysts expect if certain growth catalysts play out.

Sustained demand for digital transformation among enterprises and governments, along with stricter data localization requirements in China, positions Kingsoft strongly to gain market share from foreign competitors. This may accelerate revenue and gross margin growth in office software. The ongoing shift to remote and hybrid work models is driving higher adoption and deeper integration of Kingsoft's AI-enhanced office products (such as WPS AI 3.0 and WPS Lingxi), which could boost user stickiness, ARPU, and recurring subscription revenue.

Want to know what’s fueling this bullish outlook and how aggressive growth forecasts shape the story? Huge expectations for sales and margin expansion, plus a future profit multiple that stands out from the sector. Get the inside track on which bold projections drive this fair value. Read the full narrative to uncover the numbers behind it.

Result: Fair Value of $41.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persisting declines in Kingsoft’s gaming revenues and margin pressure from increased R&D investment could pose challenges to the upbeat growth story going forward.

Find out about the key risks to this Kingsoft narrative.

Another View: Expensive on Earnings Ratios

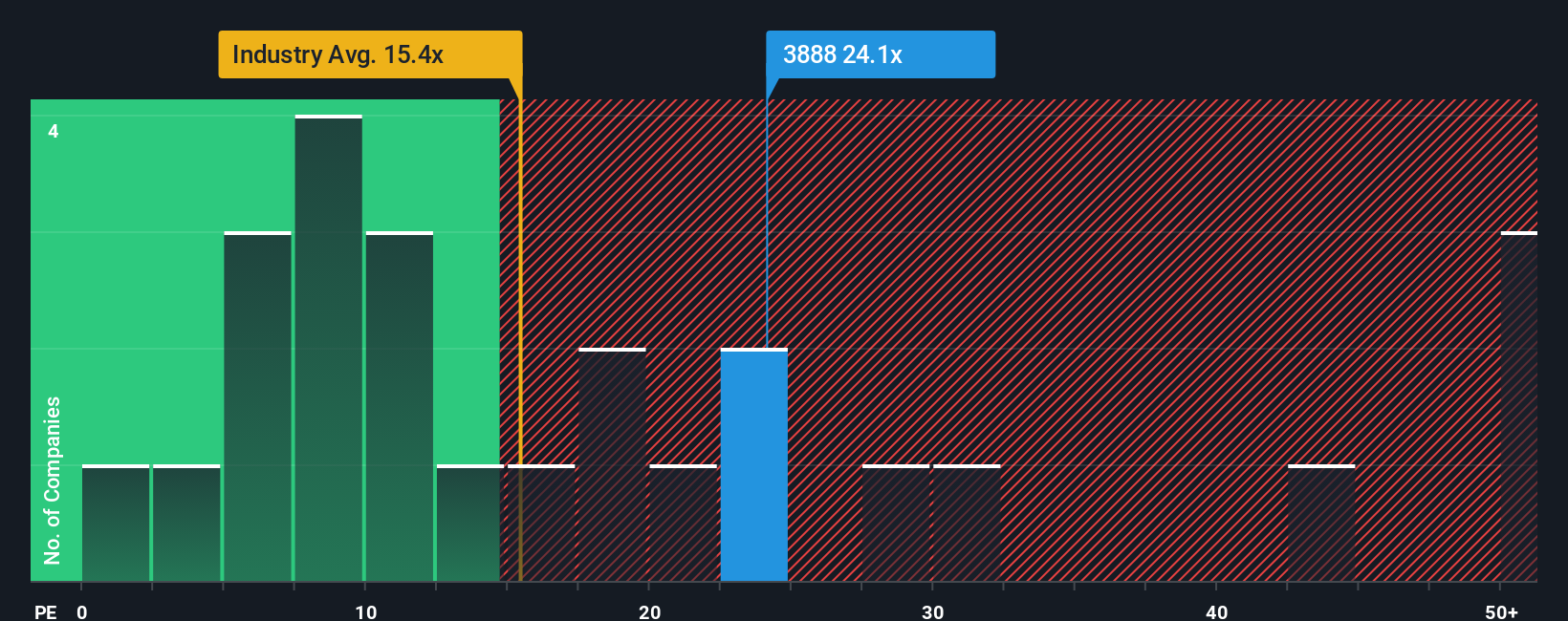

While fair value estimates suggest Kingsoft is undervalued, a closer look at its price-to-earnings ratio (24.7x) tells a different story. That figure is more than twice the peer average (10x) and notably higher than the industry average (14.9x) as well as the fair ratio (19.8x). This disconnect signals higher valuation risk if the optimistic growth narrative stalls. Should investors trust the market’s caution or the growth forecasts embedded in analyst price targets?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kingsoft Narrative

If you see things differently or want to dig into the numbers on your own terms, you can craft your own story in just a few minutes. Do it your way

A great starting point for your Kingsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next move with confidence. Simply Wall Street's screeners reveal opportunities you might otherwise overlook and could be key to your portfolio’s success. Don’t let these market leaders pass you by.

- Unlock growth by checking out these these 25 AI penny stocks powering innovation in artificial intelligence and transforming industries around the globe.

- Tap into attractive yields and steady performance with these 14 dividend stocks with yields > 3%, featuring companies offering more than 3% dividend returns.

- Stay ahead by exploring these 923 undervalued stocks based on cash flows that are primed for a potential rebound based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026