- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2489

Persistence Resources Group (SEHK:2489) Margin Decline Challenges Premium Valuation Narrative

Reviewed by Simply Wall St

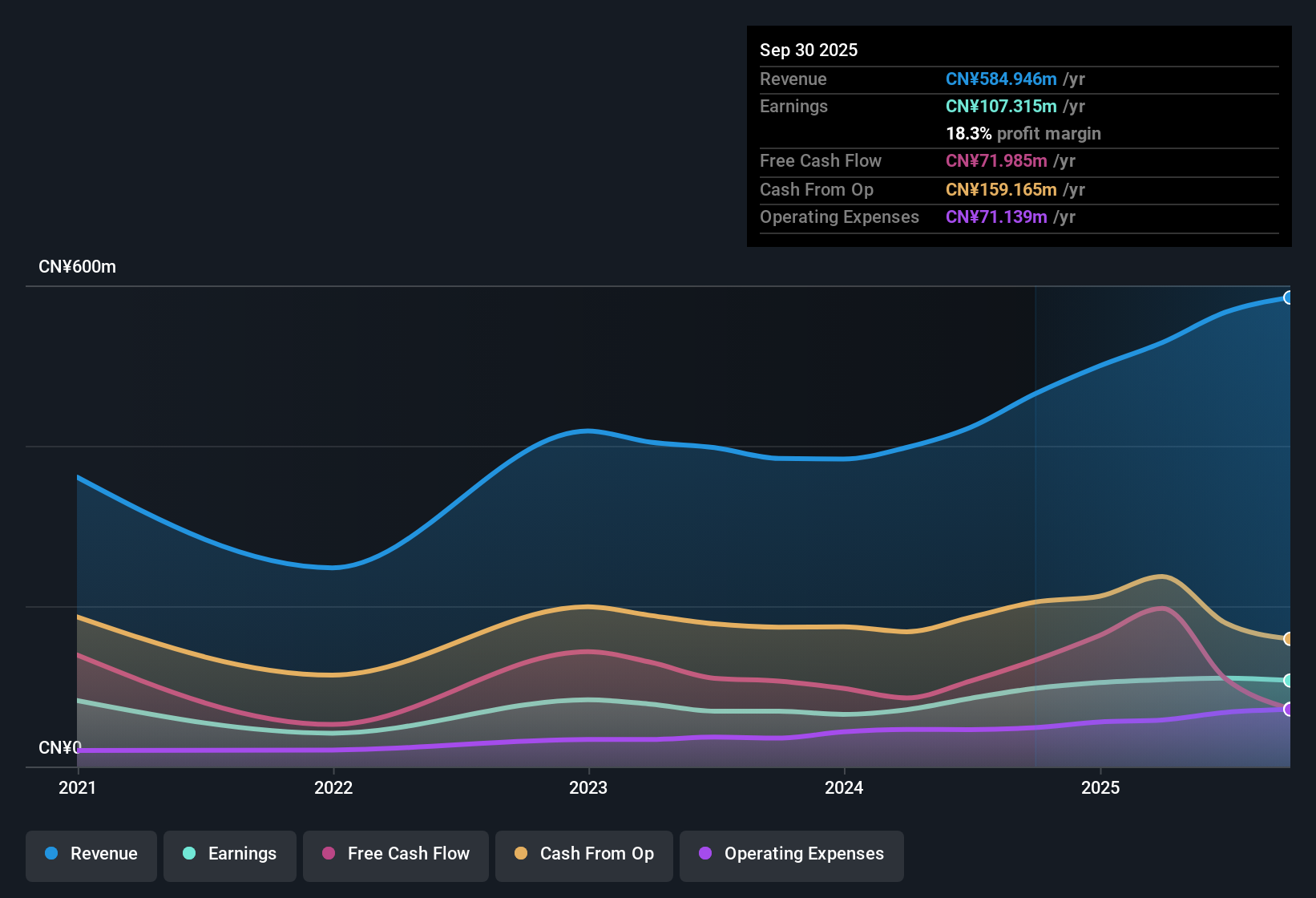

Persistence Resources Group (SEHK:2489) has just posted its Q3 2025 results, reporting revenue of 146.9 million CNY and basic EPS of 0.012714 CNY, with net income (excluding extraordinary items) at 25.4 million CNY for the quarter. The company has seen total revenue climb from 422.98 million CNY to 584.95 million CNY over the past year, while basic EPS moved from 0.048258 CNY to 0.053677 CNY. Margins remain a focal point for investors as the latest figures come alongside some signs of slowing profit momentum.

See our full analysis for Persistence Resources Group.Next, we will see how these latest numbers stand up against the prevailing stories and debates about Persistence Resources Group. The results may echo certain community narratives, while others could be challenged or reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Compression Below Historical Levels

- Net profit margin for the latest twelve months stands at 18.3%, dropping from 21% a year earlier, according to the most recent risk/reward summary.

- The prevailing market view highlights persistent earnings quality and profitability. However, this margin decline now challenges the idea that strong operating leverage will continue to insulate Persistence Resources Group from cost or pricing pressures.

- Profit grew at a 10.1% rate in the latest period, slower than the five-year average of 12.4%, confirming that momentum on margins is fading.

- The lower margin runs counter to the company's prior reputation for sustained high profitability, pushing investors to look closer at the evolving risk profile.

Dividend Coverage Puts Payout at Risk

- The reported 4.96% dividend yield is not well covered by earnings or free cash flow for the trailing 12 months, as explicitly noted in financial analysis and risk commentary.

- Market discussion stresses that a high payout offers income appeal. However, the uncovered dividend casts doubt on its durability and signals added caution for income-focused investors.

- Weak coverage is being flagged at the same time as shareholders have faced dilution and increased volatility, underscoring how payout sustainability is now intimately tied to recent financial shifts.

- Recent insider selling compounds the risk narrative, drawing attention to underlying pressures that bulls might otherwise downplay.

Premium Valuation Versus Sector and Peers

- Persistence Resources Group trades at a price-to-earnings ratio of 27 times, exceeding both the peer group average (26.1x) and the Hong Kong Metals and Mining industry (16.7x). The current share price of HK$1.33 is well above the DCF fair value of HK$0.34.

- This creates friction with more positive views. Supporters argue that high-quality profits justify a premium, yet the data reveals the current growth pace and margin profile are no longer as robust as when the stock first earned its higher multiple.

- Investors weighing rewards against risk need to consider that the stock not only trades at a sector premium but also at a premium to its own recent financial trends.

- Ongoing volatility and dilution, alongside slower earnings momentum, suggest caution might be warranted before assigning further valuation upside.

See how these premium valuation levels compare to the broader narrative on Persistence Resources Group in our detailed consensus breakdown. 📊 Read the full Persistence Resources Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Persistence Resources Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite previous profitability, Persistence Resources Group now faces uncovered dividends, margin compression, and a premium valuation. These factors raise sustainability concerns for investors.

If you want to sidestep these dividend sustainability issues, check out these 1922 dividend stocks with yields > 3% for stocks offering more reliable yields and better payout coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2489

Persistence Resources Group

An investment holding company, engages in the exploration, mining, processing, and sale of gold bullion in the People’s Republic of China.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026