FWD Group Holdings (SEHK:1828): Evaluating Valuation After Strong Share Price Momentum

Reviewed by Simply Wall St

FWD Group Holdings (SEHK:1828) has steadily climbed the “emerging stocks to watch” lists, and recent moves in the share price are catching investor attention. Although there hasn't been a specific market-shaking announcement, the uptick in momentum over the past month signals that the company is not flying under the radar anymore. With solid revenue growth reported and the market taking notice, investors are starting to ask if the current buzz reflects something deeper in FWD’s outlook.

Over the past month, shares of FWD Group Holdings have jumped 24%, delivering significantly stronger performance than many financial sector peers. That momentum has been building throughout the year as well, with the stock up 23%. Despite the lack of a single major news catalyst, this sustained upward trend hints at changing perceptions of FWD’s growth potential. Investors are likely responding to the company’s reported annual revenue expansion of 23% and the positive sentiment building around its strategic positioning in the insurance industry.

That naturally raises the big question: Is the market currently undervaluing FWD Group Holdings, or has this recent surge already factored in its future growth prospects?

Price-to-Earnings of 84.2x: Is it justified?

FWD Group Holdings is currently trading at a Price-to-Earnings (P/E) ratio of 84.2, which is significantly higher than the average P/E ratio of 11.7 for companies in the Asian Insurance industry.

The P/E ratio is a widely used metric that compares a company's share price to its earnings per share. This helps investors gauge how much they are paying for a dollar of current earnings. In the insurance sector, a lower P/E often signals stronger value unless justified by exceptional growth or profitability forecasts.

With FWD's current multiple far exceeding both industry and peer averages, the market may be pricing in very optimistic future earnings growth. However, given the company's recent transition to profitability, it remains uncertain whether such a premium is warranted based on the available data.

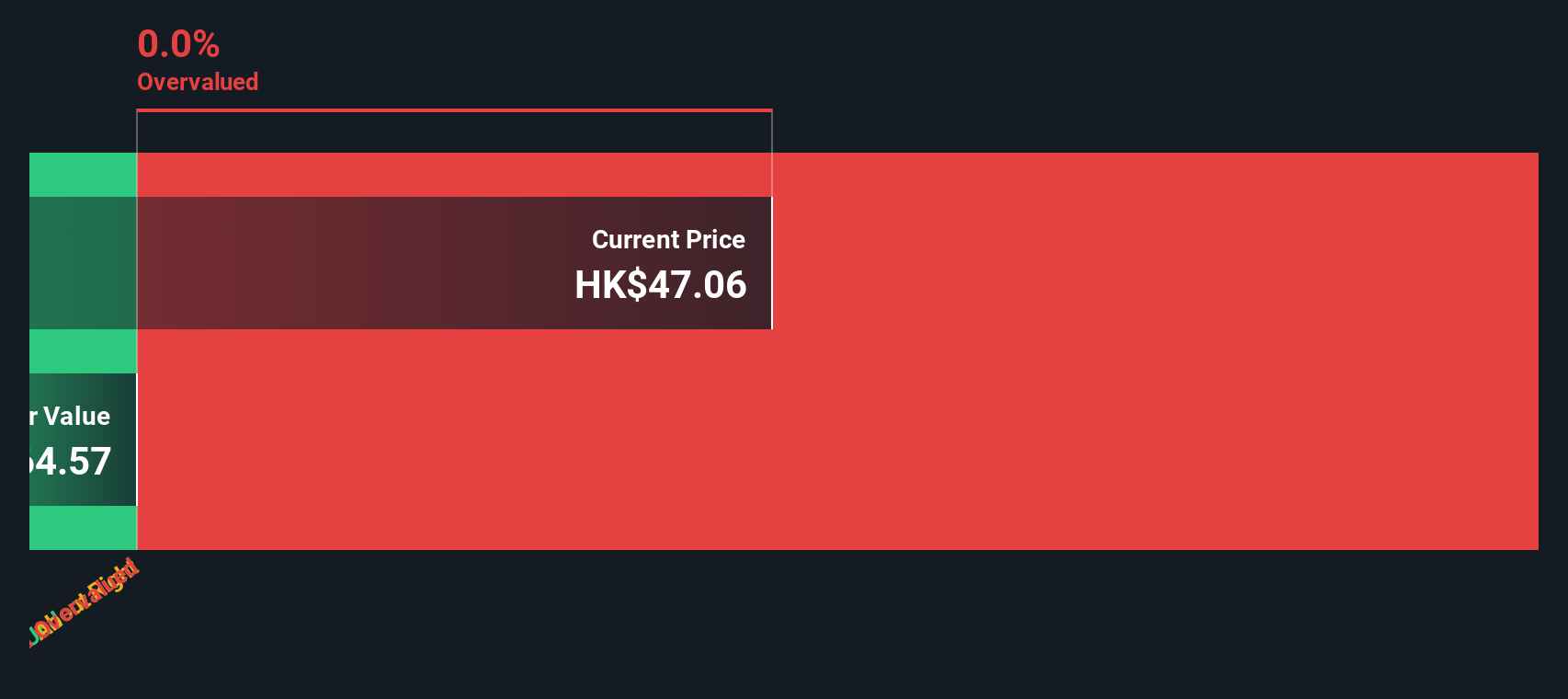

Result: Fair Value of $47.05 (OVERVALUED)

See our latest analysis for FWD Group Holdings.However, slower-than-expected profitability or sudden shifts in the broader insurance sector could quickly change sentiment around FWD Group Holdings’s valuation story.

Find out about the key risks to this FWD Group Holdings narrative.Another View: What Does the SWS DCF Model Say?

The SWS DCF model offers a very different perspective, as it is unable to calculate a fair value for FWD Group Holdings at this time because of insufficient data. This situation highlights the uncertainty involved in valuing the company based solely on its recent profitability and rapid changes. Does this lack of clarity from the DCF model affect the confidence investors have placed in traditional multiples?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FWD Group Holdings Narrative

If these findings don’t quite align with your perspective or you’d rather take a hands-on approach, you can put together your own analysis of FWD Group Holdings in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding FWD Group Holdings.

Ready for Even More Powerful Investment Ideas?

If you want to give your portfolio an extra edge, don’t miss the specialized strategies available through Simply Wall Street’s screener tools. These handpicked pathways make it easy to spot opportunities others are overlooking. Let’s make your next move count.

- Grow your wealth with steady income streams by tapping into dividend stocks with yields > 3% offering particularly high yields above 3%.

- Uncover the innovators shaping tomorrow’s medicine through healthcare AI stocks in artificial intelligence for healthcare advancements.

- Catch early-stage companies with robust financials that could spark your portfolio’s growth spurt with our penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1828

FWD Group Holdings

Through its subsidiaries, underwrites insurance products in Hong Kong and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives