- Hong Kong

- /

- Metals and Mining

- /

- SEHK:323

Is Maanshan Iron & Steel (SEHK:323) Overvalued Now? A Fresh Look at Its Fair Worth

Reviewed by Simply Wall St

Maanshan Iron & Steel (SEHK:323) has come onto the radar today, and for many investors, any movement in a stock like this raises one key question: is there a signal in the noise? With no headline-grabbing event driving the action, it is natural to pause and wonder if the latest shift in price is trying to tell us something, or if it is simply a blip in a volatile market.

Looking at the bigger picture, Maanshan Iron & Steel has delivered a strong performance over the past year, climbing 183%. The rising trend has been particularly pronounced in the past three months, posting a gain of 38%. Over five years, returns are also positive, though less dramatic. These figures paint a picture where momentum might be building rather than fading, even as revenue growth stays modest and profit figures remain under pressure.

The question, then, is whether this surge hints at an undervaluation or if the current stock price is already factoring in optimistic expectations for future growth. Could there still be room to run, or is the opportunity already gone?

Most Popular Narrative: 13.2% Overvalued

According to the most popular narrative, Maanshan Iron & Steel is seen as meaningfully overvalued compared to the consensus estimate of its intrinsic worth.

The company is investing heavily in cost optimization via supply chain integration, including increased use of low-cost, lower-grade ores, digitalized manufacturing, supply chain management reforms, and strategic partnerships within the Baowu Group. These measures are supporting EBITDA margin recovery and more stable earnings. Management is adopting green manufacturing and accelerating investment in ultra-low emission and "zero waste" initiatives. This positions the company to capture premium pricing in green steel segments and to avoid future regulatory penalties or loss of market access, positively impacting long-term profitability.

Want to know what’s driving the hefty valuation? There is a growth play hidden in the numbers. Future profits, margins, and returns are all set to shift. Which assumptions are packing the most punch in this calculation? Peek beneath the surface to discover which bullish forecasts and strategic moves underpin the price target and why analysts think the shares are priced for perfection.

Result: Fair Value of $2.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent overcapacity and a structural slowdown in Chinese steel demand could quickly challenge even the most optimistic growth story in this case.

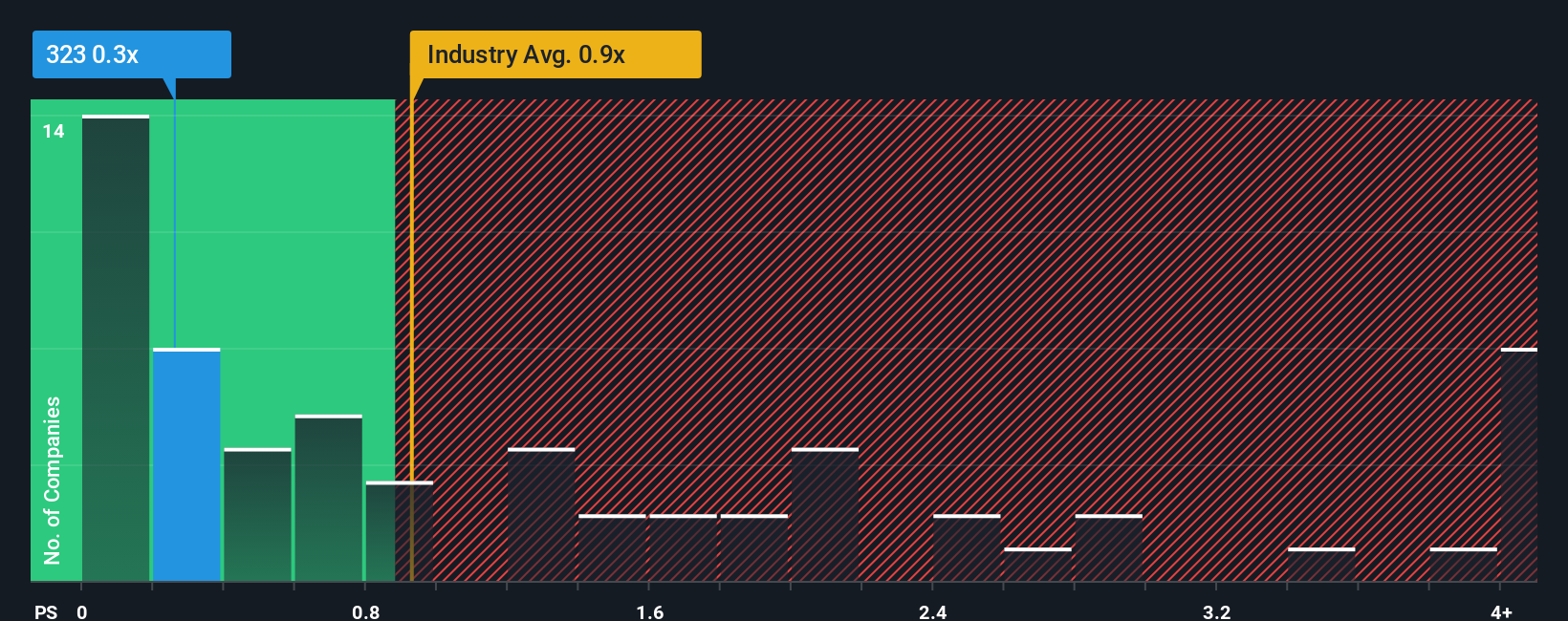

Find out about the key risks to this Maanshan Iron & Steel narrative.Another Angle: Multiples Tell a Different Story

Looking through a different lens, market comparables suggest Maanshan Iron & Steel may actually offer attractive value compared to the broader industry, even while analyst forecasts see it as overvalued. Could the market be underestimating its potential, or are the risks simply being discounted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Maanshan Iron & Steel Narrative

If this perspective does not resonate with you or you prefer to take control of your own research, you can quickly put your own view together in just a few minutes. Do it your way.

A great starting point for your Maanshan Iron & Steel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors cast a wide net. If you do not want to miss out on the next breakout star, check these market opportunities now and get ahead.

- Spot fast-rising innovators gaining traction by checking out penny stocks with strong financials for companies showing real financial backbone in a competitive field.

- Unlock tomorrow's breakthroughs with quantum computing stocks and see which businesses are set to transform industries with quantum-powered technology.

- Secure steady passive income and strong fundamentals by starting with dividend stocks with yields > 3% for top-yielding equities offering more than just market returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:323

Maanshan Iron & Steel

Manufactures and sells iron and steel products, and related by-products in Mainland China, Hong Kong, and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives