- Hong Kong

- /

- Metals and Mining

- /

- SEHK:347

Is Angang Steel’s Soaring Share Price Justified After Strong 2024 Rally?

Reviewed by Simply Wall St

Thinking about what to do with Angang Steel stock? You are far from alone. With a share price that has more than doubled over the past year, up a striking 112.4%, investors have taken notice. The 3.7% rally in the last week may look small by comparison, but it hints at renewed momentum after a slightly softer month where the stock dipped 3%. Year-to-date, though, Angang Steel has surged 54.9%, handily outpacing broader indices and signaling there is something more at play than just luck or market noise.

It is hard to ignore the energy surrounding the steel sector lately, especially as infrastructure initiatives and policy shifts fuel investor optimism in materials and industrials. When a stock moves like this, it often reflects changing risk perceptions and growth expectations. For some, that is a green light; for others, it is a signal to pause and wonder if the value has already been realized, or if the best is yet to come.

That brings us to valuation, which can cut through the excitement and help answer whether Angang Steel is still a good buy. By running the numbers, the company clocks in with a valuation score of 3, meaning it passes 3 out of 6 key undervaluation checks. But does that tell the full story? We will dig into each valuation approach in detail, and stick around for a fresh perspective at the end that could change how you think about Angang Steel’s true value.

Why Angang Steel is lagging behind its peersApproach 1: Angang Steel Dividend Discount Model (DDM) Analysis

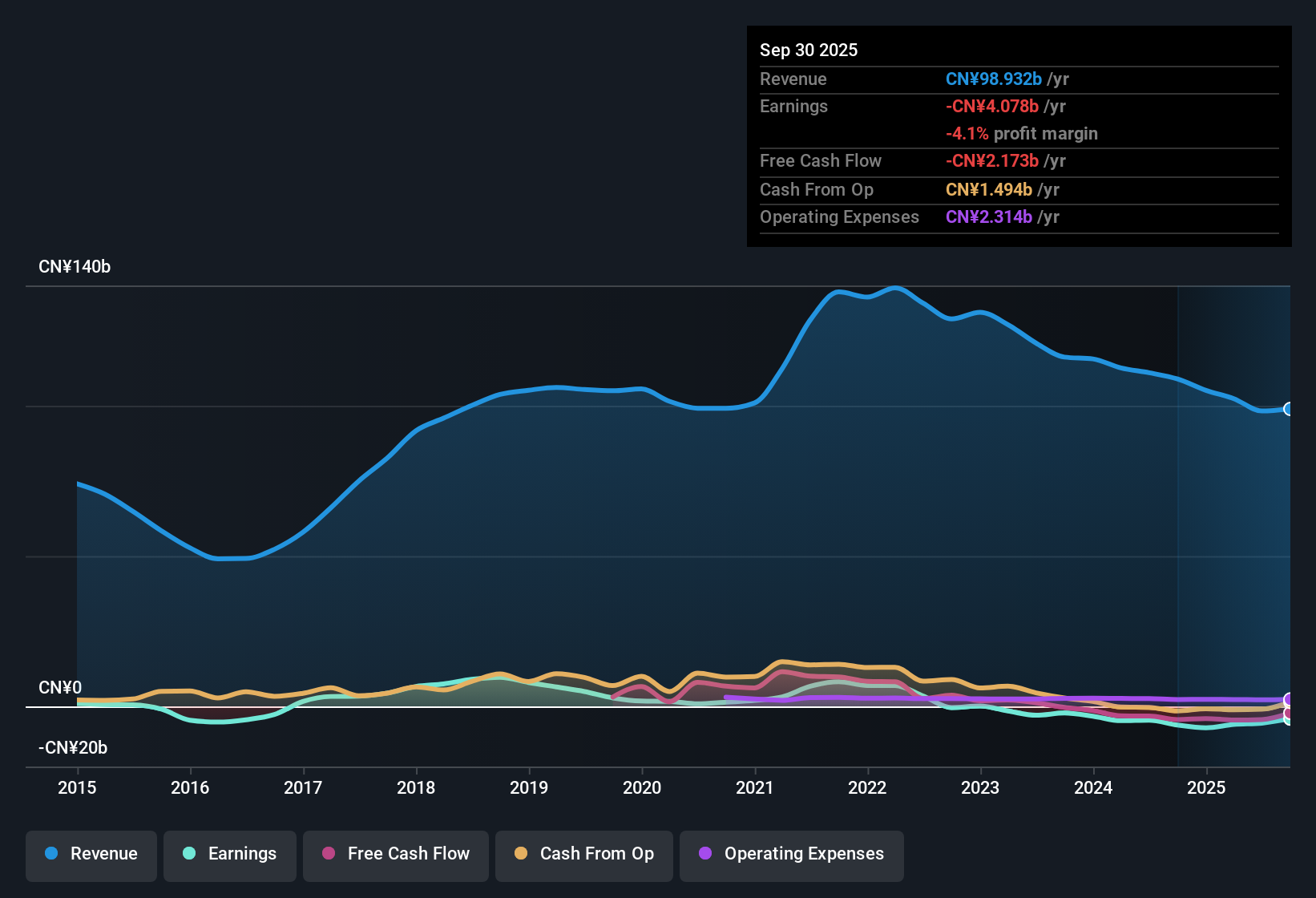

The Dividend Discount Model (DDM) estimates a stock’s intrinsic value by forecasting all future dividends and discounting them back to their present value. This method is most meaningful for companies with clear, sustainable dividend practices. For Angang Steel, the most recent data shows a dividend per share (DPS) of CN¥0.0092. However, weak financials raise immediate concerns about dividend sustainability.

Angang Steel’s return on equity stands at -5.62%, while its payout ratio is also negative at -5.48%. These negative figures reflect losses and a lack of earnings to support ongoing dividends. The DDM growth estimate for Angang Steel is -5.9%, calculated as “(1 - -5.48%) x -5.62%,” indicating that instead of growing, the company’s dividend payments are expected to contract further.

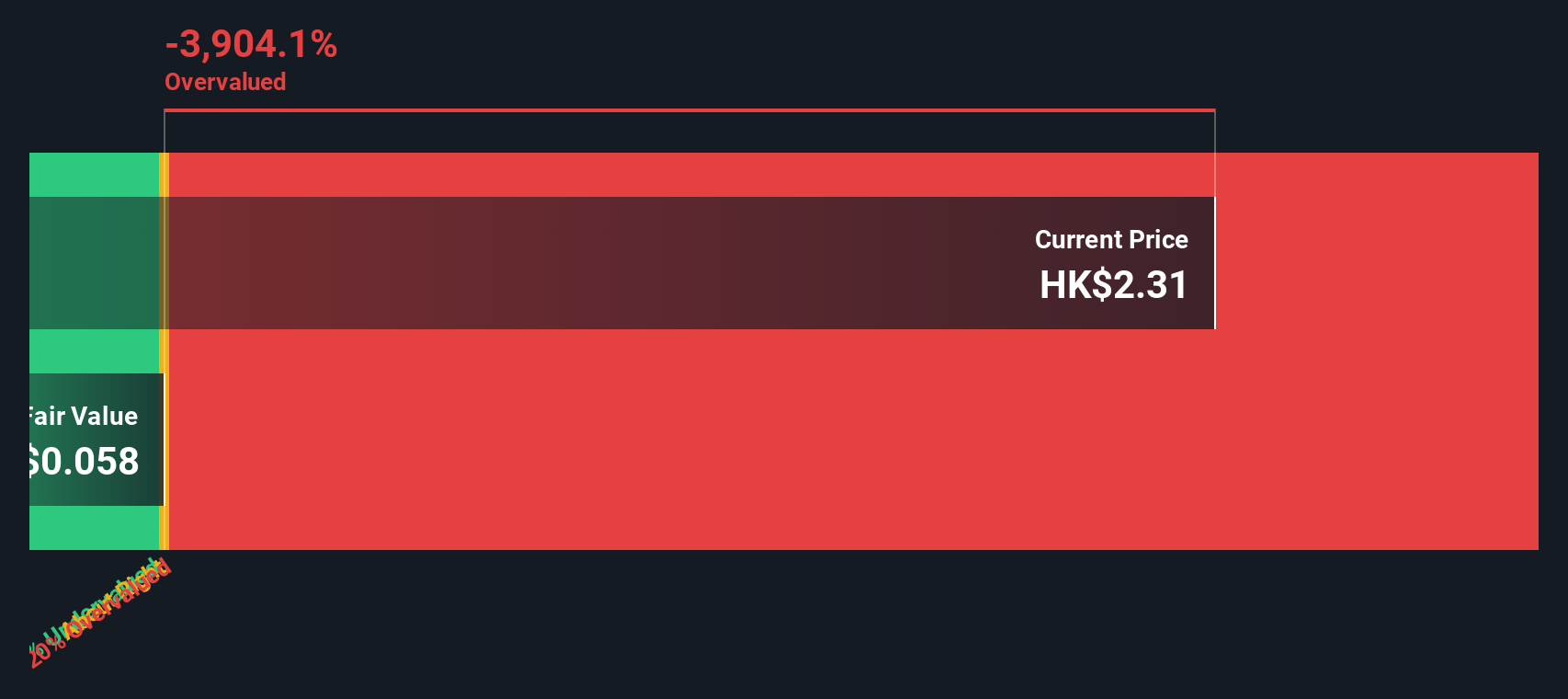

Given these inputs, the DDM calculates an intrinsic value of only HK$0.073 per share. When compared to the current trading price, this means Angang Steel is approximately 2964.4% overvalued under this method. Investors should view this as a major red flag, as the stock’s market price is drastically detached from what long-term dividend returns would justify.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Angang Steel.

Approach 2: Angang Steel Price vs Sales

The price-to-sales (PS) ratio is often a preferred valuation metric for companies in cyclical or capital-intensive sectors like steel, especially when profitability fluctuates or when a business is recovering from losses. The PS ratio gives investors a way to compare valuations irrespective of short-term earnings volatility, by measuring the stock’s price relative to its revenue.

Market expectations of growth and risk play a major role in what is considered a “normal” PS ratio. Higher growth prospects or lower risks can justify a richer multiple, while very low or negative growth, along with financial pressures, pulls the fair PS ratio down.

Currently, Angang Steel trades at a PS ratio of 0.19x. That is significantly below the Metals and Mining industry average of 0.90x and its peer average of 1.28x. However, these broad comparatives can miss important nuances. That is where Simply Wall St’s “Fair Ratio” comes in. This model estimates a fair PS ratio of 0.33x for Angang Steel, factoring in its earnings growth outlook, sector dynamics, profit margins, market cap size, and company-specific risks.

Because the Fair Ratio considers these company-specific fundamentals, it gives a clearer sense of true value than a simple industry or peer comparison. Comparing Angang Steel’s actual PS ratio of 0.19x to its Fair Ratio of 0.33x suggests the stock is modestly undervalued, trading below what would be expected given its profile, though the gap is not dramatic.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Angang Steel Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple, dynamic approach that let you attach your personal story and perspective to a company’s numbers, shaping your own assumptions for its fair value based on future revenue, earnings, and margins.

Instead of just looking at past data, a Narrative connects Angang Steel’s broader story with your financial forecast, linking what you believe about the company’s future to an easy-to-read fair value estimate. Narratives are available right within the Community page on Simply Wall St, used by millions of investors, making this tool both accessible and powerful.

By comparing your Narrative’s Fair Value with the current price, it becomes much clearer to decide when to buy or sell. Even better, Narratives update automatically when new information such as news or earnings emerges, so your outlook is always up to date.

For example, some Angang Steel investors see high long-term growth and set their Narrative Fair Value above HK$8, while others, more cautious, base theirs closer to HK$1. This demonstrates that Narratives empower every investor to make smarter, more personal decisions.

Do you think there's more to the story for Angang Steel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:347

Angang Steel

Engages in the production, processing, and sale of steel products in the People’s Republic of China and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives