- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2600

Aluminum Corporation of China (HKG:2600) stock performs better than its underlying earnings growth over last five years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term Aluminum Corporation of China Limited (HKG:2600) shareholders would be well aware of this, since the stock is up 163% in five years. It's also good to see the share price up 30% over the last quarter. But this could be related to the strong market, which is up 16% in the last three months.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

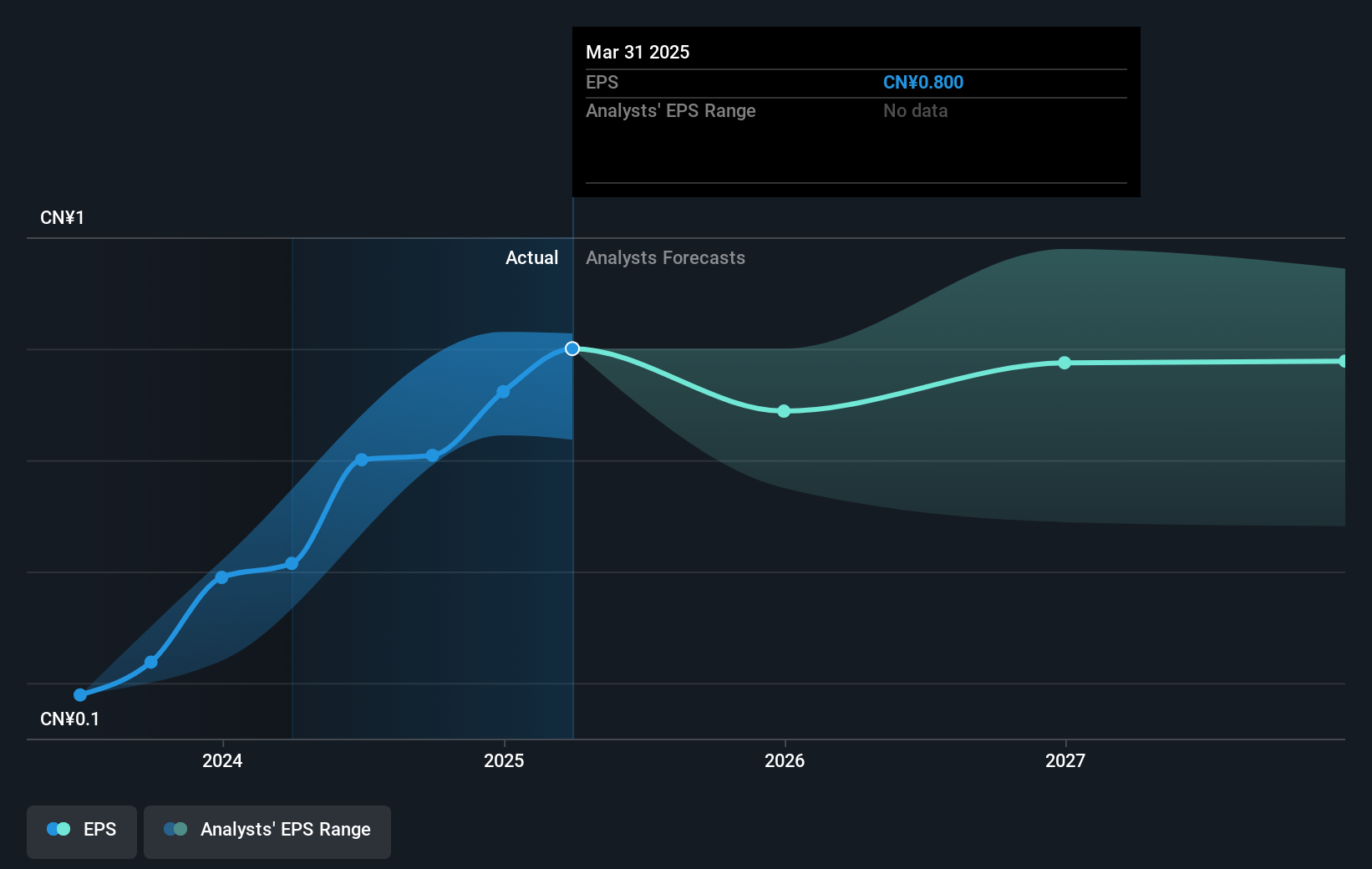

During five years of share price growth, Aluminum Corporation of China achieved compound earnings per share (EPS) growth of 125% per year. This EPS growth is higher than the 21% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. This cautious sentiment is reflected in its (fairly low) P/E ratio of 6.29.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Aluminum Corporation of China has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Aluminum Corporation of China will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Aluminum Corporation of China the TSR over the last 5 years was 186%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Aluminum Corporation of China shareholders are up 3.9% for the year (even including dividends). But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 23% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. Before forming an opinion on Aluminum Corporation of China you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course Aluminum Corporation of China may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2600

Aluminum Corporation of China

Primarily engages in the exploration and mining of bauxite, coal, and other resources in the People's Republic of China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives