As global markets navigate a period of volatility, with U.S. stocks experiencing a downturn amid concerns over AI spending and economic uncertainties, Asian markets have shown resilience, particularly in China where easing trade tensions have bolstered investor sentiment. In such an environment, growth companies with high insider ownership can be appealing as they often signal management's confidence in the business's long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| M31 Technology (TPEX:6643) | 26.3% | 101.9% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Let's dive into some prime choices out of the screener.

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited is an investment holding company that manufactures, distributes, and sells polymers, organic silicone, refrigerants, dichloromethane, liquid alkali, and other products both in the People's Republic of China and internationally with a market cap of HK$18.56 billion.

Operations: The company's revenue segments include CN¥6.21 billion from refrigerants, CN¥4.77 billion from organic silicon, CN¥3.73 billion from polymers, and CN¥1.25 billion from dichloromethane PVC and liquid alkali.

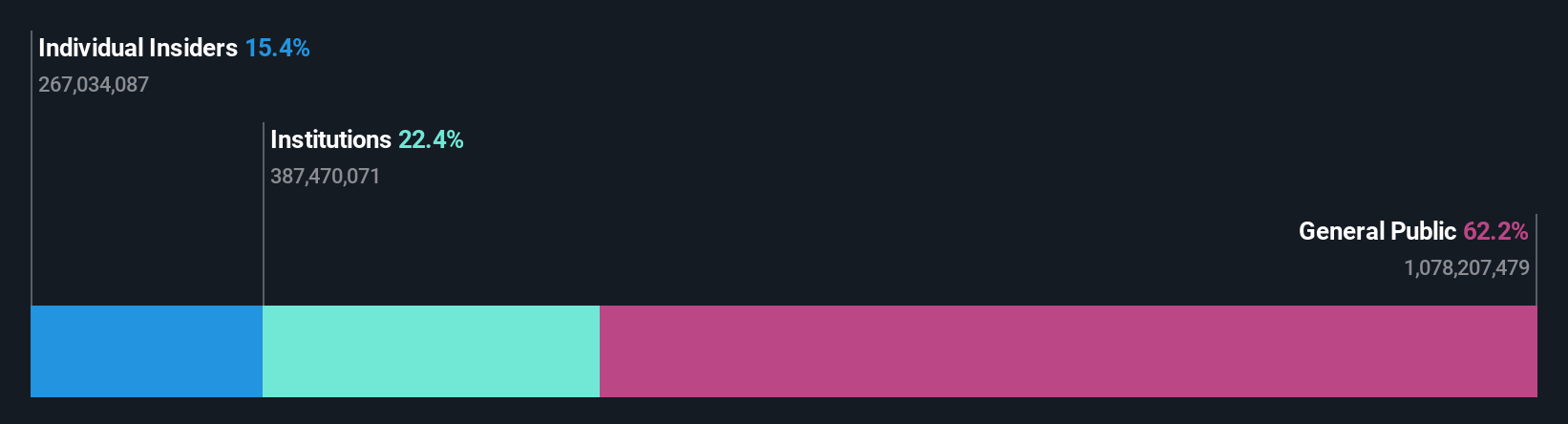

Insider Ownership: 15.4%

Earnings Growth Forecast: 26.6% p.a.

Dongyue Group's earnings are forecast to grow significantly, at 26.6% annually, outpacing the Hong Kong market's growth rate. Despite slower revenue growth at 12.7%, it remains above the market average of 8.4%. Recent financials show a substantial increase in net income to CNY 779.2 million for the half year ended June 2025, highlighting robust profitability with no recent insider trading activity reported. The stock trades significantly below its estimated fair value, presenting potential investment appeal.

- Unlock comprehensive insights into our analysis of Dongyue Group stock in this growth report.

- Our expertly prepared valuation report Dongyue Group implies its share price may be lower than expected.

West China Cement (SEHK:2233)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: West China Cement Limited is an investment holding company that manufactures and sells cement and cement products in various regions including the People’s Republic of China, Mozambique, Ethiopia, Democratic Republic of Congo, other African countries, and internationally with a market cap of HK$17.15 billion.

Operations: The company generates revenue from two main segments: CN¥5.98 billion from the People's Republic of China and CN¥4.19 billion from overseas markets.

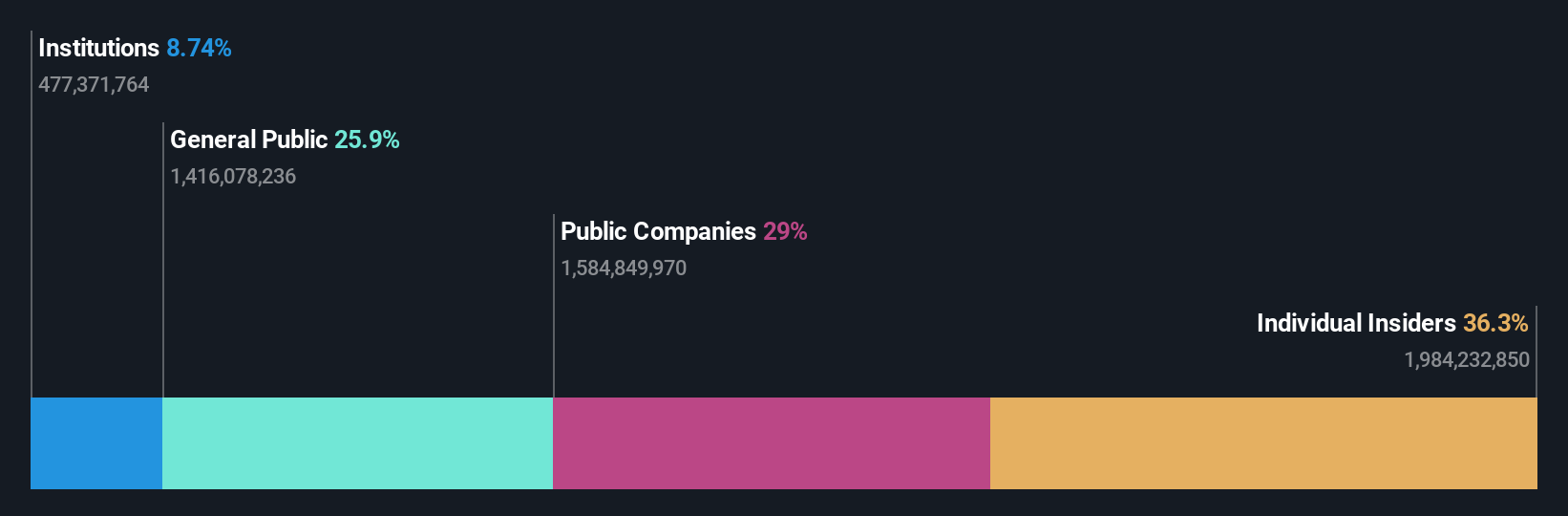

Insider Ownership: 36.3%

Earnings Growth Forecast: 29.9% p.a.

West China Cement's earnings are projected to grow significantly at 29.9% annually, surpassing the Hong Kong market's rate. Revenue is expected to rise by 16.1% annually, also outpacing the market average of 8.4%. Recent financial results show a notable increase in net income to CNY 748.26 million for H1 2025, indicating strong profitability despite low return on equity forecasts and debt concerns. The stock trades below its estimated fair value, enhancing its investment appeal without recent insider trading activity reported.

- Click here and access our complete growth analysis report to understand the dynamics of West China Cement.

- Our valuation report here indicates West China Cement may be undervalued.

Nanjing Leads Biolabs (SEHK:9887)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Leads Biolabs Co., Ltd. is a clinical-stage biotechnology company focused on the research, development, and commercialization of novel antibody drugs globally, with a market cap of approximately HK$11.63 billion.

Operations: Nanjing Leads Biolabs Co., Ltd. generates its revenue through the research, development, and commercialization of innovative antibody drugs on a global scale.

Insider Ownership: 15.3%

Earnings Growth Forecast: 57.9% p.a.

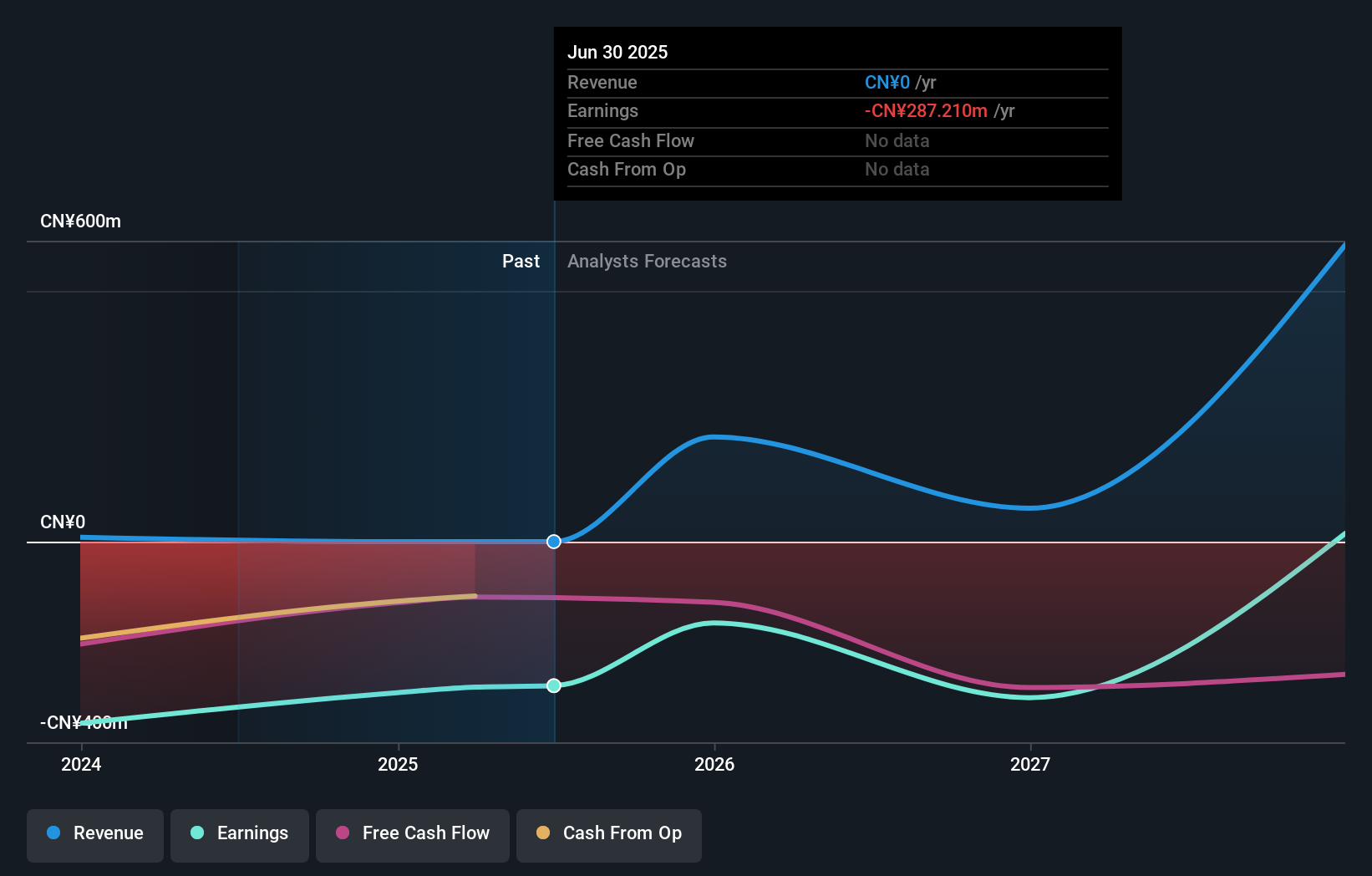

Nanjing Leads Biolabs, with significant insider ownership, is advancing its innovative pipeline, notably LBL-034 and LBL-076 for multiple myeloma. Recent product announcements highlight international recognition and potential market leadership in China. Despite low current revenue, the company's projected 64.3% annual revenue growth outpaces the Hong Kong market significantly. Analysts expect profitability within three years, indicating robust growth prospects despite a forecasted low return on equity of 18%.

- Take a closer look at Nanjing Leads Biolabs' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Nanjing Leads Biolabs' current price could be inflated.

Seize The Opportunity

- Click through to start exploring the rest of the 622 Fast Growing Asian Companies With High Insider Ownership now.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:189

Dongyue Group

An investment holding company, manufactures, distributes, and sells polymers, organic silicone, refrigerants, dichloromethane, liquid alkali, and other products in the People's Republic of China and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives