Asian Market Gems: Anton Oilfield Services Group And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Amidst global market fluctuations driven by geopolitical tensions and economic uncertainties, Asian markets have continued to capture investor interest with their unique opportunities. Penny stocks, often associated with smaller or emerging companies, remain a compelling investment area despite being considered somewhat outdated in terminology. These stocks can offer growth potential when backed by solid financials, and this article will explore some promising penny stocks in Asia that may present intriguing opportunities for investors seeking undervalued gems.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| T.A.C. Consumer (SET:TACC) | THB4.14 | THB2.48B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$45B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.16 | HK$736.35M | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.87 | HK$647.93M | ★★★★★★ |

| Newborn Town (SEHK:9911) | HK$4.90 | HK$6.91B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.22 | SGD43.83M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.02 | CN¥3.5B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.68 | SGD10.59B | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.86 | THB2.22B | ★★★★☆☆ |

| TTCL (SET:TTCL) | THB1.55 | THB954.8M | ★★★★★☆ |

Click here to see the full list of 1,163 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anton Oilfield Services Group is an investment holding company that offers oilfield engineering and technical services to oil companies in China, Iraq, and other international markets, with a market cap of HK$2.57 billion.

Operations: The company's revenue is primarily generated from Oilfield Technical Services (CN¥2.22 billion), Oilfield Management Services (CN¥1.77 billion), Inspection Services (CN¥441.14 million), and Drilling Rig Services (CN¥293 million).

Market Cap: HK$2.57B

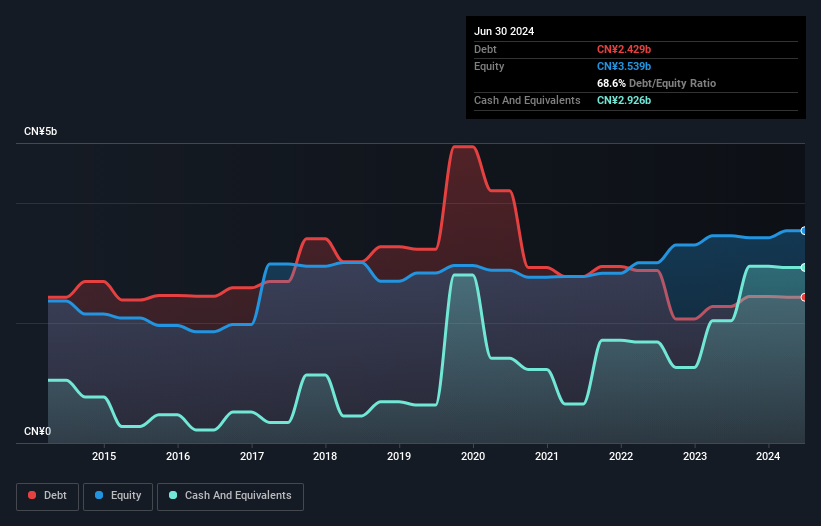

Anton Oilfield Services Group, with a market cap of HK$2.57 billion, has shown mixed financial performance. Despite a reduction in debt from 114% to 68.6% over five years and having more cash than total debt, the company faced negative earnings growth last year at -32.1%. However, it is trading at a significant discount to its estimated fair value by 53.1%, suggesting potential undervaluation for investors seeking opportunities in penny stocks. Recent developments include completing the repayment of its 2025 Notes and appointing Ms. CHEN Xin as an independent non-executive director and chairman of the ESG Committee, indicating strategic governance changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Anton Oilfield Services Group.

- Examine Anton Oilfield Services Group's earnings growth report to understand how analysts expect it to perform.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, is engaged in the manufacturing and sale of petroleum and chemical products in the People’s Republic of China, with a market capitalization of approximately HK$29.16 billion.

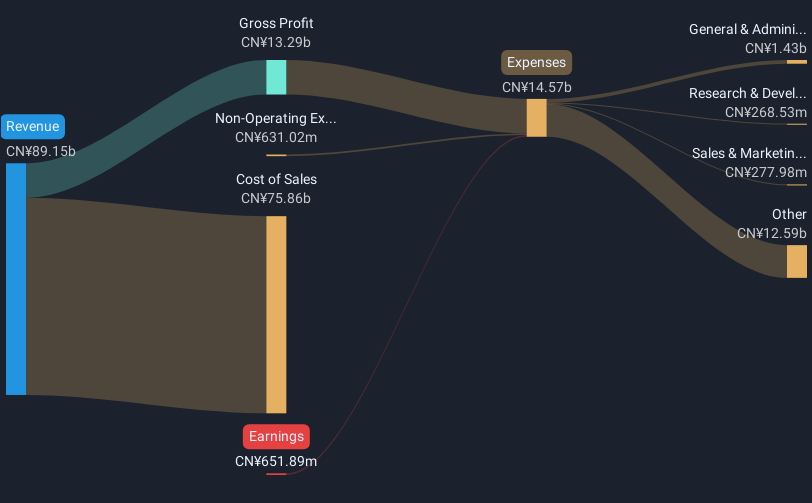

Operations: There are no specific revenue segments reported for Sinopec Shanghai Petrochemical Company Limited.

Market Cap: HK$29.16B

Sinopec Shanghai Petrochemical, with a market cap of HK$29.16 billion, has experienced increased debt levels over the past five years but maintains more cash than total debt. The company is unprofitable, with losses growing at 47.2% annually over five years; however, earnings are forecast to grow significantly by 114.14% per year. Recent executive changes include the retirement of President Mr. Guan Zemin, which should not disrupt operations due to an experienced management team and board averaging 4-5 years in tenure. Strategic moves include a technology R&D framework agreement with Sinopec Corp., potentially enhancing future growth prospects.

- Dive into the specifics of Sinopec Shanghai Petrochemical here with our thorough balance sheet health report.

- Evaluate Sinopec Shanghai Petrochemical's prospects by accessing our earnings growth report.

Honbridge Holdings (SEHK:8137)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Honbridge Holdings Limited is an investment holding company involved in the research, development, production, and sale of lithium batteries across China, Hong Kong, Brazil, France, and internationally with a market cap of approximately HK$5.94 billion.

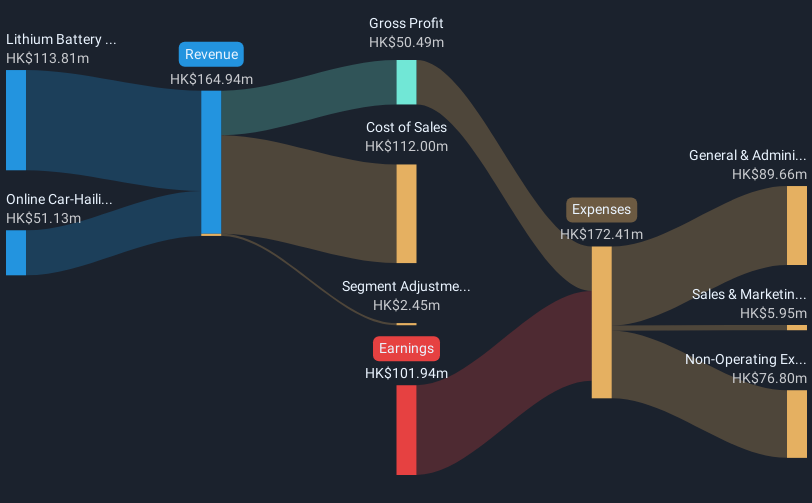

Operations: The company's revenue is primarily derived from its lithium battery production, which generated HK$113.81 million, and online car-hailing and related services, contributing HK$51.13 million.

Market Cap: HK$5.94B

Honbridge Holdings, with a market cap of HK$5.94 billion, focuses on lithium battery production and online car-hailing services, generating revenues of HK$113.81 million and HK$51.13 million respectively. Despite having more cash than total debt, the company faces challenges with short-term assets not covering long-term liabilities of HK$2.4 billion. It remains unprofitable with a negative return on equity and increasing losses over five years at 54.8% annually; however, its cash runway exceeds three years based on current free cash flow trends. The management team is relatively new but backed by an experienced board averaging 9.7 years in tenure.

- Navigate through the intricacies of Honbridge Holdings with our comprehensive balance sheet health report here.

- Explore historical data to track Honbridge Holdings' performance over time in our past results report.

Taking Advantage

- Embark on your investment journey to our 1,163 Asian Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:338

Sinopec Shanghai Petrochemical

Manufactures and sells petroleum and chemical products in the People’s Republic of China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives