We Ran A Stock Scan For Earnings Growth And China Treasures New Materials Group (HKG:2439) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China Treasures New Materials Group (HKG:2439). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is China Treasures New Materials Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years China Treasures New Materials Group grew its EPS by 4.7% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

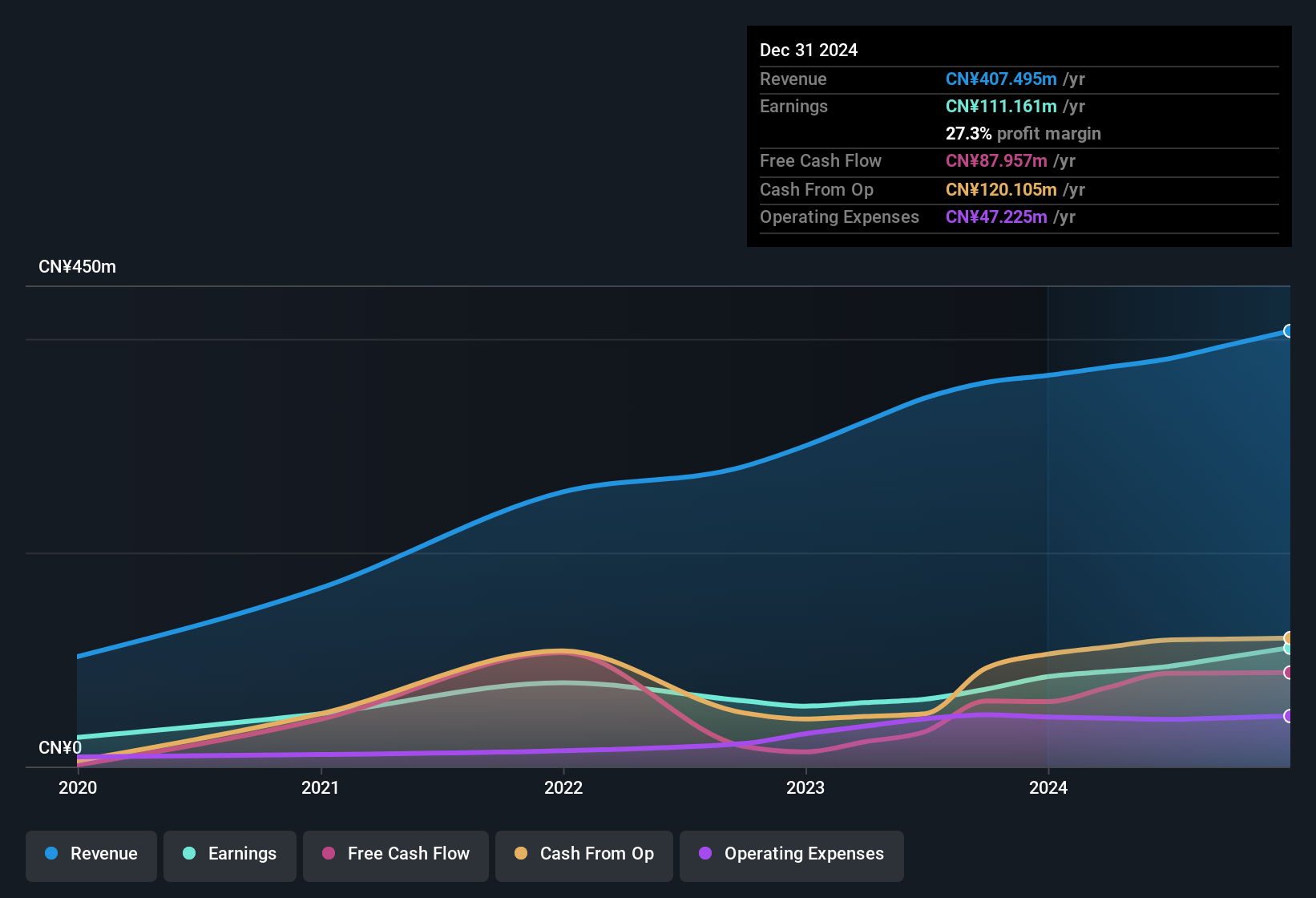

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note China Treasures New Materials Group achieved similar EBIT margins to last year, revenue grew by a solid 11% to CN¥407m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Check out our latest analysis for China Treasures New Materials Group

China Treasures New Materials Group isn't a huge company, given its market capitalisation of HK$325m. That makes it extra important to check on its balance sheet strength.

Are China Treasures New Materials Group Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that China Treasures New Materials Group insiders own a significant number of shares certainly is appealing. In fact, they own 52% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have CN¥170m invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to China Treasures New Materials Group, with market caps under CN¥1.4b is around CN¥1.7m.

The China Treasures New Materials Group CEO received CN¥953k in compensation for the year ending December 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is China Treasures New Materials Group Worth Keeping An Eye On?

As previously touched on, China Treasures New Materials Group is a growing business, which is encouraging. The growth of EPS may be the eye-catching headline for China Treasures New Materials Group, but there's more to bring joy for shareholders. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. Even so, be aware that China Treasures New Materials Group is showing 1 warning sign in our investment analysis , you should know about...

Although China Treasures New Materials Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2439

China Treasures New Materials Group

An investment holding company, develops, manufactures, and sells biodegradable plastic product bags in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives