Should New Board Appointments Signal a Shift in Leadership Strategy for China Resources Beer (SEHK:291)?

Reviewed by Sasha Jovanovic

- China Resources Beer (Holdings) announced key board appointments on November 18, 2025, including Mr. Xu Lin and Ms. Yang Hongxia as executive directors, and Ms. Hon Wai Man Samantha as an independent non-executive director.

- Their combined backgrounds in finance, operations, and investment banking may be viewed as bolstering leadership strength and corporate governance at the company.

- We'll explore how these leadership changes, notably the addition of a director with significant financial expertise, may shape China Resources Beer's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is China Resources Beer (Holdings)'s Investment Narrative?

Shareholders in China Resources Beer (Holdings) tend to focus on stable earnings and the potential for modest revenue growth in an industry where steady demand often underpins long-term performance. The company's recent appointments, specifically the addition of a CFO with deep finance experience and a director with an extensive investment banking background, speak to efforts to strengthen both internal controls and external corporate governance. These moves could help address concerns about the relatively inexperienced management and board teams flagged in earlier analysis, possibly boosting short-term confidence during a period of higher board turnover. However, given that underlying profit growth and revenue forecasts remain unchanged and recent price movements have not shown strong reactions, these appointments may not materially shift the key risks or catalysts in the immediate term. Still, investors should monitor how these changes influence board effectiveness and future earnings reliability. In contrast, board turnover and its impact may be an issue to watch going forward.

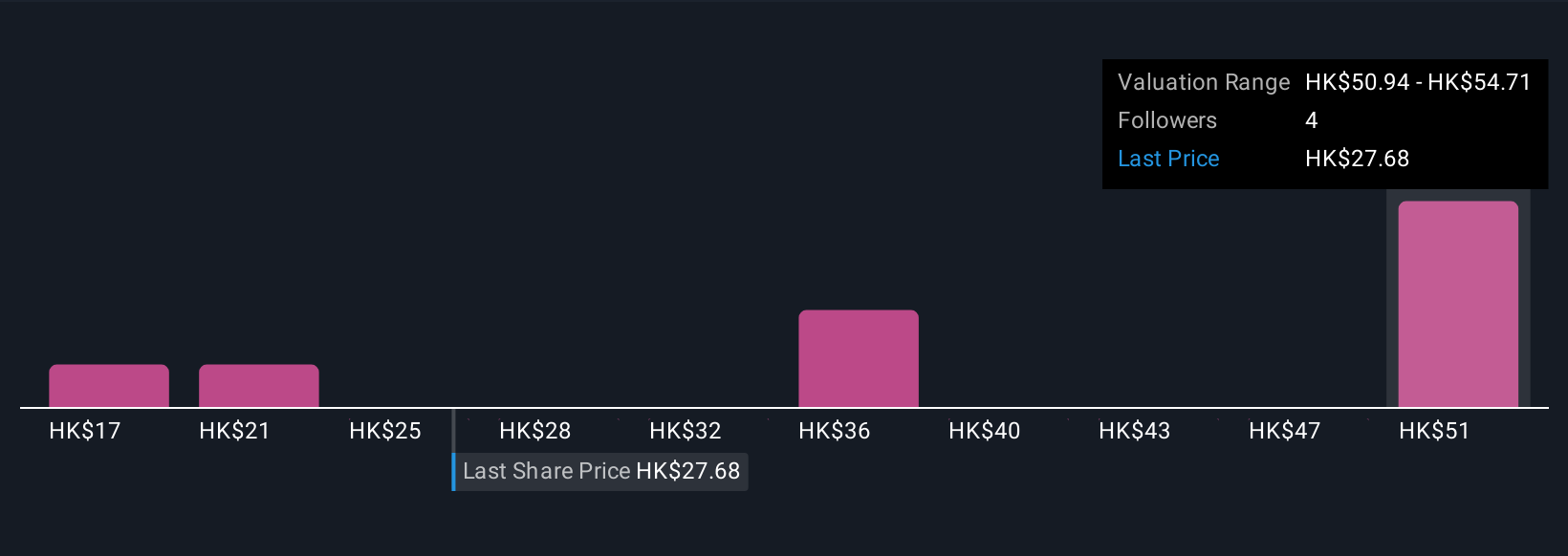

China Resources Beer (Holdings)'s shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on China Resources Beer (Holdings) - why the stock might be worth as much as 98% more than the current price!

Build Your Own China Resources Beer (Holdings) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Resources Beer (Holdings) research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Resources Beer (Holdings) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Resources Beer (Holdings)'s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:291

China Resources Beer (Holdings)

An investment holding company, manufactures, distributes, and sells alcoholic beverages in Mainland China.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026