Why We're Not Concerned About Qinqin Foodstuffs Group (Cayman) Company Limited's (HKG:1583) Share Price

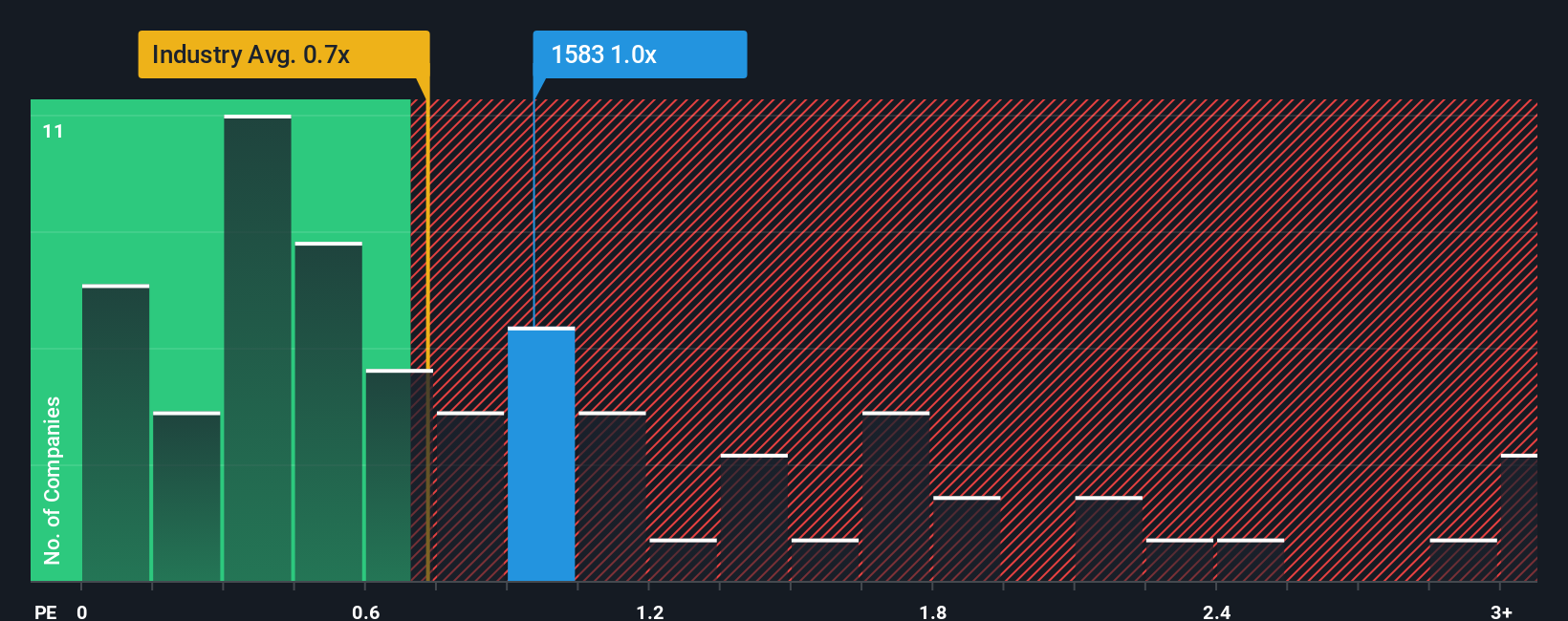

There wouldn't be many who think Qinqin Foodstuffs Group (Cayman) Company Limited's (HKG:1583) price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S for the Food industry in Hong Kong is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Qinqin Foodstuffs Group (Cayman)

How Qinqin Foodstuffs Group (Cayman) Has Been Performing

For example, consider that Qinqin Foodstuffs Group (Cayman)'s financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Qinqin Foodstuffs Group (Cayman)'s earnings, revenue and cash flow.How Is Qinqin Foodstuffs Group (Cayman)'s Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Qinqin Foodstuffs Group (Cayman)'s is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 1.4% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.6% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 4.7% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why Qinqin Foodstuffs Group (Cayman)'s P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On Qinqin Foodstuffs Group (Cayman)'s P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Qinqin Foodstuffs Group (Cayman) maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 1 warning sign for Qinqin Foodstuffs Group (Cayman) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Qinqin Foodstuffs Group (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1583

Qinqin Foodstuffs Group (Cayman)

An investment holding company, engages in manufacturing, distributing, and selling food and snacks products in the People's Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026