Are Poor Financial Prospects Dragging Down Budweiser Brewing Company APAC Limited (HKG:1876 Stock?

Budweiser Brewing Company APAC (HKG:1876) has had a rough three months with its share price down 8.2%. We decided to study the company's financials to determine if the downtrend will continue as the long-term performance of a company usually dictates market outcomes. In this article, we decided to focus on Budweiser Brewing Company APAC's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Budweiser Brewing Company APAC is:

5.9% = US$609m ÷ US$10b (Based on the trailing twelve months to September 2025).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.06.

Check out our latest analysis for Budweiser Brewing Company APAC

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Budweiser Brewing Company APAC's Earnings Growth And 5.9% ROE

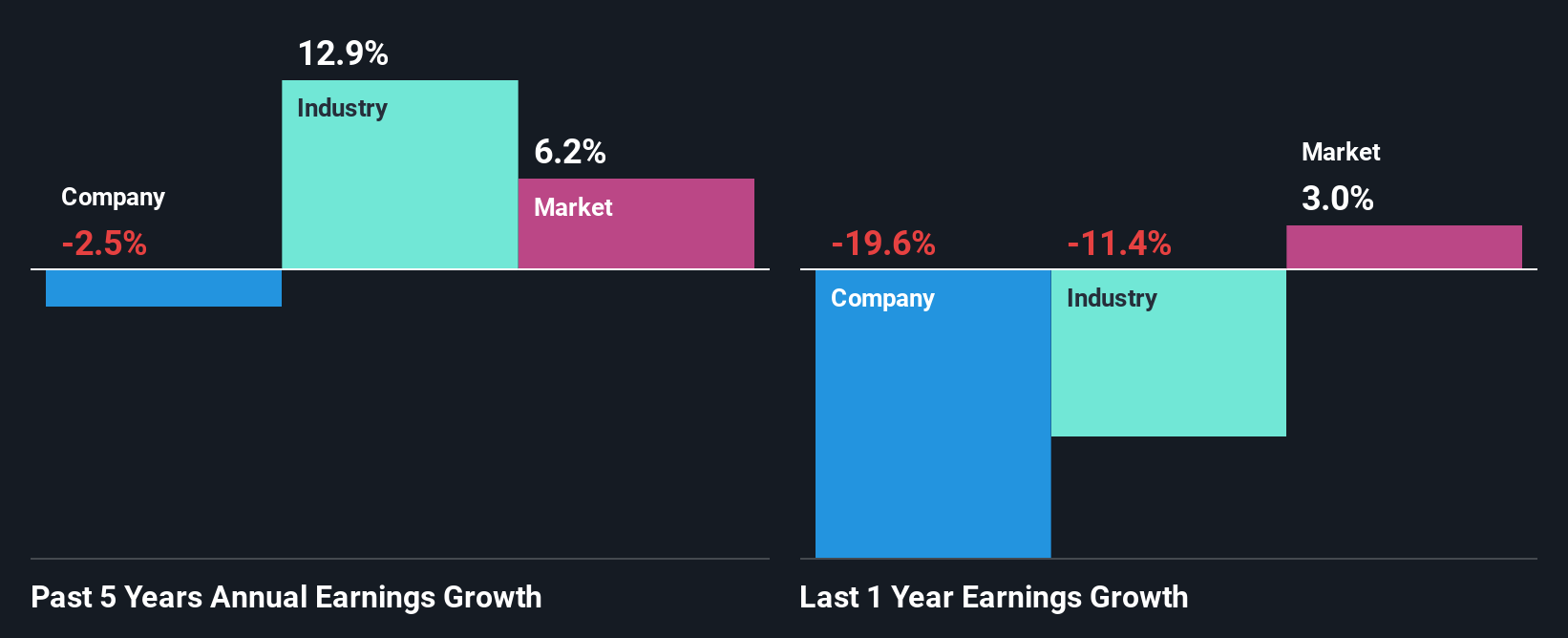

On the face of it, Budweiser Brewing Company APAC's ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 12% either. Given the circumstances, the significant decline in net income by 2.5% seen by Budweiser Brewing Company APAC over the last five years is not surprising. However, there could also be other factors causing the earnings to decline. Such as - low earnings retention or poor allocation of capital.

So, as a next step, we compared Budweiser Brewing Company APAC's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 13% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Budweiser Brewing Company APAC's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Budweiser Brewing Company APAC Making Efficient Use Of Its Profits?

Budweiser Brewing Company APAC has a high three-year median payout ratio of 84% (that is, it is retaining 16% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent.

In addition, Budweiser Brewing Company APAC has been paying dividends over a period of six years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 83%. However, Budweiser Brewing Company APAC's ROE is predicted to rise to 10% despite there being no anticipated change in its payout ratio.

Conclusion

On the whole, Budweiser Brewing Company APAC's performance is quite a big let-down. The company has seen a lack of earnings growth as a result of retaining very little profits and whatever little it does retain, is being reinvested at a very low rate of return. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're here to simplify it.

Discover if Budweiser Brewing Company APAC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1876

Budweiser Brewing Company APAC

An investment holding company, engages in brewing and distribution of beer in South Korea, Japan, New Zealand, China, India, Vietnam, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026