- Hong Kong

- /

- Capital Markets

- /

- SEHK:6881

China Galaxy Securities (SEHK:6881): Valuation Check After RMB4 Billion Short-Term Commercial Paper Issuance

Reviewed by Simply Wall St

China Galaxy Securities (SEHK:6881) has just wrapped up a RMB4 billion short term commercial paper issuance. This financing move sharpens its liquidity profile and gives it more flexibility on day to day funding needs.

See our latest analysis for China Galaxy Securities.

That push to shore up liquidity comes after a strong run, with a year to date share price return of about 60 percent and a three year total shareholder return above 200 percent, suggesting momentum is still broadly constructive despite recent pullbacks.

If this kind of funding move has you thinking about where else capital might quietly be driving growth, it could be worth exploring fast growing stocks with high insider ownership as a source of fresh ideas.

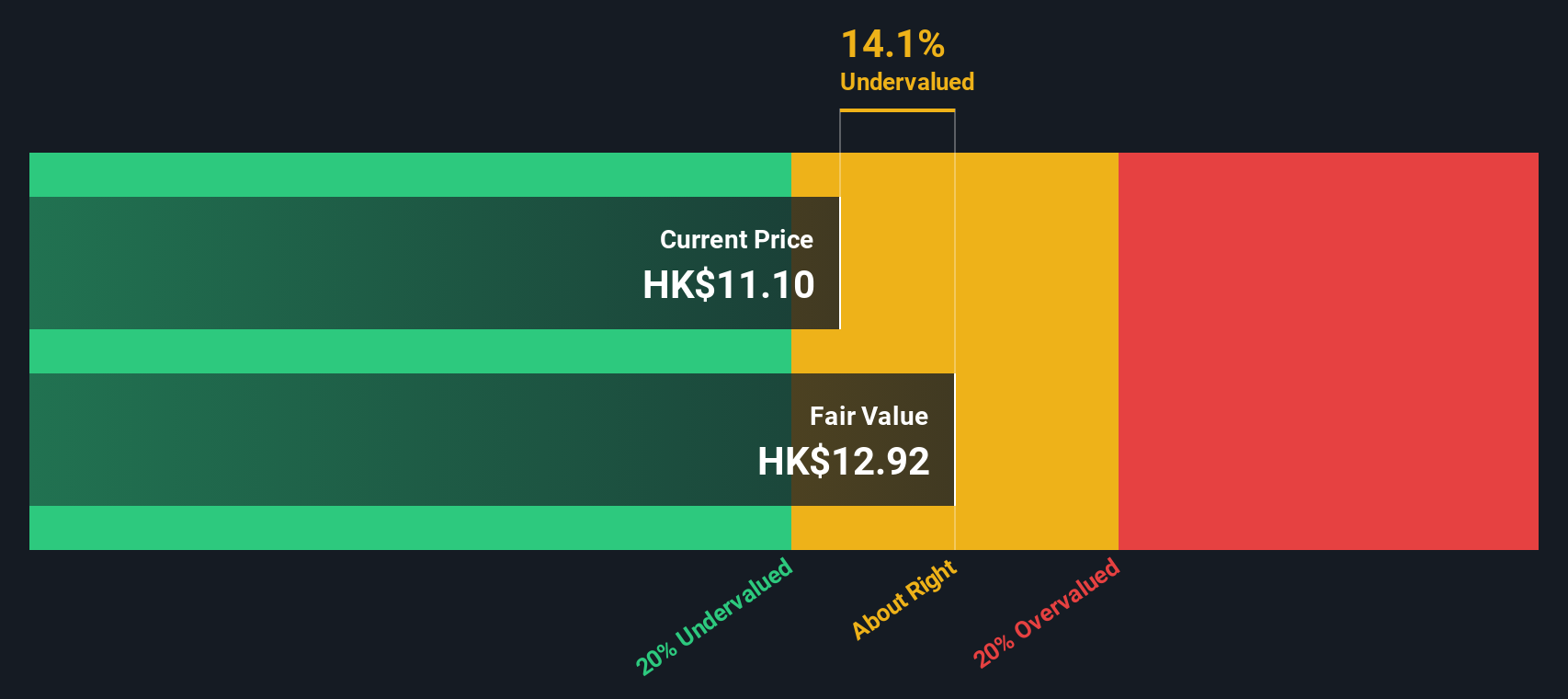

With earnings still growing and the shares trading at a discount to analyst targets and intrinsic estimates, the key question now is whether China Galaxy remains undervalued or if the market is already pricing in its next leg of growth.

Price-to-Earnings of 8.2x: Is it justified?

On a last close of HK$10.61, China Galaxy Securities trades on a seemingly modest 8.2x price-to-earnings ratio, even after its strong share price run.

The price-to-earnings multiple compares what investors pay today to the company’s current earnings. It is a key yardstick for capital markets firms with relatively mature profit profiles.

For China Galaxy Securities, that 8.2x earnings multiple screens as inexpensive, with statements indicating it is good value against peers and supported by forecasts for mid single digit annual profit growth rather than sharp declines.

The comparison with the wider Hong Kong Capital Markets industry is stark. The stock trades on less than half the sector’s average P/E and below an estimated fair P/E of 13x that the market could plausibly converge toward if sentiment remains constructive.

Explore the SWS fair ratio for China Galaxy Securities

Result: Price-to-Earnings of 8.2x (UNDERVALUED)

However, sustained earnings growth is not guaranteed, as softer revenue expansion and any policy shifts in China’s capital markets are both capable of derailing the valuation re-rating.

Find out about the key risks to this China Galaxy Securities narrative.

Another View on Value

Our DCF model points to a fair value of around HK$13.74, implying China Galaxy Securities may be roughly 23 percent undervalued even after its rally. If both earnings multiples and cash flow suggest upside, is the market still underestimating the cycle, or already looking past it?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Galaxy Securities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Galaxy Securities Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a personalised view in just minutes: Do it your way.

A great starting point for your China Galaxy Securities research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investment move?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy before the market moves without you.

- Capitalize on potential mispricings by targeting companies trading below intrinsic value through these 902 undervalued stocks based on cash flows tailored to cash flow strength.

- Ride powerful secular trends in automation and data by zeroing in on these 27 AI penny stocks poised to benefit from AI adoption.

- Strengthen your income stream by focusing on reliable payers using these 15 dividend stocks with yields > 3% to find yields above 3 percent with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6881

China Galaxy Securities

Provides various financial services in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026