- Hong Kong

- /

- Entertainment

- /

- SEHK:1060

Why Damai Entertainment Holdings (SEHK:1060) Doubled Its Content Investment Cap Amid Rising Drama Series Demand

Reviewed by Sasha Jovanovic

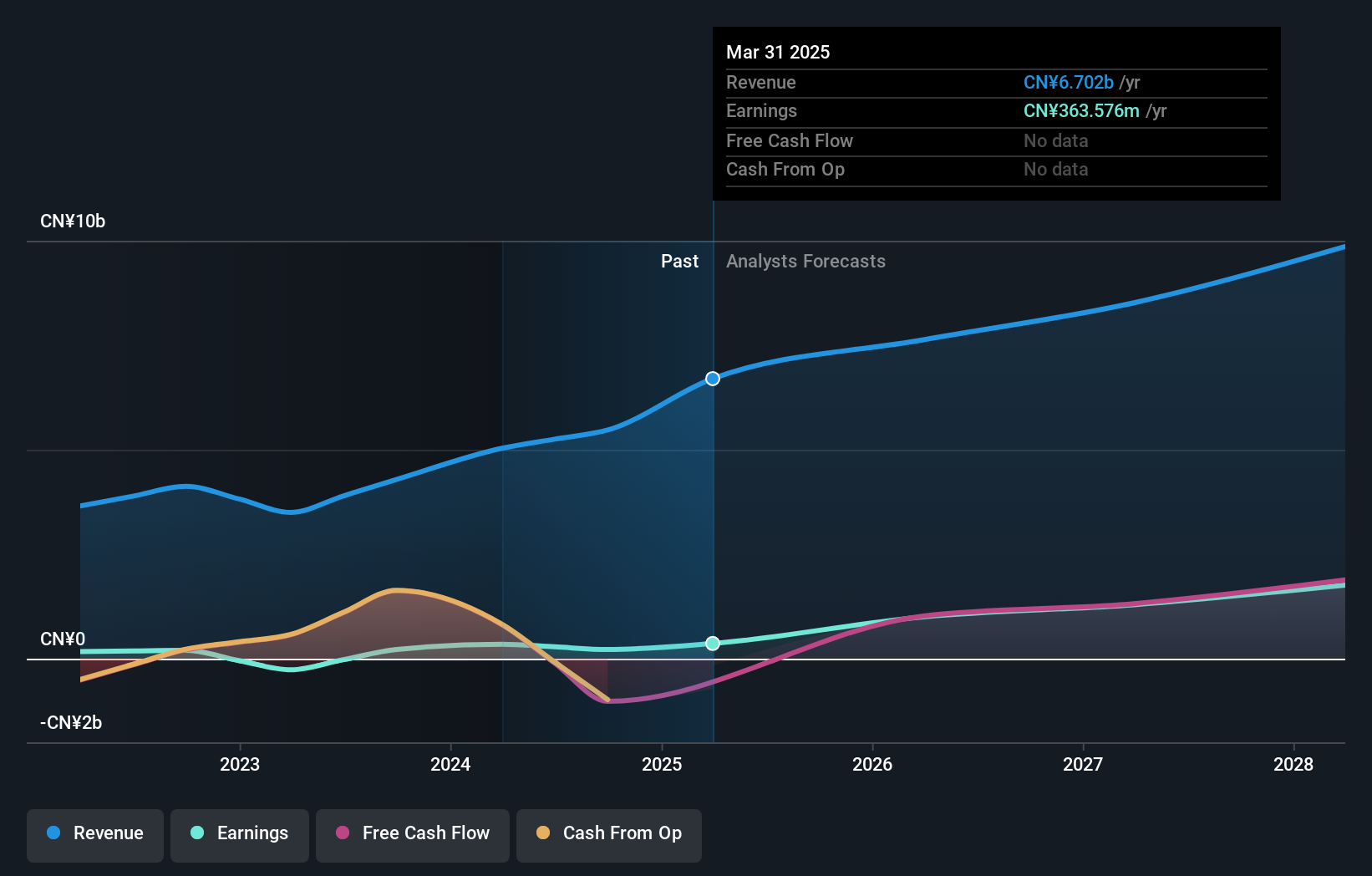

- Damai Entertainment Holdings announced it has revised its annual cap for continuing connected transactions under the Commissioned Production Cooperation Framework Agreement, increasing it from RMB100 million to RMB200 million for the financial year ending March 31, 2026.

- This move highlights how surging demand for drama series production is prompting the company to scale investment in premium content and broaden its market reach.

- With business growth driving a doubling of its transaction limit, we assess what Damai’s content investment means for its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Damai Entertainment Holdings' Investment Narrative?

For anyone considering Damai Entertainment Holdings, it’s important to believe in the case for premium content scaling up and the company’s ability to seize new demand for drama production. The recent decision to double the cap on commissioned production transactions from RMB100 million to RMB200 million shows Damai is reacting directly to stronger business activity and interest in its content, making this a potentially material development for short-term growth. Previously, the biggest near-term catalysts centered on continued revenue expansion, new partnerships, and sustaining high content output, while a slowdown in demand or overextending capital on production stood out as key risks. With the new higher cap aligned to confirmed rising demand, some short-term upside catalysts may look more robust, but the risk profile shifts, particularly around how efficiently new investment is translated into sustained returns rather than one-off gains. Pay close attention to execution, as the stakes are now higher and competition for viewer attention remains fierce.

However, increased production spending means exposure to higher costs if demand expectations aren’t met. Damai Entertainment Holdings' shares have been on the rise but are still potentially undervalued by 15%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Damai Entertainment Holdings - why the stock might be worth as much as 38% more than the current price!

Build Your Own Damai Entertainment Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Damai Entertainment Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Damai Entertainment Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Damai Entertainment Holdings' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1060

Damai Entertainment Holdings

An investment holding company, operates in the content, technology, and IP merchandising and commercialization businesses in Hong Kong and the People's Republic of China.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026