- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1053

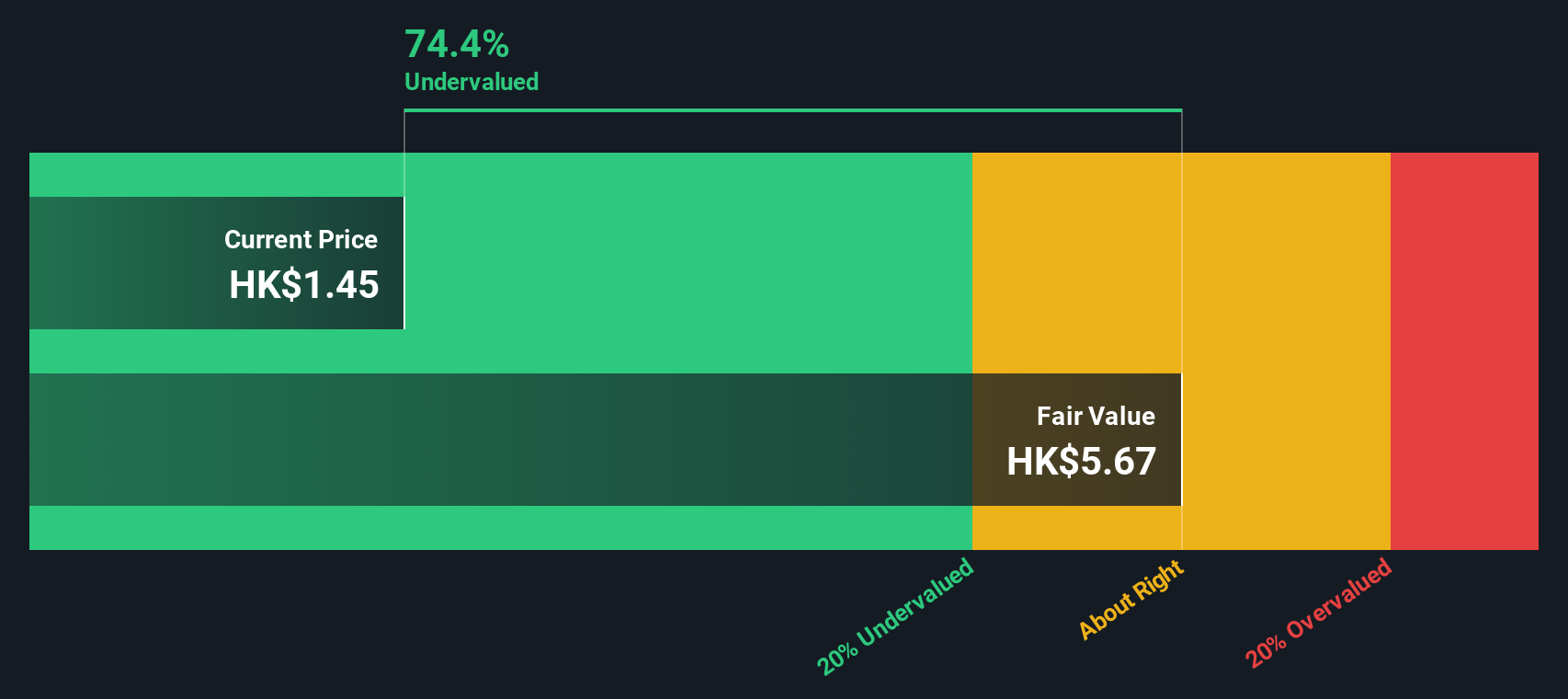

Is Chongqing Iron & Steel (SEHK:1053) Still Undervalued After a Steady Rally?

Reviewed by Simply Wall St

If you have been watching Chongqing Iron & Steel (SEHK:1053) lately, you may have noticed that the stock’s recent moves have turned a few heads, even without a big event hitting the headlines. As attention drifts toward the company, some investors might be wondering if there is an underlying signal or just routine market noise. In situations like this, shifts in price can prompt a fresh look at what the current valuation might mean for those deciding whether to stay on the sidelines or get involved.

Over the past year, Chongqing Iron & Steel’s share price has more than doubled, and momentum has clearly built up over the past quarter as well. While there are no headline-grabbing events to explain this surge, the fact remains that, after a dip last month, the stock’s long-term trend is still strong. This pattern of swings could be driving new questions about risk and reward as the company navigates changing market sentiment.

With this year’s rally in mind, is Chongqing Iron & Steel trading at a discount, or is the market already baking in optimism for future growth?

Price-to-Sales Ratio of 0.4x: Is it justified?

Based on the Price-to-Sales (P/S) ratio, Chongqing Iron & Steel appears undervalued when compared to its industry peers. The company currently trades at a P/S ratio of 0.4x, which is noticeably lower than both the Hong Kong Metals and Mining industry average of 0.9x and the peer average of 1.2x.

The Price-to-Sales ratio measures how much investors are willing to pay for each dollar of revenue. In the steel and mining sector, this multiple offers a useful benchmark, especially when earnings are negative or volatile. This is currently the case for Chongqing Iron & Steel.

This significant discount suggests the market is being especially cautious about the company’s future potential. It may reflect concerns about profitability despite anticipated revenue growth. For value-focused investors, this could present an appealing entry point if the company can deliver on its turnaround expectations.

Result: Fair Value of HK$2.11 (UNDERVALUED)

See our latest analysis for Chongqing Iron & Steel.However, ongoing losses and only minimal revenue growth remain notable risks. These factors could dampen sentiment and reverse the current positive trend.

Find out about the key risks to this Chongqing Iron & Steel narrative.Another View: What Does the SWS DCF Model Say?

While market multiples suggest Chongqing Iron & Steel is attractively valued, the SWS DCF model arrives at a similar conclusion and supports the idea that the stock remains undervalued. Could both methods be picking up on the same opportunity, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Chongqing Iron & Steel Narrative

If you are curious to reach your own conclusion or want to take a hands-on approach with the data, it is easy to explore alternative perspectives in just a few minutes. Do it your way

A great starting point for your Chongqing Iron & Steel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to find winning stocks. Discover market-changing opportunities using our handpicked screeners and give your portfolio a boost today.

- Accelerate your search for high potential picks by targeting penny stocks with strong financials through our penny stocks with strong financials.

- Kickstart your hunt for tomorrow’s leaders by focusing on AI trends shaping the market using our AI penny stocks.

- Boost your income strategy by seeking out dividend stocks with yields greater than 3% thanks to our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1053

Chongqing Iron & Steel

Engages in the production and sale of steel plates in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives