- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1208

Will MMG (SEHK:1208)'s Leadership Reshuffle Subtly Recast Its Governance And Risk Narrative?

Reviewed by Sasha Jovanovic

- MMG Limited recently reshaped its leadership structure, appointing Cao Liang as Chairman, expanding executive roles including a new COO, and formalising a refreshed board and committee line-up to align with updated corporate governance requirements.

- The creation of a Lead Independent Non-Executive Director role and elevation of regional presidents to the Executive Committee point to a stronger focus on board oversight and operational accountability across key assets such as Las Bambas and African operations.

- We’ll now examine how the appointment of Cao Liang as Chairman could influence MMG’s existing investment narrative and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

MMG Investment Narrative Recap

To stay invested in MMG, you need to be comfortable with a copper focused portfolio where Las Bambas remains central, while accepting exposure to community, political and project execution risks. The leadership reshuffle around Cao Liang as Chairman and the new governance structure does not immediately change the key short term catalyst, which still hinges on operational continuity at Las Bambas, or the biggest risk, which remains disruption from local unrest and infrastructure constraints.

The designation of a Lead Independent Non Executive Director and refreshed committee memberships directly ties into that risk reward balance, because stronger oversight can matter most where operations are concentrated in a few critical assets. With regional presidents for Las Bambas and Africa now on the Executive Committee, investors may focus on how clearly accountability for production, community relations and capital deployment is reflected in future disclosures and any updates around project timelines or cost outcomes.

Yet investors should also be aware that community tensions around Las Bambas could still...

Read the full narrative on MMG (it's free!)

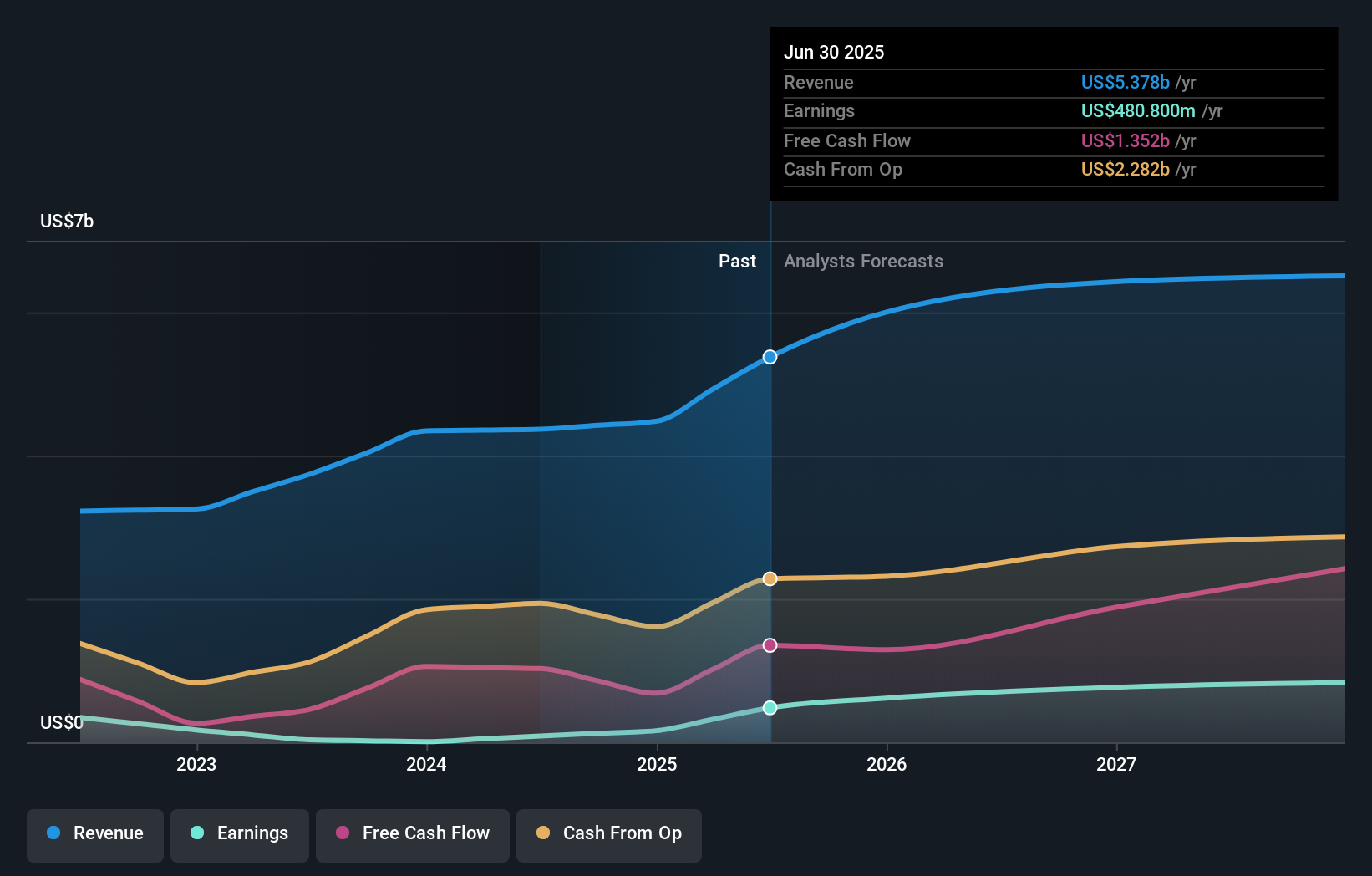

MMG's narrative projects $6.8 billion revenue and $833.1 million earnings by 2028. This requires 8.0% yearly revenue growth and an earnings increase of about $352 million from $480.8 million today.

Uncover how MMG's forecasts yield a HK$6.16 fair value, a 27% downside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member now pegs MMG’s fair value at HK$6.16, underscoring how differently individual investors can view the same business. Set that against the ongoing risk of social disruption around Las Bambas and you can see why it helps to compare several perspectives before deciding what MMG’s recent governance changes might mean for its future performance.

Explore another fair value estimate on MMG - why the stock might be worth as much as HK$6.16!

Build Your Own MMG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MMG research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MMG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MMG's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1208

MMG

An investment holding company, engages in the exploration, development, and mining of mineral properties.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026