- Hong Kong

- /

- Capital Markets

- /

- SEHK:6881

How Strong Institutional Backing of New Bond Issuance Could Influence China Galaxy Securities (SEHK:6881) Investors

Reviewed by Sasha Jovanovic

- China Galaxy Securities announced that it has successfully completed a non-public issuance of RMB 5 billion in corporate bonds on 19 November 2025, with two- and three-year maturities and coupon rates of 1.92% and 1.97%, respectively, aimed at refinancing maturing debts.

- This issuance saw substantial participation from leading financial institutions and related parties, highlighting confidence from key market players in the company’s credit profile.

- We'll explore how the strong institutional support for this bond issuance may shape China Galaxy Securities' investment narrative moving forward.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is China Galaxy Securities' Investment Narrative?

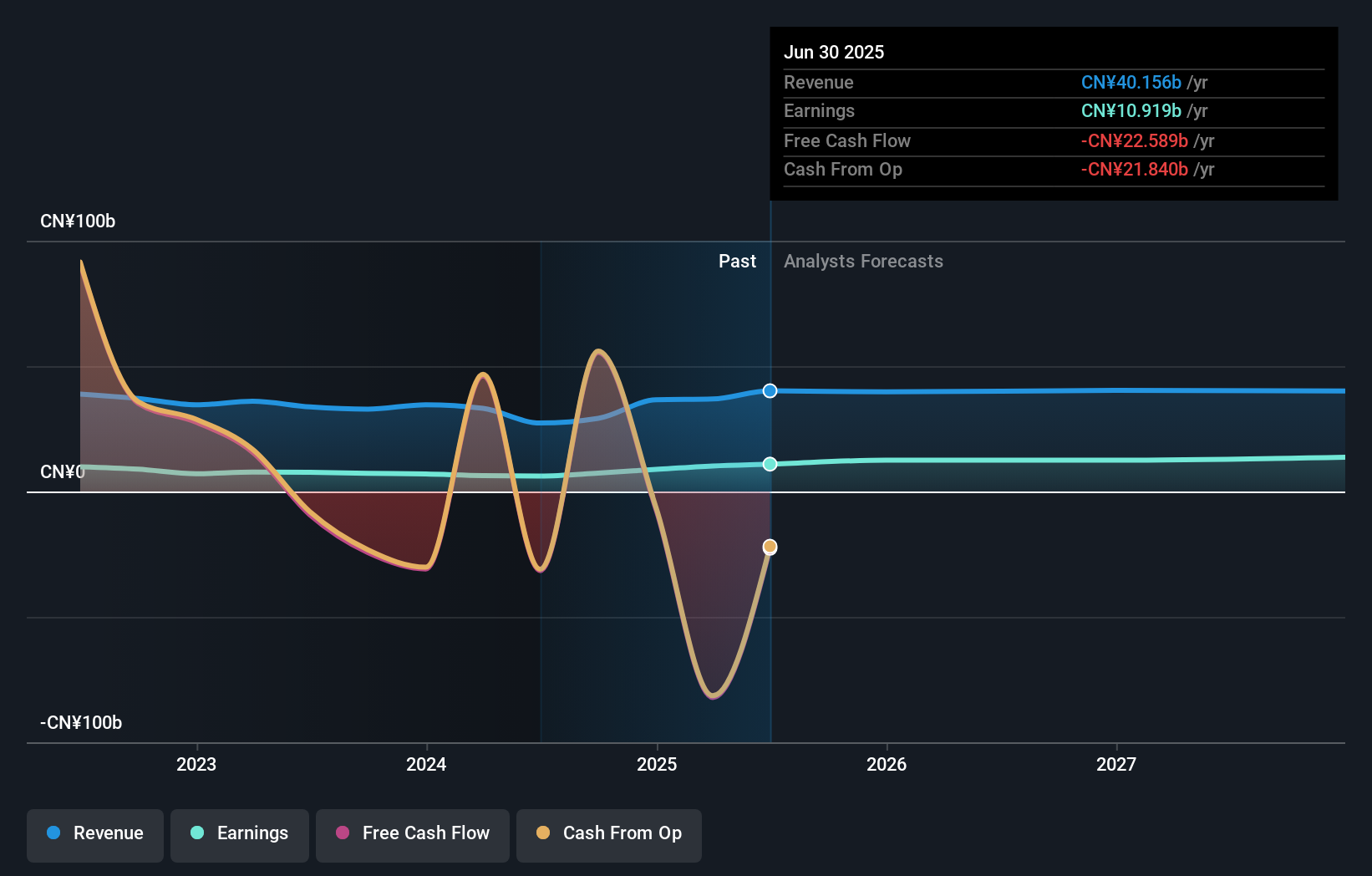

For anyone considering China Galaxy Securities, the big picture hinges on the company’s ability to maintain stable earnings growth and manage its sizable debt obligations while operating in a competitive capital markets environment. The recent successful bond issuance of RMB 5 billion directly addresses a key short-term catalyst, refinancing maturing debt, and signals confidence from major institutional backers at relatively low coupon rates. This inflow bolsters liquidity and may place the company in a better position to sustain dividend payments or strategic investments, potentially reducing near-term financing risks, which was one of the larger concerns in previous analyses. However, risks around dividend coverage, high board turnover, and a less independent board remain pertinent. While this financing improves the firm’s credit profile, unresolved corporate governance issues and slower forecast revenue growth could continue to weigh on sentiment.

But don’t overlook the renewed concerns around board independence, which could influence key decisions.

Exploring Other Perspectives

Explore 2 other fair value estimates on China Galaxy Securities - why the stock might be worth just HK$12.55!

Build Your Own China Galaxy Securities Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Galaxy Securities research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Galaxy Securities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Galaxy Securities' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6881

China Galaxy Securities

Provides various financial services in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026