- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1066

What Shandong Weigao Group Medical Polymer (SEHK:1066)'s Third Quarter Revenue Growth Means For Shareholders

Reviewed by Sasha Jovanovic

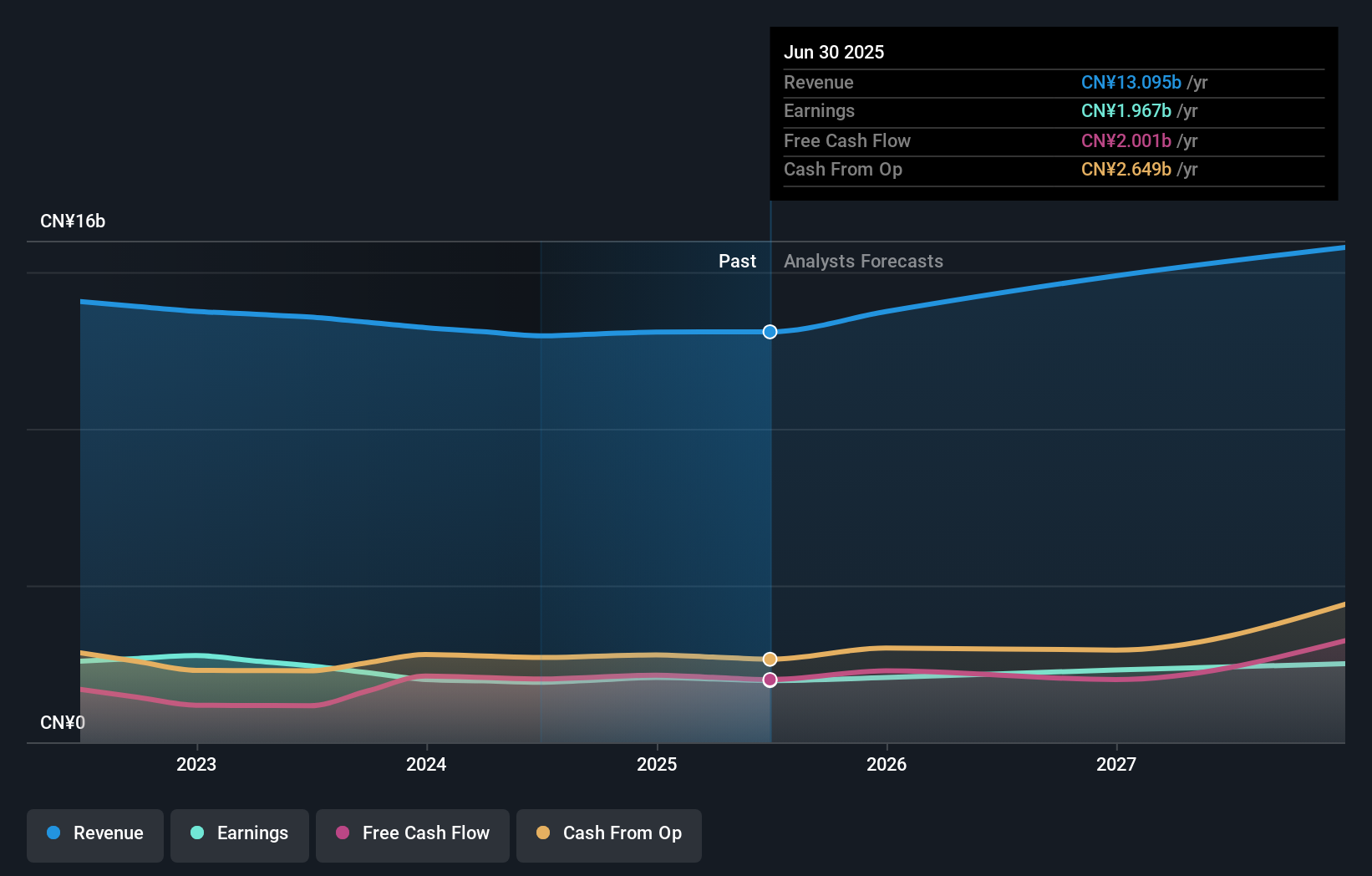

- Shandong Weigao Group Medical Polymer Company Limited announced on November 3, 2025, that unaudited third quarter revenue reached approximately RMB 3.26 billion, a 2.6% year-on-year increase.

- This steady revenue growth offers an up-to-date indicator of market demand for the company's medical device portfolio across China and beyond.

- We'll explore how this sustained sales momentum contributes to Shandong Weigao Group Medical Polymer's investment narrative and operational outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Shandong Weigao Group Medical Polymer's Investment Narrative?

For anyone following Shandong Weigao Group Medical Polymer, the latest third quarter revenue update suggests some stabilization after a period of flattish growth and margin compression. The modest 2.6% year-on-year revenue increase, arriving just after ongoing board changes and renewed share buybacks, could help stabilize sentiment in the near term. That said, recent price moves and the subdued scale of revenue growth imply the news is unlikely to alter the core short-term catalysts: investors are still watching for signs of margin improvement, profit growth reacceleration, or material outperformance of the broader industry. Risks remain in consistently low return on equity and an uneven earnings track record, which are key points in current market debate. For now, the sales uptick offers an incremental positive, but those looking for a clear inflection in business momentum will want to see more than a single quarter’s progress.

But beneath the headline, boardroom changes add a risk investors should be aware of. Shandong Weigao Group Medical Polymer's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Shandong Weigao Group Medical Polymer - why the stock might be worth over 3x more than the current price!

Build Your Own Shandong Weigao Group Medical Polymer Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shandong Weigao Group Medical Polymer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shandong Weigao Group Medical Polymer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shandong Weigao Group Medical Polymer's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1066

Shandong Weigao Group Medical Polymer

Engages in the research and development, production, wholesale, and sale of medical devices in the People’s Republic of China and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives