- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1088

A Look at China Shenhua Energy (SEHK:1088) Valuation Following New Multi-Year Framework Agreement with China Railway Taiyuan

Reviewed by Simply Wall St

China Shenhua Energy (SEHK:1088) has recently advanced a new framework agreement for 2026 to 2028 in partnership with China Railway Taiyuan Group. The agreement covers transportation, coal supply, and related services between both companies.

See our latest analysis for China Shenhua Energy.

China Shenhua Energy’s new partnership with China Railway Taiyuan Group follows a year of impressive momentum, with the share price climbing over 23% year-to-date and the 1-year total shareholder return reaching 38%. This continued strength underscores the market’s optimistic outlook, especially in light of recent collaborations and robust long-term performance.

If this kind of progress has you interested in what else is out there, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

Yet with strong returns over multiple years and recent performance exceeding many peers, investors may wonder whether China Shenhua Energy is still trading below its true value or if the market has already priced in these future gains.

Price-to-Earnings of 12.9x: Is it justified?

China Shenhua Energy’s shares currently trade at a price-to-earnings (P/E) ratio of 12.9x, which is notably higher than its peer group and industry benchmarks. Despite solid recent returns, the stock appears expensive on this metric.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of earnings. For a major coal and energy producer like China Shenhua, this ratio can reflect market expectations about its future profit potential and risk profile.

China Shenhua’s P/E is well above both the peer average of 9.5x and the Hong Kong Oil and Gas industry average of 9.8x. It also exceeds the estimated fair P/E ratio of 12x for the company, suggesting markets are pricing in more optimistic outcomes than broader benchmarks and historical regression analysis might indicate.

Explore the SWS fair ratio for China Shenhua Energy

Result: Price-to-Earnings of 12.9x (OVERVALUED)

However, slower revenue growth and recent declines in net income could signal potential headwinds for maintaining above-trend market performance.

Find out about the key risks to this China Shenhua Energy narrative.

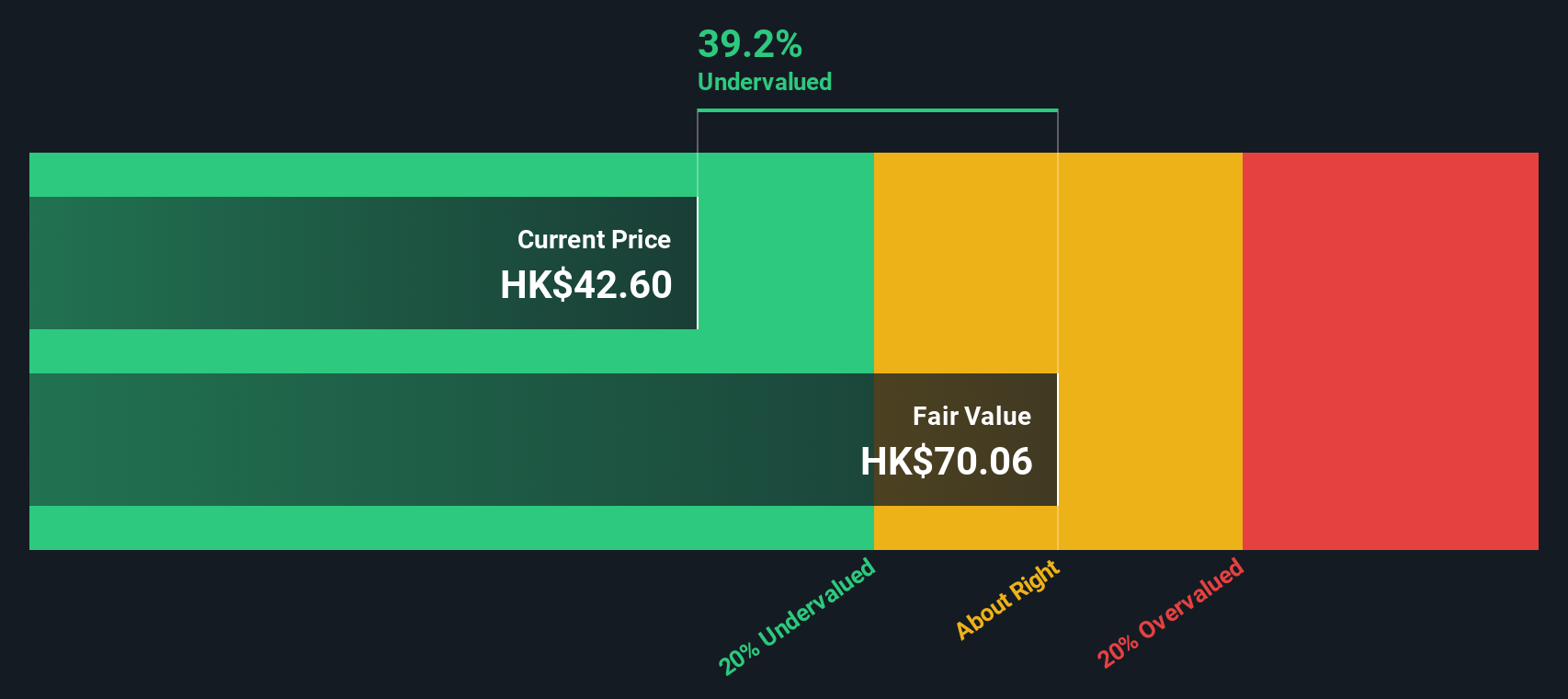

Another View: SWS DCF Model Suggests Undervaluation

Taking a different perspective, our DCF model estimates China Shenhua Energy’s shares are trading about 43% below their fair value, with a calculated value of HK$70.71 compared to the current price of HK$40.06. This signals the stock may be much cheaper than the market thinks. This raises the question: Are investors overlooking hidden value beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Shenhua Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Shenhua Energy Narrative

If you see things differently or want to reach your own conclusions, it is simple to dig into the data and shape your personal view in just a few minutes. Do it your way

A great starting point for your China Shenhua Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move by amplifying your strategy and tapping into stocks that fit your financial goals and appetite for growth, only on Simply Wall Street.

- Tap into fresh upside potential with these 923 undervalued stocks based on cash flows, featuring opportunities priced below their cash flow value for stronger return prospects.

- Accelerate your search for the next tech revolution through these 25 AI penny stocks, where artificial intelligence blends rapid growth with industry transformation.

- Boost your passive income strategy by targeting these 14 dividend stocks with yields > 3%, a handpicked selection of stocks offering yields above 3% for reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1088

China Shenhua Energy

Engages in the production and sale of coal and power; railway, port, and shipping transportation; and coal-to-olefins businesses in the People’s Republic of China and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026