How Investors Are Reacting To China Reinsurance (SEHK:1508) Overhaul of Corporate Governance Structure

Reviewed by Sasha Jovanovic

- China Reinsurance (Group) Corporation recently held a board meeting approving substantial amendments to its Articles of Association, driven by changes in Chinese company law and regulatory requirements, including the planned removal of its board of supervisors and updates to compliance and shareholder governance.

- This restructuring signals a shift in corporate governance, as oversight functions will transition from the board of supervisors to the audit committee, potentially impacting accountability and risk management frameworks moving forward.

- We'll explore how this major overhaul in internal governance could reshape China Reinsurance (Group)'s investment narrative and long-term operational approach.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

China Reinsurance (Group) Investment Narrative Recap

To be a shareholder in China Reinsurance (Group), you need to believe in the company’s capacity to adapt its governance, product innovation, and global expansion to manage competition and evolving regulatory frameworks. The board-approved amendments to the Articles of Association, though significant internally, are not expected to materially alter the immediate catalysts or risks, especially those tied to market competitiveness and investment returns in the near term.

Among recent developments, the scheduled extraordinary general meeting on November 28, 2025 stands out, as it is where shareholders will vote on the proposed amendments to the Articles of Association. This meeting, which requires shareholders to confirm their registrations ahead of the register closure, underscores the company’s focus on compliance and governance transparency, key components aligning with market catalysts like digital transformation and regulatory clarity.

By contrast, oversight changes moving to the audit committee introduce an area investors should be aware of in terms of...

Read the full narrative on China Reinsurance (Group) (it's free!)

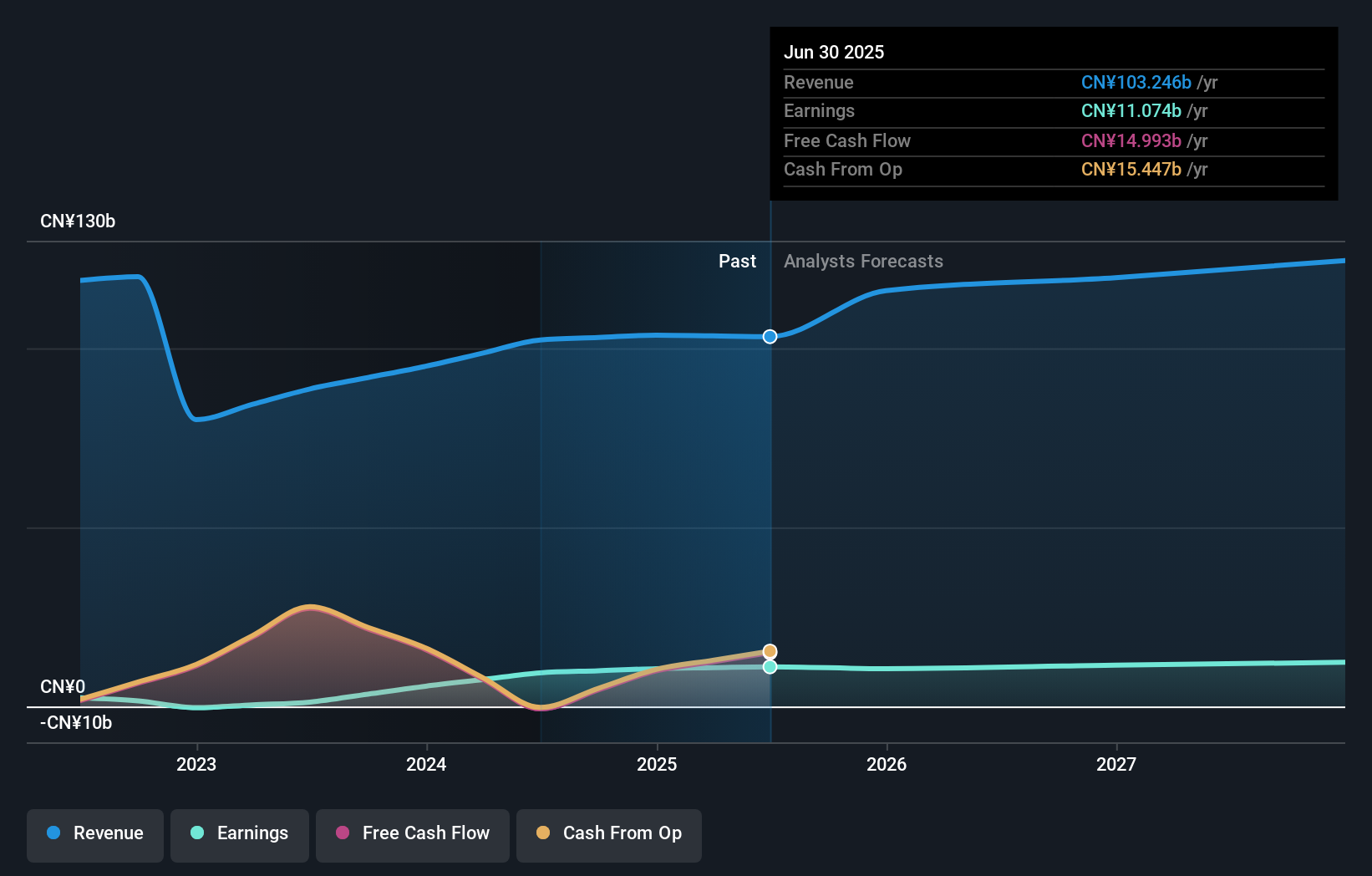

China Reinsurance (Group) is projected to reach CN¥114.7 billion in revenue and CN¥11.8 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 3.4%, with earnings rising by CN¥1.2 billion from the current CN¥10.6 billion.

Uncover how China Reinsurance (Group)'s forecasts yield a HK$1.69 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 1 fair value estimate for China Reinsurance (Group), clustering at HK$1.69. With the latest governance overhaul, your view on risk management could shape a unique outlook compared to others, so it’s worth exploring these diverse perspectives further.

Explore another fair value estimate on China Reinsurance (Group) - why the stock might be worth as much as HK$1.69!

Build Your Own China Reinsurance (Group) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Reinsurance (Group) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Reinsurance (Group) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Reinsurance (Group)'s overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1508

China Reinsurance (Group)

Operates as a reinsurance company in the People's Republic of China and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives