Asian Market Picks: 3 Stocks That Might Be Trading Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the Asian markets navigate a landscape marked by easing U.S.-China trade tensions and a cautiously optimistic outlook, investors are increasingly on the lookout for opportunities that might be trading below their intrinsic value estimates. In this environment, identifying stocks with strong fundamentals and potential for growth can provide a strategic advantage in building a resilient portfolio.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet Tianlu (SHSE:600326) | CN¥12.27 | CN¥24.20 | 49.3% |

| TESEC (TSE:6337) | ¥2080.00 | ¥4120.70 | 49.5% |

| SRE Holdings (TSE:2980) | ¥3105.00 | ¥6199.50 | 49.9% |

| Nichicon (TSE:6996) | ¥1294.00 | ¥2571.20 | 49.7% |

| Mobvista (SEHK:1860) | HK$18.86 | HK$37.71 | 50% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥9.99 | CN¥19.92 | 49.9% |

| Japan Eyewear Holdings (TSE:5889) | ¥2083.00 | ¥4123.84 | 49.5% |

| Genesem (KOSDAQ:A217190) | ₩9350.00 | ₩18449.44 | 49.3% |

| Food Empire Holdings (SGX:F03) | SGD2.57 | SGD5.06 | 49.2% |

| EverProX Technologies (SZSE:300548) | CN¥95.52 | CN¥187.65 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

Beijing Fourth Paradigm Technology (SEHK:6682)

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of HK$27.53 billion.

Operations: The company's revenue segments include CN¥505.70 million from Sagegpt Aigs Services, CN¥4.57 billion from the 4ParadigmSage AI Platform, and CN¥940.30 million from Shift Intelligent Solutions.

Estimated Discount To Fair Value: 13.6%

Beijing Fourth Paradigm Technology, trading at HK$53.05, is undervalued with a fair value estimate of HK$61.38. Analysts project significant revenue growth of 26.7% annually, surpassing the Hong Kong market's average growth rate. Despite a current net loss, earnings are improving and expected to grow over 110% per year as profitability is anticipated within three years. A strategic alliance with Solowin Holdings aims to enhance compliance solutions in blockchain technology, potentially boosting future cash flows and valuation prospects.

- Our comprehensive growth report raises the possibility that Beijing Fourth Paradigm Technology is poised for substantial financial growth.

- Take a closer look at Beijing Fourth Paradigm Technology's balance sheet health here in our report.

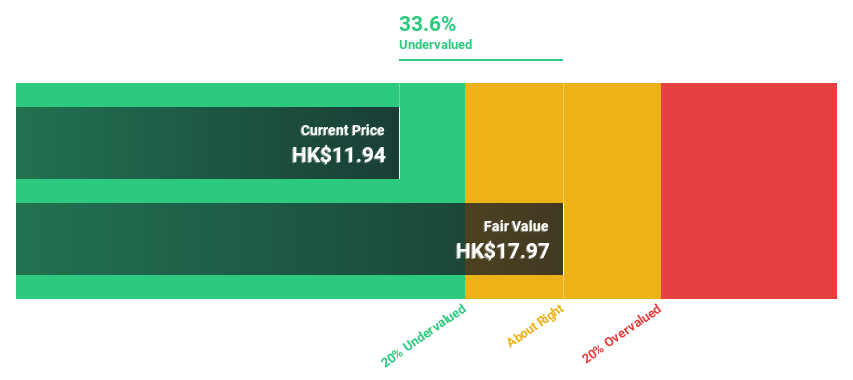

Smoore International Holdings (SEHK:6969)

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market cap of HK$80.89 billion.

Operations: Smoore International Holdings Limited generates revenue from its vaping technology solutions.

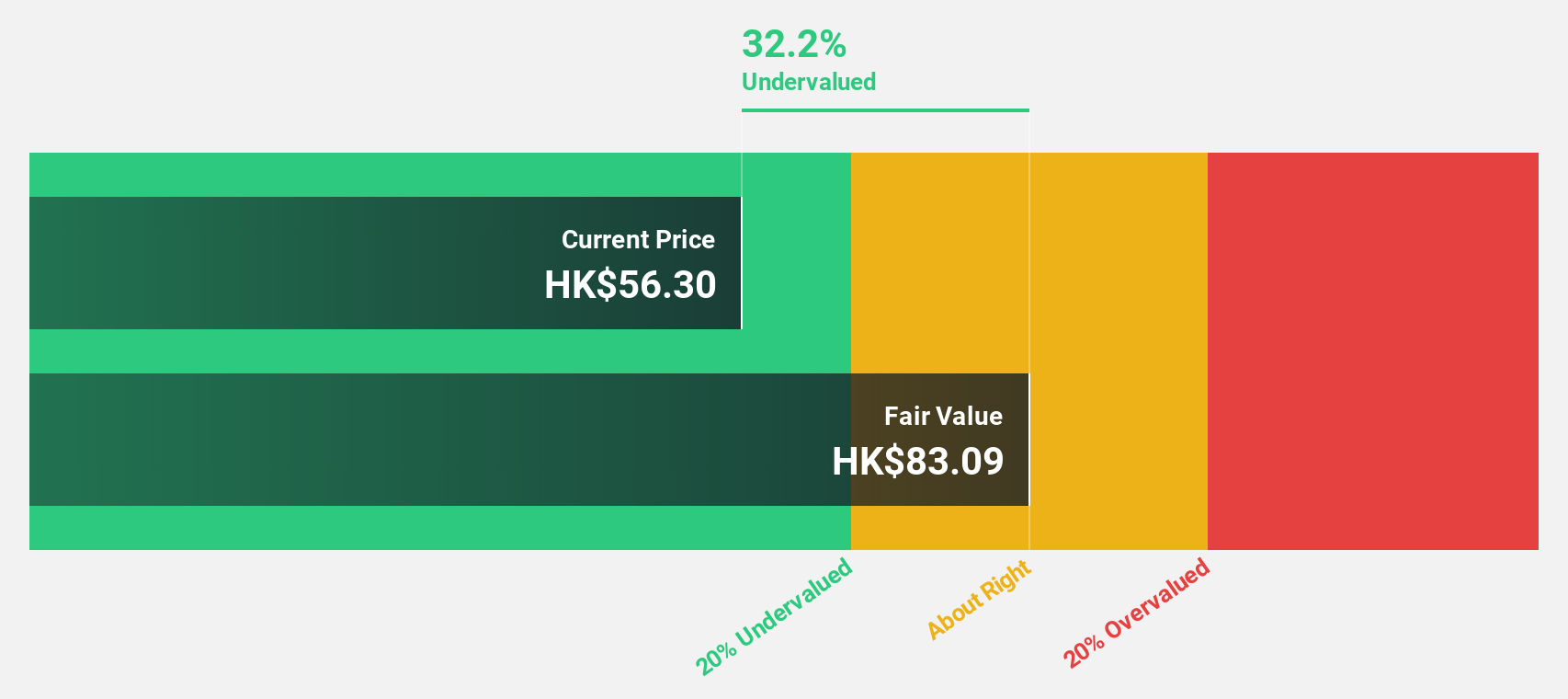

Estimated Discount To Fair Value: 38%

Smoore International Holdings, trading at HK$13.06, is undervalued with an estimated fair value of HK$21.06. Despite a decline in profit margins from 13.1% to 7.7%, earnings are forecast to grow significantly at 37.6% annually, outpacing the Hong Kong market's average growth rate of 11.7%. Recent third-quarter results show increased sales but decreased net income year-on-year, highlighting operational challenges amidst strong revenue growth projections of 13.9% per annum.

- Upon reviewing our latest growth report, Smoore International Holdings' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Smoore International Holdings stock in this financial health report.

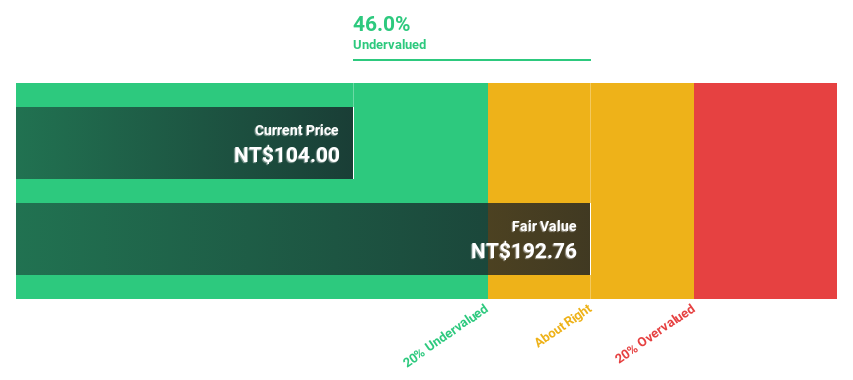

Kinsus Interconnect Technology (TWSE:3189)

Overview: Kinsus Interconnect Technology Corp., along with its subsidiaries, manufactures and sells electronic products both in Taiwan and internationally, with a market cap of NT$65.97 billion.

Operations: Kinsus Interconnect Technology Corp.'s revenue is derived from the manufacturing and sale of electronic products, serving both domestic and international markets.

Estimated Discount To Fair Value: 23.8%

Kinsus Interconnect Technology, trading at NT$144.5, is undervalued with a fair value estimate of NT$189.58. The company's earnings are projected to grow significantly at over 60% annually, surpassing the Taiwan market's average growth rate. Despite recent share price volatility, Kinsus reported strong third-quarter results with sales rising to TWD 10.36 billion from TWD 8.2 billion year-on-year and net income increasing to TWD 339 million from TWD 185 million, reflecting robust financial performance amidst growth expectations.

- Our earnings growth report unveils the potential for significant increases in Kinsus Interconnect Technology's future results.

- Click here to discover the nuances of Kinsus Interconnect Technology with our detailed financial health report.

Taking Advantage

- Navigate through the entire inventory of 289 Undervalued Asian Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fourth Paradigm Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

High growth potential and good value.

Market Insights

Community Narratives