As global markets face volatility and economic uncertainties, the Asian stock market continues to capture attention with its unique dynamics and opportunities. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area despite being considered somewhat outdated. By focusing on those with robust financials and growth potential, investors can uncover hidden gems that offer stability alongside promising prospects for growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.096 | SGD40.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.08 | SGD8.19B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.53 | HK$51.86B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.17 | HK$738.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.94 | HK$1.62B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,167 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

EROAD (NZSE:ERD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EROAD Limited offers electronic on-board units and software as a service to the transport industry across New Zealand, the United States, and Australia, with a market cap of NZ$252.48 million.

Operations: The company has not reported specific revenue segments.

Market Cap: NZ$252.48M

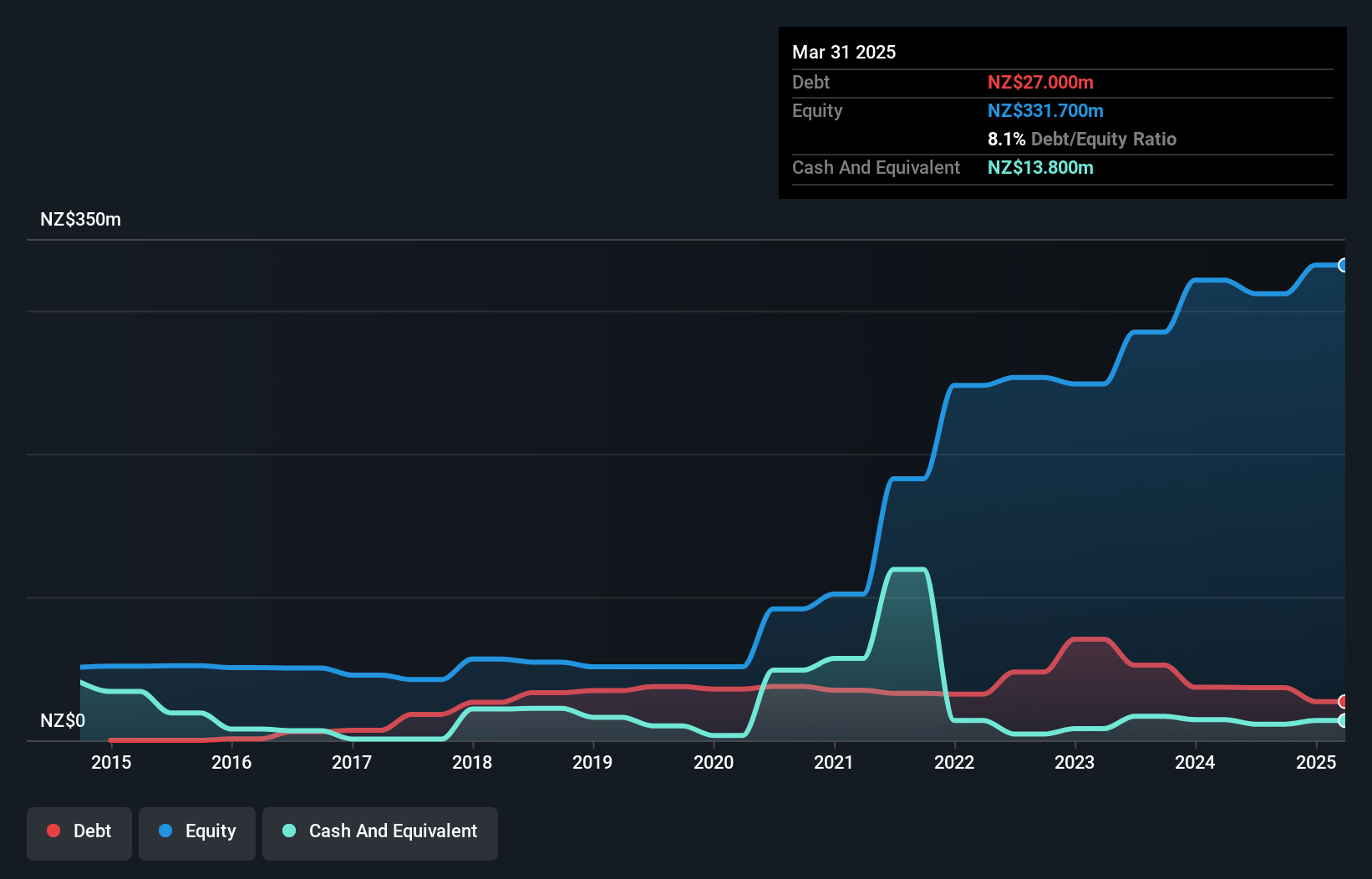

EROAD Limited, with a market cap of NZ$252.48 million, has shown promising financial performance by achieving profitability recently and reporting sales of NZ$194.4 million for the fiscal year ended March 31, 2025. The company's net income was NZ$1.4 million compared to a net loss the previous year, indicating improved margins. EROAD's debt management is commendable with a reduced debt to equity ratio from 69.8% to 8% over five years and satisfactory net debt levels at 3.8%. However, challenges remain with high share price volatility and an inexperienced board and management team impacting stability perceptions in the penny stock landscape.

- Unlock comprehensive insights into our analysis of EROAD stock in this financial health report.

- Review our growth performance report to gain insights into EROAD's future.

Ding Yi Feng Holdings Group International (SEHK:612)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Ding Yi Feng Holdings Limited is a publicly owned investment manager with a market cap of HK$569.92 million.

Operations: The company's revenue segment is Investment Holding, which reported a revenue of -HK$245.20 million.

Market Cap: HK$569.92M

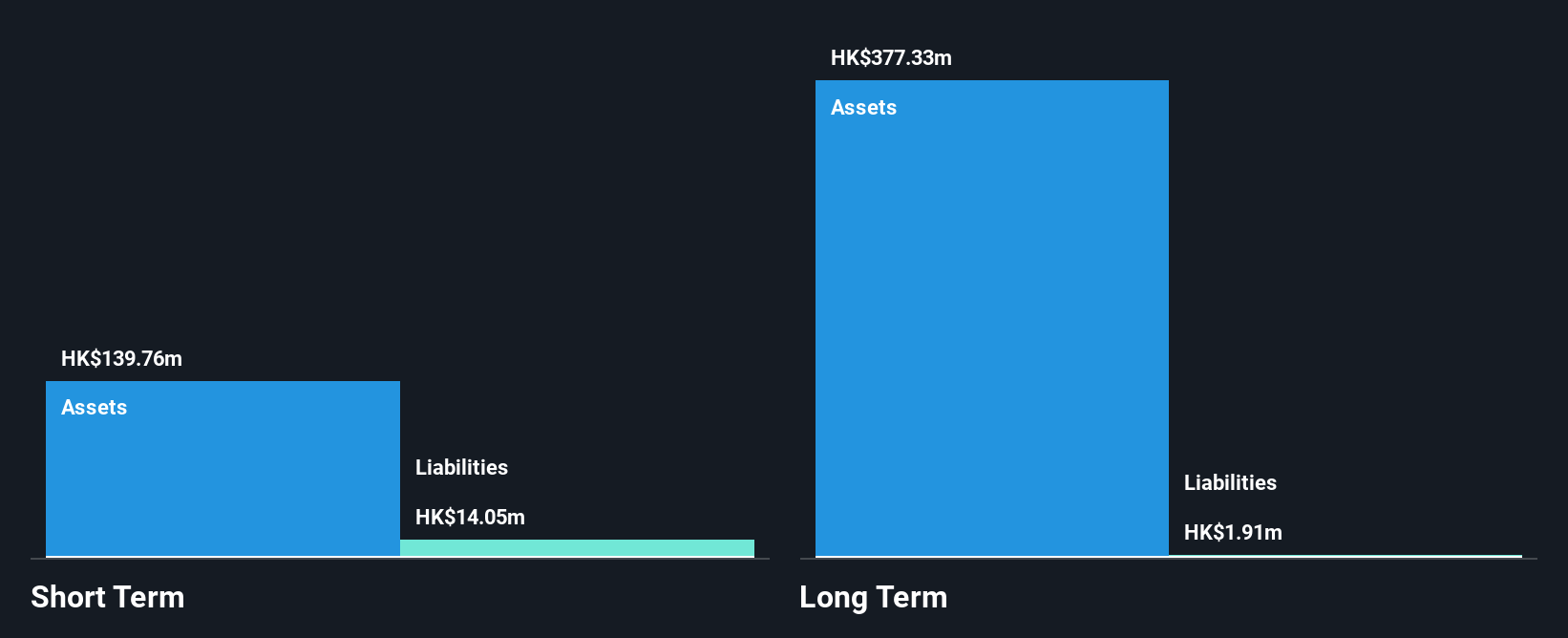

Ding Yi Feng Holdings Group International, with a market cap of HK$569.92 million, is pre-revenue and reported substantial negative revenue of -HK$367.55 million for 2024. Despite its unprofitable status and high volatility compared to other Hong Kong stocks, the company maintains a debt-free position with short-term assets exceeding liabilities significantly. The seasoned board has an average tenure of 8.8 years, which may provide stability amid recent changes like auditor transitions announced in May 2025. While the stock's price remains volatile, sufficient cash reserves suggest operational continuity for over a year without additional funding needs.

- Click here and access our complete financial health analysis report to understand the dynamics of Ding Yi Feng Holdings Group International.

- Gain insights into Ding Yi Feng Holdings Group International's past trends and performance with our report on the company's historical track record.

Boustead Singapore (SGX:F9D)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various regions worldwide with a market capitalization of SGD560.45 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: SGD560.45M

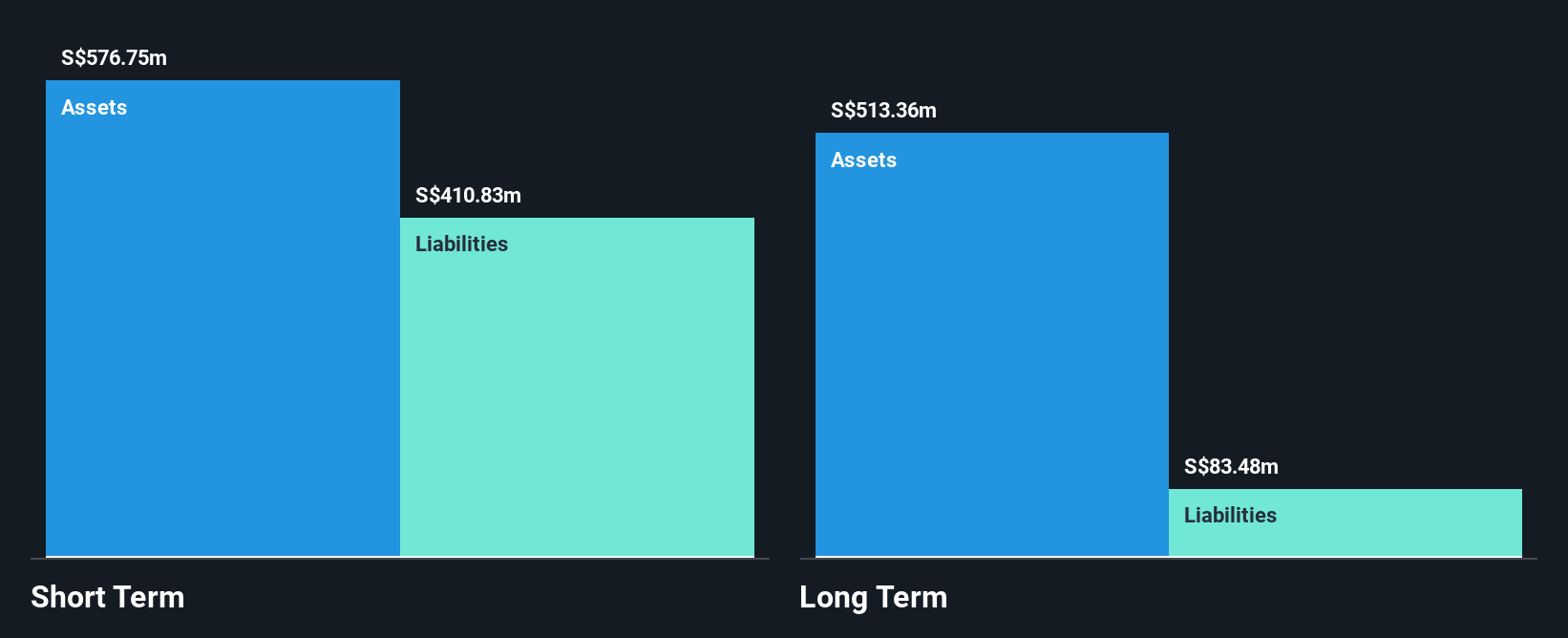

Boustead Singapore Limited, with a market cap of SGD560.45 million, recently reported full-year sales of SGD527.1 million and net income growth to SGD95.05 million, reflecting improved profit margins from 8.4% to 18%. The company shows financial robustness with cash exceeding total debt and high operating cash flow coverage of debt at 970.2%. Earnings have grown significantly by 48.1% over the past year, surpassing both its five-year average and industry growth rates. While trading below estimated fair value by 44.5%, the stock's dividend track record remains unstable despite strong short-term asset coverage over liabilities.

- Click here to discover the nuances of Boustead Singapore with our detailed analytical financial health report.

- Learn about Boustead Singapore's historical performance here.

Where To Now?

- Explore the 1,167 names from our Asian Penny Stocks screener here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EROAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:ERD

EROAD

Provides electronic on-board units and software as a service to the transport industry in New Zealand, the United States, and Australia.

Excellent balance sheet and good value.

Market Insights

Community Narratives