- Hong Kong

- /

- Capital Markets

- /

- SEHK:863

Will OSL Group's (SEHK:863) Stablecoin Expansion Redefine Its International Strategy?

Reviewed by Sasha Jovanovic

- OSL Group Limited recently presented at the Morgan Stanley 24th Asia-Pacific Summit in Singapore, sharing updates on their international strategy and digital asset initiatives.

- Hong Kong-listed OSL Group has announced the launch of stablecoin payment services for wholesale clients in Australia, highlighting opportunities arising from evolving digital asset regulations in that market.

- We'll explore how OSL Group’s move to introduce stablecoin payments in Australia could influence its growth and international expansion narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is OSL Group's Investment Narrative?

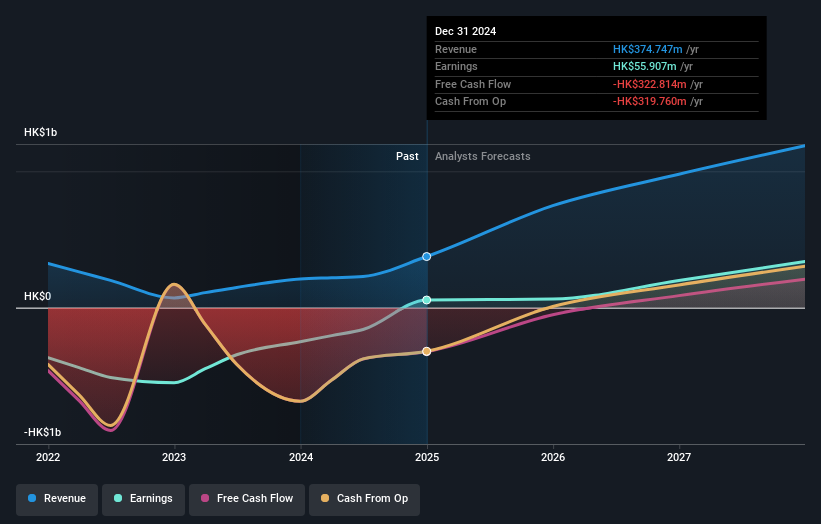

Owning OSL Group stock means buying into the view that digital asset adoption and regulatory evolution will continue powering opportunities in markets like Hong Kong and, now, Australia. The group’s recent stablecoin payment launch stands out as a timely move, coinciding with encouraging changes in Australian digital asset policy. This could broaden OSL’s reach and payment volumes, making it a new short-term catalyst, especially as investors had been mainly focused on earnings growth, capital needs, and the upcoming Banxa legal hearing. However, key risks remain, shareholder dilution from recent equity offerings, limited board experience, and unresolved legal matters around the Banxa merger can still introduce volatility. While the price has moved little since the news, the new payment service might reshape the balance between growth catalysts and near-term risks.

But in contrast, investors should be mindful of uncertainties surrounding the Banxa legal process. According our valuation report, there's an indication that OSL Group's share price might be on the expensive side.Exploring Other Perspectives

Explore another fair value estimate on OSL Group - why the stock might be worth as much as 23% more than the current price!

Build Your Own OSL Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OSL Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OSL Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OSL Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:863

OSL Group

An investment holding company, engages in digital assets and blockchain platform business in Hong Kong, Australia, Japan, Singapore, and Mainland China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026