- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1208

MMG Limited (SEHK:1208): Assessing Valuation Following Leadership Change and Board Oversight Updates

Reviewed by Simply Wall St

MMG (SEHK:1208) announced that Chairman and Non-Executive Director Mr. Xu Jiqing will step down on December 2, 2025. He will transition to a leadership role at China Minmetals Corporation.

See our latest analysis for MMG.

MMG’s leadership shake-up lands amid an impressive run, with its 90-day share price return standing at 65.6% and its total shareholder return for the year reaching 138.6%. Momentum has clearly accelerated as investors respond not only to the governance news but also to the company's recent growth moves and expansion plans. This has set a confident tone for both near- and long-term performance.

If these big moves have you looking to broaden your investing horizons, it’s an ideal moment to discover fast growing stocks with high insider ownership.

Yet with shares up sharply and the stock now trading above analyst targets, investors must consider whether MMG is undervalued based on fundamentals or if the market is already factoring in future growth potential.

Most Popular Narrative: 19.3% Overvalued

With MMG's last closing price sitting well above the narrative's fair value, the current optimism in the market merits a closer look at the assumptions analysts are making for the company's future.

Ongoing production expansions, including Las Bambas optimization, the ramp-up at Kinsevere, and the multi-year capacity expansion at Khoemacau (targeting 130kt by 2028), should drive meaningful volume growth and operating leverage, contributing to sustained top-line gains and improved margins.

Are these blockbuster growth projections enough to defend such a stretched valuation? This narrative is anchored on big increases in both scale and profitability, but the exact drivers behind those bold forecasts might surprise you. Wondering what makes analysts believe in this future? The full narrative reveals numbers and logic that could remake your view of MMG’s potential.

Result: Fair Value of $5.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational setbacks at Las Bambas or ongoing cost pressures could quickly challenge even the most optimistic growth scenario for MMG.

Find out about the key risks to this MMG narrative.

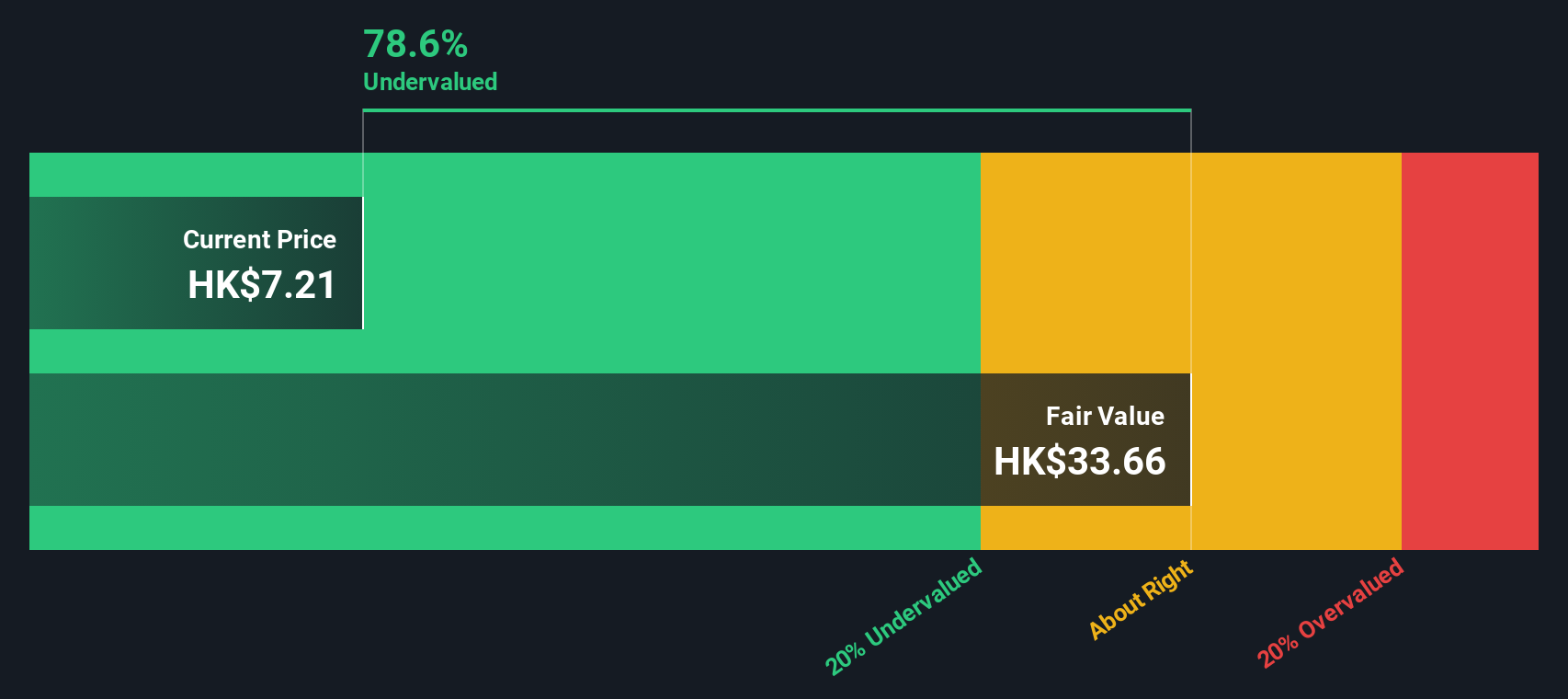

Another View: SWS DCF Model Says MMG Is Deeply Undervalued

While the current narrative says MMG is overvalued based on its price relative to analyst targets, our DCF model presents a contrasting perspective. According to the SWS DCF model, MMG is actually trading well below its estimated fair value. This suggests the market could be overlooking some long-term upside. Why is there such a sharp disconnect between what analysts see and what the discounted cash flows indicate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MMG Narrative

If you see the story differently or want to dig into the numbers your own way, shaping your personal outlook is quick and simple. Do it your way.

A great starting point for your MMG research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

You’re missing out if you stop here. Make your next move by tapping into unique opportunities from some of the most dynamic corners of the market.

- Tap into strong income potential and secure your portfolio with the help of these 16 dividend stocks with yields > 3%, offering yields above 3%.

- Stay ahead as artificial intelligence reshapes industries by checking out these 25 AI penny stocks, poised for innovation-driven growth.

- Seize value by targeting companies that may trade under their true worth, all highlighted through these 884 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1208

MMG

An investment holding company, engages in the exploration, development, and mining of mineral properties.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives