- Hong Kong

- /

- Metals and Mining

- /

- SEHK:347

Angang Steel (SEHK:347): What Recent Market Attention Means for Its Valuation

Reviewed by Simply Wall St

There has been a flurry of interest around Angang Steel (SEHK:347) after its latest move in the market. For anyone weighing their next step, it is understandable to be curious. Although there is no headline-grabbing event or specific news to explain the recent attention, these developments are often enough to spark debate among investors, especially when signals are mixed and the numbers hint at underlying shifts.

Looking at the bigger picture, Angang Steel’s stock has delivered an impressive 113% total return over the past year. This far outpaces returns from earlier periods and suggests that momentum has accelerated recently, even after a modest dip over the past month. The company’s fundamentals have also shown some variation, with annual revenue ticking slightly down but net income growing sharply, a combination that invites questions about its sustainability and future trajectory.

With all these figures in mind, is the market underestimating Angang Steel’s longer-term prospects, or is this past year’s gain a sign that expectations are already sky high?

Price-to-Sales of 0.2x: Is it justified?

Angang Steel is trading at a Price-to-Sales ratio of 0.2x. This is significantly lower than both its peer group average of 1.3x and the broader Hong Kong Metals and Mining industry average of 0.9x. On a revenue basis, this suggests the company’s shares may be undervalued compared to its industry peers.

The Price-to-Sales (P/S) ratio compares a company's stock price to its revenues and gives investors a sense of how much they are willing to pay for each unit of sales. In sectors such as metals and mining, where earnings can be volatile or negative, the P/S ratio is especially relevant as an alternative to earnings-based valuation methods.

Because Angang Steel's valuation is well below both peer and industry averages, the market seems to be factoring in skepticism about future profitability or the sustainability of revenues. Whether this discount is justified depends on the company’s ability to turn around profits and meet growth expectations in the near term.

Result: Fair Value of $2.16 (ABOUT RIGHT)

See our latest analysis for Angang Steel.However, persistent revenue declines and recent net losses remain risks that could challenge the idea of a sustained turnaround for Angang Steel.

Find out about the key risks to this Angang Steel narrative.Another View: Discounted Cash Flow Model

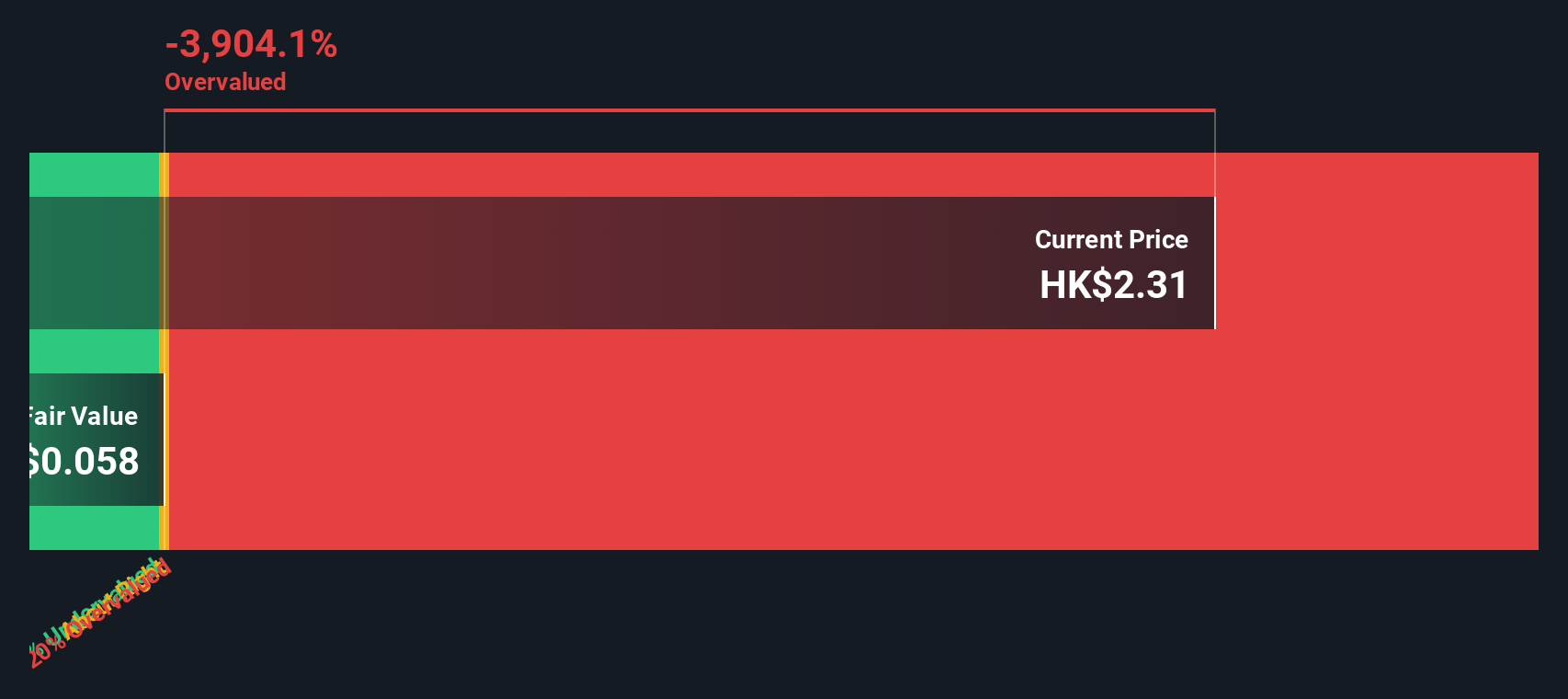

While the price-to-sales ratio points toward potential value, the SWS DCF model offers a different perspective and suggests the shares may in fact be trading above what future cash flows might justify. Which outlook will win out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Angang Steel Narrative

If this perspective does not fully resonate or you would rather examine the numbers on your own terms, you can put together your own view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Angang Steel.

Looking for More Investment Ideas?

Stay ahead by exploring other investment themes that could shape your portfolio’s growth. These hand-picked opportunities offer a fresh perspective and could help you spot your next winner.

- Supercharge your returns by tapping into penny stocks with strong financials using our penny stocks with strong financials.

- Hunt for future tech giants with our shortcut to AI-powered companies via AI penny stocks.

- Unlock hidden gems that are often overlooked by the crowd through our list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:347

Angang Steel

Engages in the production, processing, and sale of steel products in the People’s Republic of China and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives