Why Is Dekon Food and Agriculture Group (SEHK:2419) Seeking H Share Conversion Amid Shifting Pork Market Trends?

Reviewed by Sasha Jovanovic

- Dekon Food and Agriculture Group recently announced plans to convert its domestic shares into H shares, subject to regulatory approval from the China Securities Regulatory Commission and the Hong Kong Stock Exchange.

- The company also reported an increase in pig sales volume for October 2025, even as average selling prices for market hogs declined, providing insights into ongoing trends in the agriculture sector.

- We'll explore how the move to improve share liquidity through H share conversion is shaping Dekon's investment thesis.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Dekon Food and Agriculture Group's Investment Narrative?

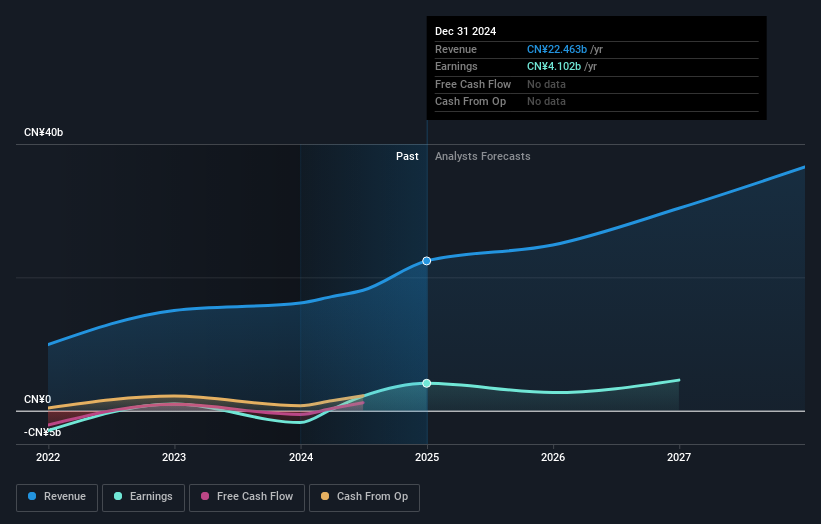

For shareholders in Dekon Food and Agriculture Group, the big picture rests on confidence in the company's ability to balance fast-moving operational trends with recent strategic initiatives. The headline news of converting domestic shares into H shares, if approved, could meaningfully boost share liquidity and market access, potentially supporting Dekon's position in Hong Kong’s food sector. This could bring short term catalysts into sharper focus, particularly around valuation and trading volumes, especially since recent returns show both sharp growth and notable volatility. At the same time, the reported rise in pig sales volumes for October 2025, despite falling hog and poultry prices, highlights ongoing margin pressure, a key risk that has weighed on recent earnings. Taken together, these developments may shift attention from governance or dividend policy to how Dekon manages price cycles and seizes new market opportunities. Yet even with improved liquidity, swings in commodity prices remain a crucial risk for investors to consider.

Dekon Food and Agriculture Group's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Dekon Food and Agriculture Group - why the stock might be worth just HK$119.13!

Build Your Own Dekon Food and Agriculture Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dekon Food and Agriculture Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Dekon Food and Agriculture Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dekon Food and Agriculture Group's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2419

Dekon Food and Agriculture Group

Engages in the livestock and poultry breeding and farming businesses.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives